Exhibit 99.1

INVESTOR PRESENTATION PRESENTATION May 2022

DISCLAIMER This presentation has been designed to provide general information about Applied Blockchain, Inc. (“APLD” or the “Company”). Any information contained or referenced herein is suitable only as an introduction to the Company. The information contained in this presentation is for informational purposes only. The information contained in this presenta tio n is not investment or financial product advice and is not intended to be used as the basis for making an investment decision . Neither the Company or any of its affiliates make any representation or warranty, express or implied as to, and no reliance s hou ld be placed on, the fairness, accuracy, completeness or correctness of any of the information or opinions contained in this presentation. This presentation has been prepared without taking into account the investment objectives, financial situation par ticular needs of any particular person. The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use shou ld not be construed as an endorsement of the platform and solutions of Applied Blockchain. Forward - Looking Statements This presentation contains forward - looking statements that reflect the Company’s current expectations and projections with respect to, among other things, its financial condition, results of operations, plans, objectives, future performance and business . When used in this presentation, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward - looking statements, although not all forward - looking statements contain such identifying words . Forward - looking statements include all statements that are not historical facts . Forward - looking statements are based on information available at the time those statements are made and/or management’s good faith beliefs and assumptions as of that time with respect to future events . Such forward - looking statements are subject to various risks and uncertainties . Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements . Forward - looking statements may include statements about the Company’s future financial performance, including the Company’s expectations regarding net revenue, operating expenses, and its ability to achieve and maintain future profitability ; the Company’s business plan and ability to effectively manage growth ; anticipated trends, growth rates, and challenges in the Company’s business, the cryptoeconomy, and in the markets in which the Company operates ; further development and market acceptance of cryptoasset networks and other cryptoassets ; further development of the Company’s co - hosting facilities and customer base for co - hosting services ; beliefs and objectives for future operations ; the value of Bitcoin, Ether and other cryptoassets, which may be subject to pricing risk has historically been subject to wide swings ; the Company’s expectations concerning relationships with third parties ; the effects of increased competition in the Company’s markets and the Company’s ability to compete effectively ; the Company’s ability to stay in compliance with laws and regulations that currently apply or become applicable to its business both in the United States and internationally ; economic and industry trends, projected growth, or trend analysis ; trends in revenue, cost of revenue, and gross margin ; trends in operating expenses, including technology and development expenses, sales and marketing expenses, and general and administrative expenses, and expectations regarding these expenses as a percentage of revenue ; increased expenses associated with being a public company ; and other statements regarding the Company’s future operations, financial condition, and prospects and business strategies . There is no assurance that any forward - looking statements will materialize . You are cautioned not to place undue reliance on forward - looking statements, which reflect expectations only as of this date . Applied Blockchain undertakes no obligation to publicly update or review any forward - looking statement, whether as a result of new information, future developments or otherwise . Market and Industry Data This presentation includes information concerning economic conditions, the Company’s industry, the Company’s markets and the Company’s competitive position that is based on a variety of sources, including information from independent industry analysts and publications, as well as Applied Blockchain’s own estimates and research . Applied Blockchain’s estimates are derived from publicly available information released by third party sources, as well as data from its internal research, and are based on such data and the Company’s knowledge of its industry, which the Company believes to be reasonable . Any independent industry publications used in this presentation were not prepared on the Company’s behalf . This information involves many assumptions and limitations, and you are cautioned not to give undue weight to these estimates . The Company has not independently verified the accuracy or completeness of the data contained in these industry publications and other publicly available information . Accordingly, we make no representations as to the accuracy or completeness of that data nor do we undertake to update such data after the date of this presentation . An investment in the Company entails a high degree of risk and no assurance can be given that the Company’s objective will be achieved or that investors will receive a return on their investment . Recipients of this presentation should make their own investigations and evaluations of any information referenced herein . 2

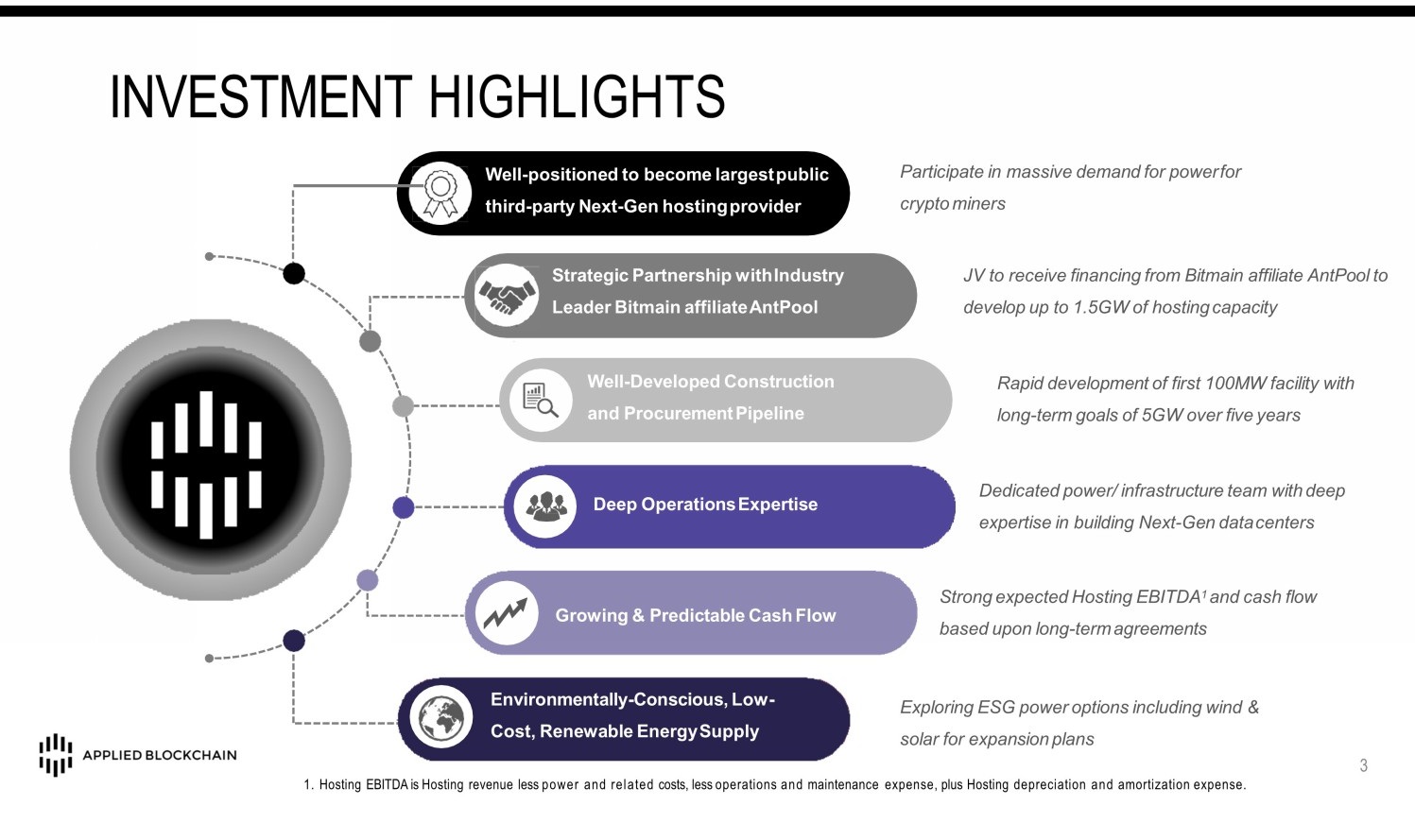

INVESTMENT HIGHLIGHTS 3 Strategic Partnership with Industry Leader Bitmain affiliate AntPool JV to receive financing from Bitmain affiliate AntPool to develop up to 1.5GW of hosting capacity Dedicated power/ infrastructure team with deep expertise in building Next - Gen data centers Rapid development of first 100MW facility with long - term goals of 5GW over five years Strong expected Hosting EBITDA 1 and cash flow based upon long - term agreements Well - Developed Construction and Procurement Pipeline Exploring ESG power options including wind & solar for expansion plans Growing & Predictable Cash Flow Deep Operations Expertise Well - positioned to become largest public third - party Next - Gen hosting provider Participate in massive demand for power for crypto miners 1. Hosting EBITDA is Hosting revenue less power and related costs, less operations and maintenance expense, plus Hosting depreci ati on and amortization expense.

EXPERIENCED LEADERSHIP TEAM 4 POWER & INFRASTRUCTURE DEVELOPMENT TEAM Wes Cummins, Chairman & CEO • B. Riley Asset Management, 2021 – Present, President • 272 Capital L.P., 2020 – Present, Founder and CEO • Nokomis Capital, 2012 – 2020, Research Analyst • B. Riley & Co, 2002 – 2011, President • Current Board Member at Vishay Precision Group, Inc. (NYSE: VPG), and Sequans Communications (NYSE: SQNS) • Former Board Member at Telenav (NASDAQ:TNAV) David Rench, CFO • Hirzel Capital, 2017 – 2020, CFO • Ihiji (acquired by Control4 – NASDAQ: CTRL), 2010 – 2017, Co - founder, VP of Finance and Operations Etienne Snyman, EVP of Power 1 Nick Phillips, EVP of Hosting and Public Affairs 1 Roland Davidson, EVP of Engineering 1 Saidal Mohmand EVP of Finance 1 Regina Ingel EVP of Operations

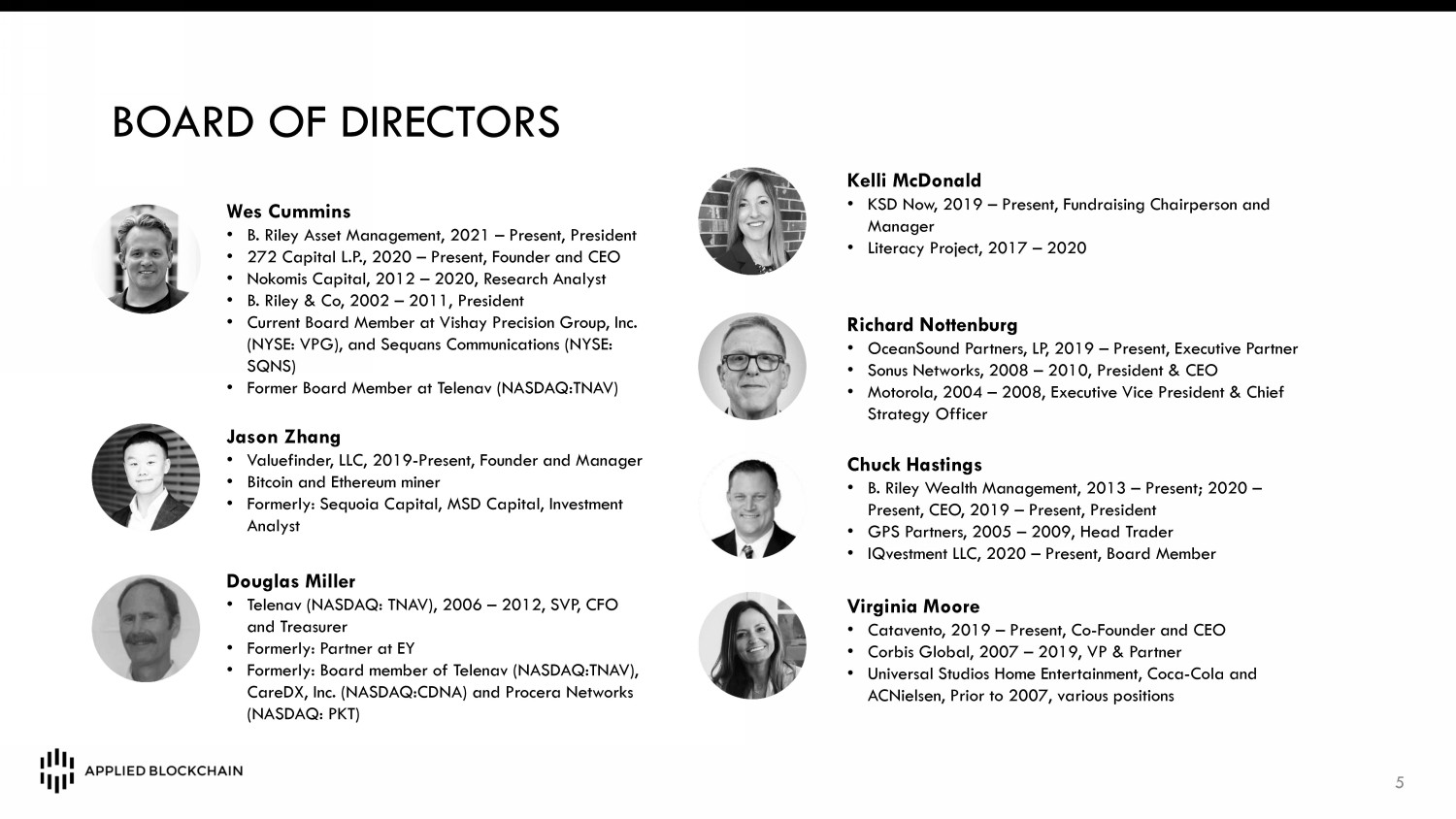

BOARD OF DIRECTORS 5 Wes Cummins • B. Riley Asset Management, 2021 – Present, President • 272 Capital L.P., 2020 – Present, Founder and CEO • Nokomis Capital, 2012 – 2020, Research Analyst • B. Riley & Co, 2002 – 2011, President • Current Board Member at Vishay Precision Group, Inc. (NYSE: VPG), and Sequans Communications (NYSE: SQNS) • Former Board Member at Telenav (NASDAQ:TNAV) Jason Zhang • Valuefinder, LLC, 2019 - Present, Founder and Manager • Bitcoin and Ethereum m iner • Formerly: Sequoia Capital, MSD Capital, Investment Analyst Douglas Miller • Telenav (NASDAQ: TNAV), 2006 – 2012, SVP, CFO and Treasurer • Formerly: Partner at EY • Formerly: Board member of Telenav (NASDAQ:TNAV), CareDX, Inc. (NASDAQ:CDNA) and Procera Networks (NASDAQ: PKT) Kelli McDonald • KSD Now, 2019 – Present, Fundraising Chairperson and Manager • Literacy Project, 2017 – 2020 Richard Nottenburg • OceanSound Partners, LP, 2019 – Present, Executive Partner • Sonus Networks, 2008 – 2010, President & CEO • Motorola, 2004 – 2008, Executive Vice President & Chief Strategy Officer Chuck Hastings • B. Riley Wealth Management, 2013 – Present; 2020 – Present, CEO, 2019 – Present, President • GPS Partners, 2005 – 2009, Head Trader • IQvestment LLC, 2020 – Present, Board Member Virginia Moore • Catavento, 2019 – Present, Co - Founder and CEO • Corbis Global, 2007 – 2019, VP & Partner • Universal Studios Home Entertainment, Coca - Cola and ACNielsen, Prior to 2007, various positions

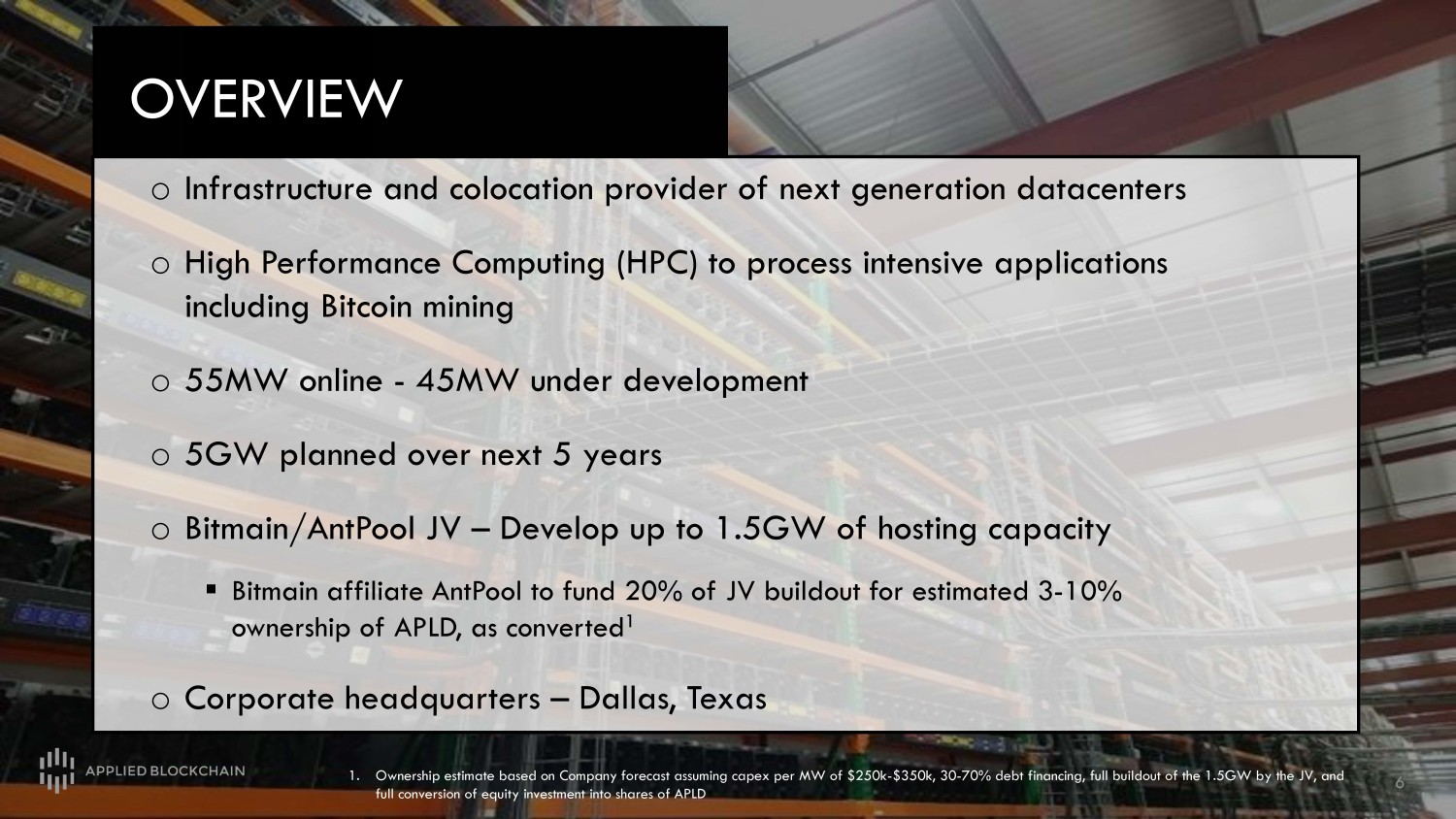

6 o Infrastructure and colocation provider of next generation datacenters o High Performance Computing (HPC) to process intensive applications including Bitcoin mining o 55MW online - 45MW under development o 5GW planned over next 5 years o Bitmain/AntPool JV – Develop up to 1.5GW of hosting capacity ▪ Bitmain affiliate AntPool to fund 20% of JV buildout for estimated 3 - 10% ownership of APLD, as converted 1 o Corporate headquarters – Dallas, Texas OVERVIEW 1. Ownership estimate based on Company forecast assuming capex per MW of $250k - $350k, 30 - 70% debt financing, full buildout of the 1 .5GW by the JV, and full conversion of equity investment into shares of APLD

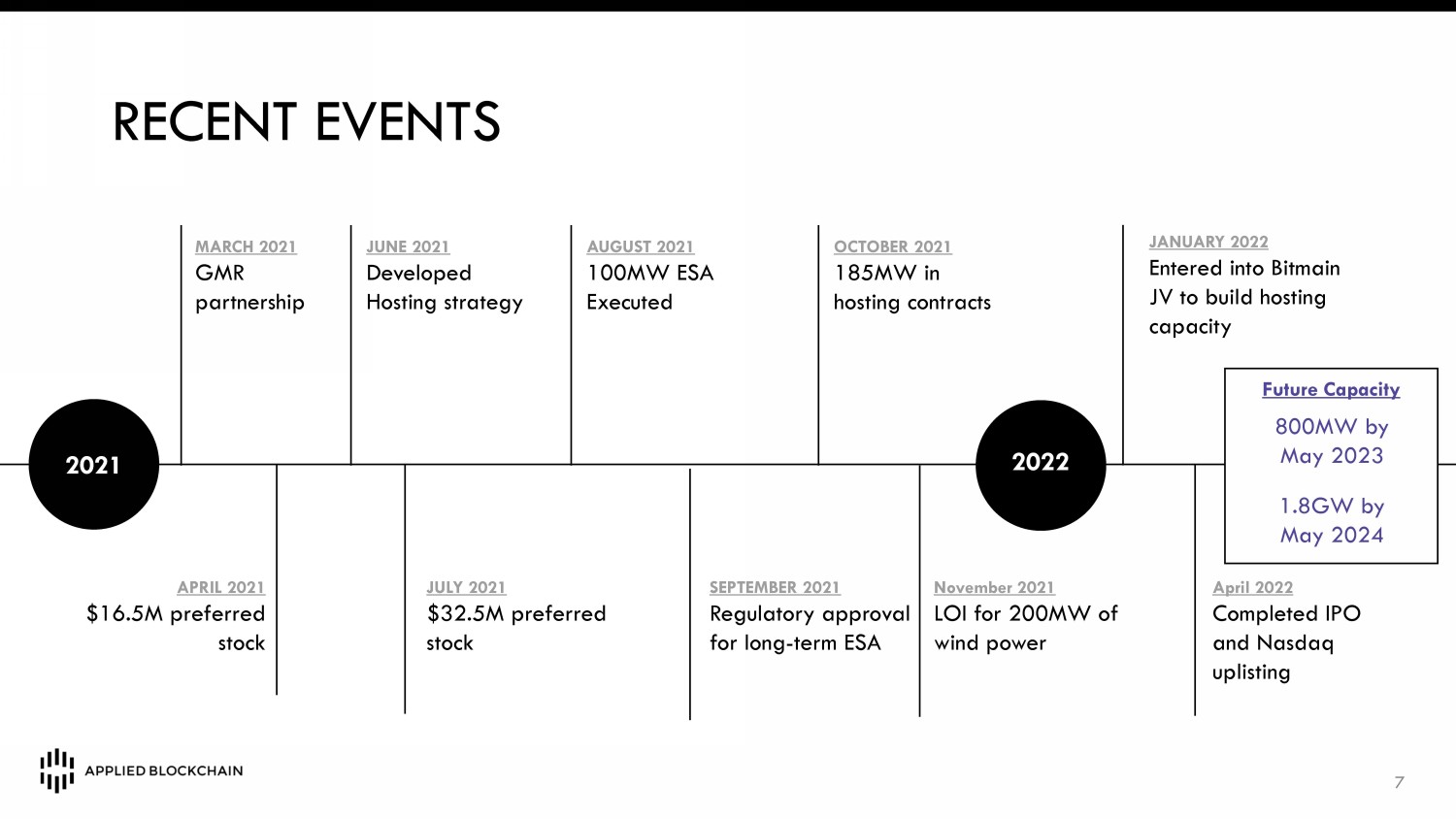

RECENT EVENTS 7 2021 2022 MARCH 2021 GMR partnership APRIL 2021 $16.5M preferred stock JUNE 2021 Developed Hosting strategy JULY 2021 $32.5M preferred stock AUGUST 2021 100MW ESA Executed SEPTEMBER 2021 Regulatory approval for long - term ESA OCTOBER 2021 185MW in hosting contracts 800MW by May 2023 1.8GW by May 2024 Future Capacity November 2021 LOI for 200MW of wind power JANUARY 2022 Entered into Bitmain JV to build hosting capacity April 2022 Completed IPO and Nasdaq uplisting

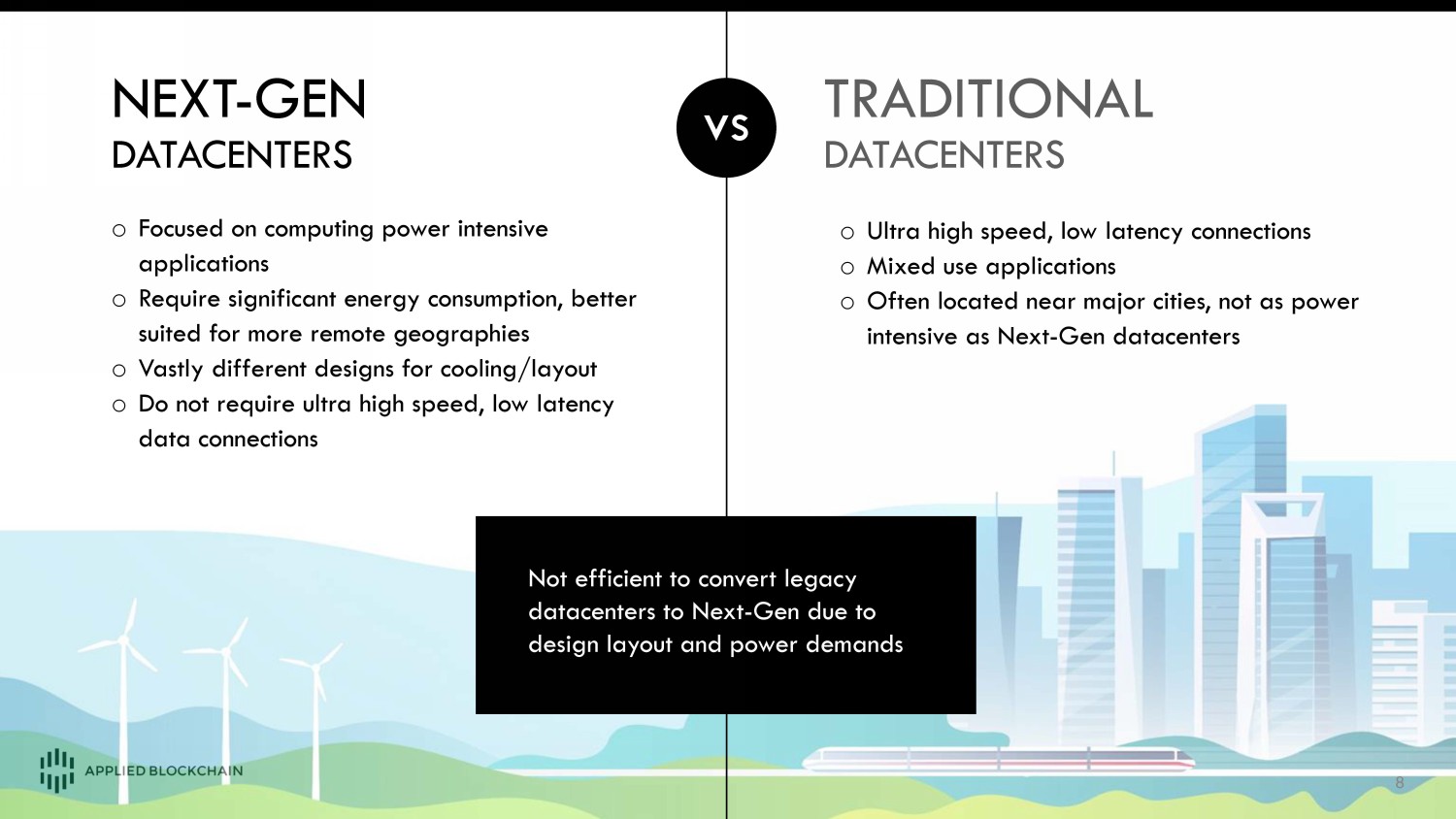

NEXT - GEN DATACENTERS o Focused on computing power intensive applications o Require significant energy consumption, better suited for more remote geographies o Vastly different designs for cooling/layout o Do not require ultra high speed, low latency data connections 8 o Ultra high speed, low latency connections o Mixed use applications o Often located near major cities, not as power intensive as Next - Gen datacenters TRADITIONAL DATACENTERS vs Not efficient to convert legacy datacenters to Next - Gen due to design layout and power demands

9 DATACENTER CONSTRUCTION

MARKET OPPORTUNITY 10 o 6+ GW 1 of Bitcoin mining capacity expected to move from China - $4.3B 1 in annual hosting demand o North America expected to be main beneficiary given reliable power options & strong hosting demand Near to Medium Term Tailwinds Long - Term Tailwinds o Next - Gen datacenters will be critical for the growth of cryptographically secure applications based on proof of work consensus mechanisms o Secure blockchain networks for sensitive data o Other compute intensive applications like artificial intelligence and machine learning 1. Source: Cambridge Bitcoin Electricity Consumption Index. China share as of February 1, 2021, prior to crackdown on mining activities, and assumes $0.08/kwh average hosting cost.

Blue Chip Blockchain Partnerships Assist in Goal of Becoming Largest Public Third - Party Next - Gen Datacenter Provider 11 o Leading designer of ASIC chips for bitcoin mining o Provides Applied Blockchain with financial resources o Funding evidenced by ownership in JV, and ultimately convertible into APLD stock o Bitmain affiliate AntPool to own an estimated 3 - 10% of APLD 1 o Joint Venture to build up to 1.5GW of hosting capacity in North America o Capex share: Bitmain will fund 20% of all JV capex BITMAIN STRATEGIC JOINT VENTURE 1. Ownership estimate based on Company forecast assuming capex per MW of $250k - $350k, 30 - 70% debt financing, full buildout of the 1 .5GW, and full conversion of equity investment into shares of APLD.

Well - positioned to become largest public third - party Next - Gen hosting provider Strong demand for hosting and co - location services No direct competition with customers – APLD does not mine in Company - owned facilities 12

SITE LEVEL STRATEGY Blue chip anchor tenant at each facility with a 3 - 5 year term Remaining capacity targets smaller - scale tenants with higher pricing and 18 - 36 month term 13 o Revenues are based on fixed USD price, not contractually linked to cryptocurrency prices o Long - term contracts provide visibility into financial performance o Ancillary services can enhance margins

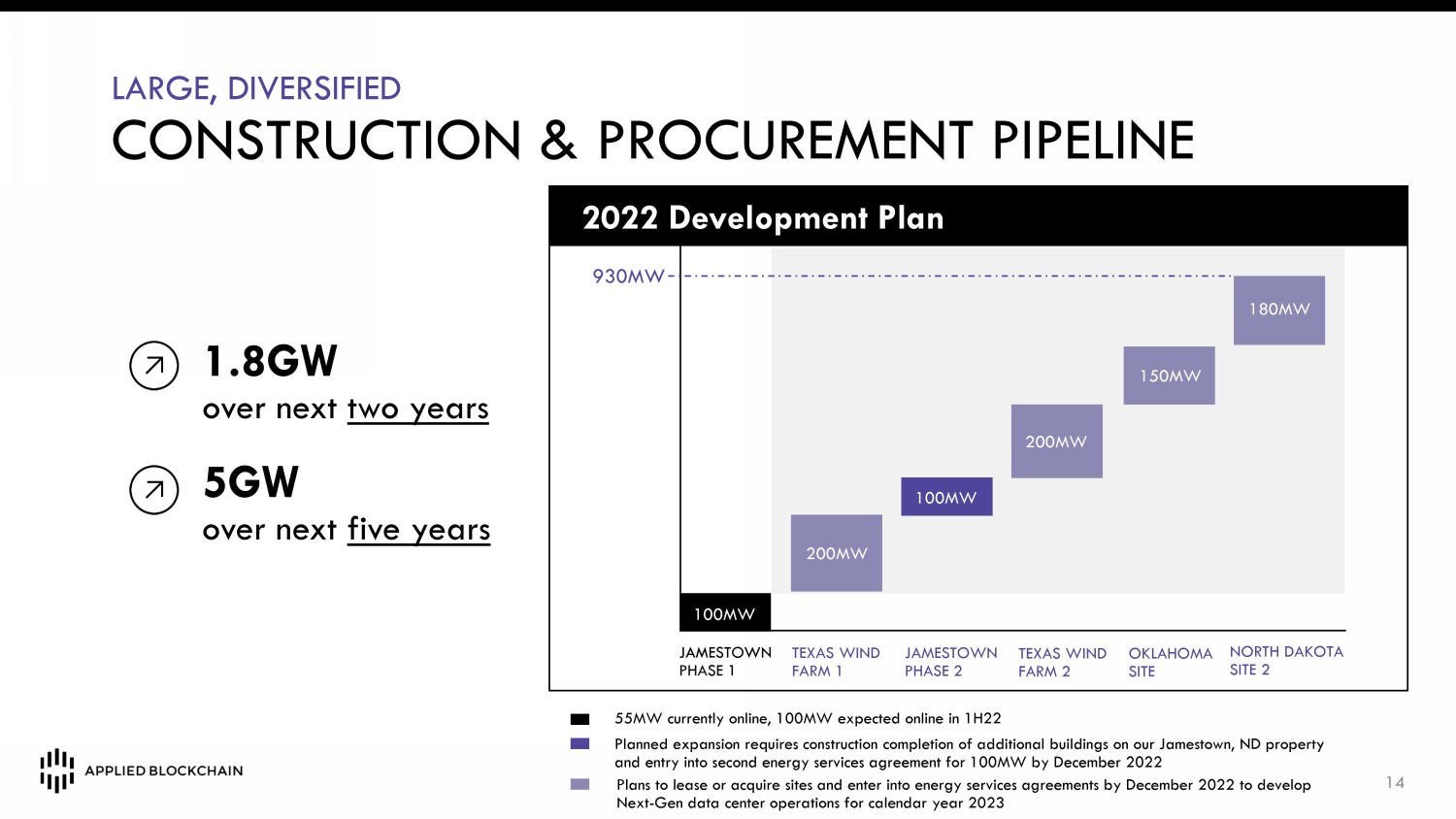

LARGE, DIVERSIFIED CONSTRUCTION & PROCUREMENT PIPELINE 14 55MW currently online, 100MW expected online in 1H22 Planned expansion requires construction completion of additional buildings on our Jamestown, ND property and entry into second energy services agreement for 100MW by December 2022 Plans to lease or acquire sites and enter into energy services agreements by December 2022 to develop Next - Gen data center operations for calendar year 2023 JAMESTOWN PHASE 1 TEXAS WIND FARM 1 100MW TEXAS WIND FARM 2 OKLAHOMA SITE 2022 Development Plan JAMESTOWN PHASE 2 NORTH DAKOTA SITE 2 930MW 200MW 180MW 200MW 100MW 150MW 5GW over next five years 1.8GW over next two years

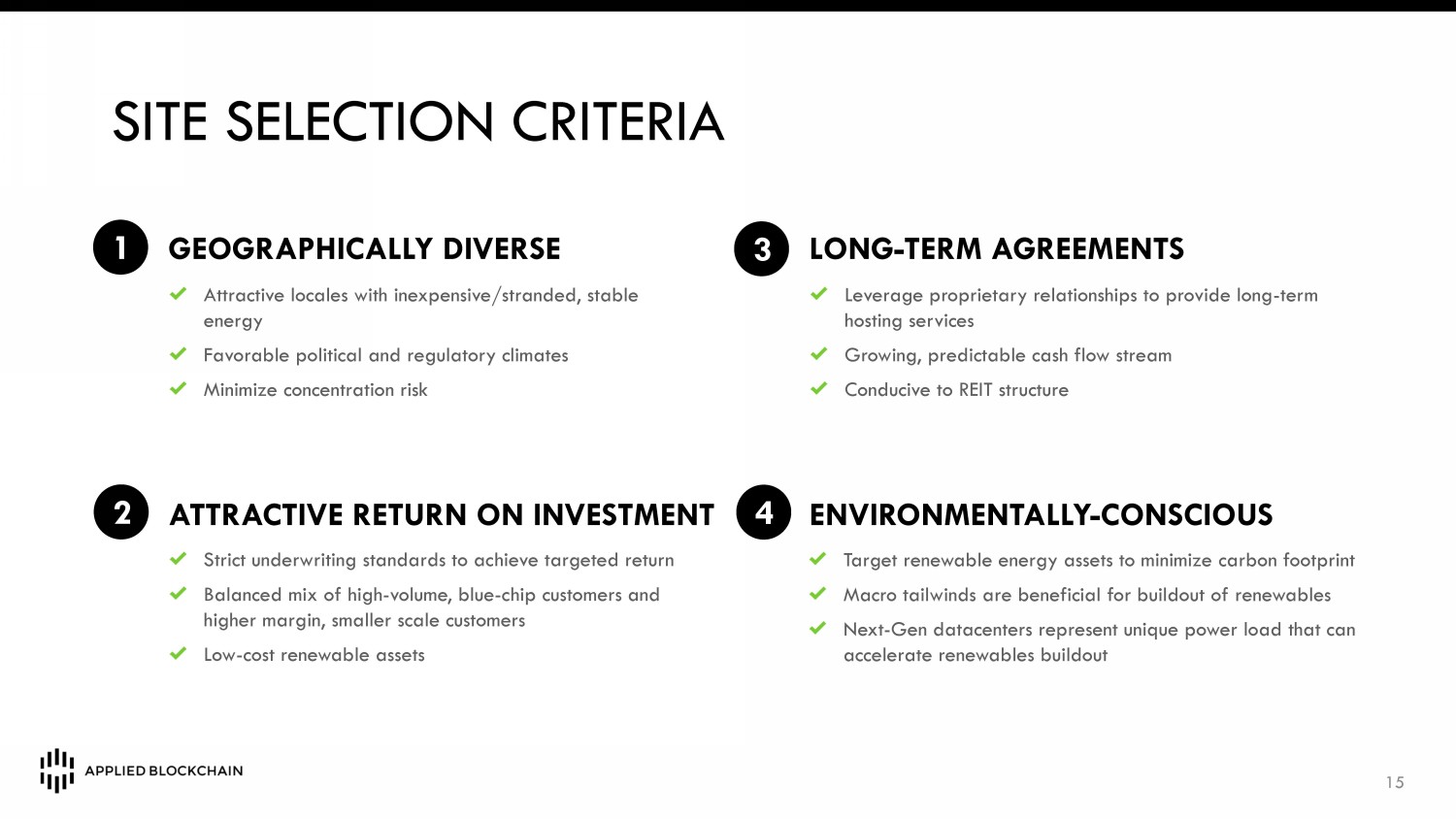

SITE SELECTION CRITERIA 15 GEOGRAPHICALLY DIVERSE ATTRACTIVE RETURN ON INVESTMENT LONG - TERM AGREEMENTS ENVIRONMENTALLY - CONSCIOUS Attractive locales with inexpensive/stranded, stable energy Favorable political and regulatory climates Minimize concentration risk Strict underwriting standards to achieve targeted return Balanced mix of high - volume, blue - chip customers and higher margin, smaller scale customers Low - cost renewable assets Leverage proprietary relationships to provide long - term hosting services Growing, predictable cash flow stream Conducive to REIT structure Target renewable energy assets to minimize carbon footprint Macro tailwinds are beneficial for buildout of renewables Next - Gen datacenters represent unique power load that can accelerate renewables buildout 1 2 3 4

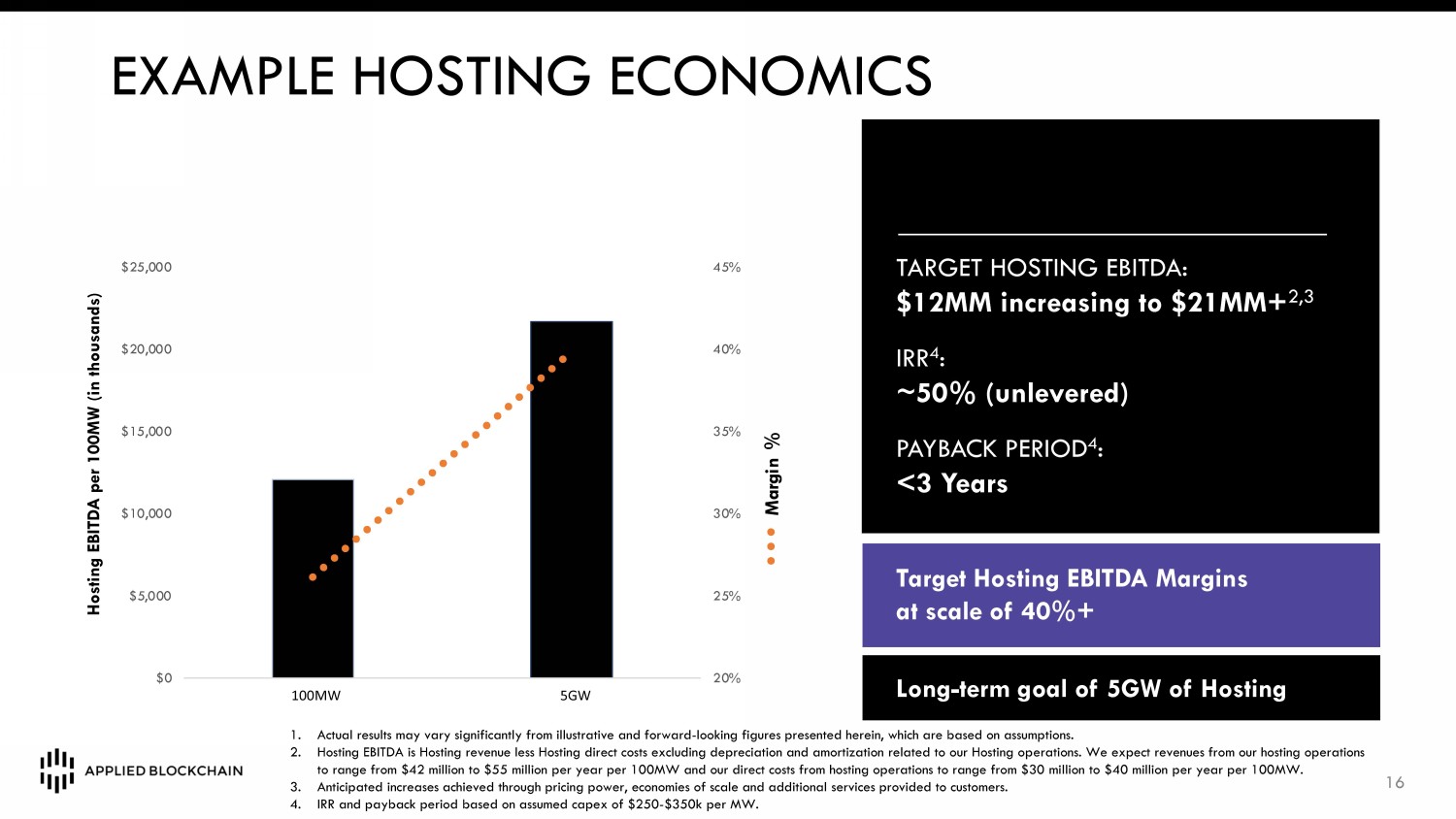

EXAMPLE HOSTING ECONOMICS 16 1. Actual results may vary significantly from illustrative and forward - looking figures presented herein, which are based on assumpt ions. 2. Hosting EBITDA is Hosting revenue less Hosting direct costs excluding depreciation and amortization related to our Hosting op era tions. We expect revenues from our hosting operations to range from $42 million to $55 million per year per 100MW and our direct costs from hosting operations to range from $30 mi lli on to $40 million per year per 100MW. 3. Anticipated increases achieved through pricing power, economies of scale and additional services provided to customers. 4. IRR and payback period based on assumed capex of $250 - $350k per MW. Target Hosting EBITDA Margins at scale of 40%+ Long - term goal of 5GW of Hosting TARGET HOSTING EBITDA: $12MM increasing to $21MM+ 2,3 IRR 4 : ~50% (unlevered) PAYBACK PERIOD 4 : <3 Years 20% 25% 30% 35% 40% 45% $0 $5,000 $10,000 $15,000 $20,000 $25,000 FY22E Jamestown FY27E 5GW M a r g i n % P r o j e c t E B I T D A p e r 1 0 0 M W Hosting EBITDA per 100MW (in thousands) 100MW 5GW

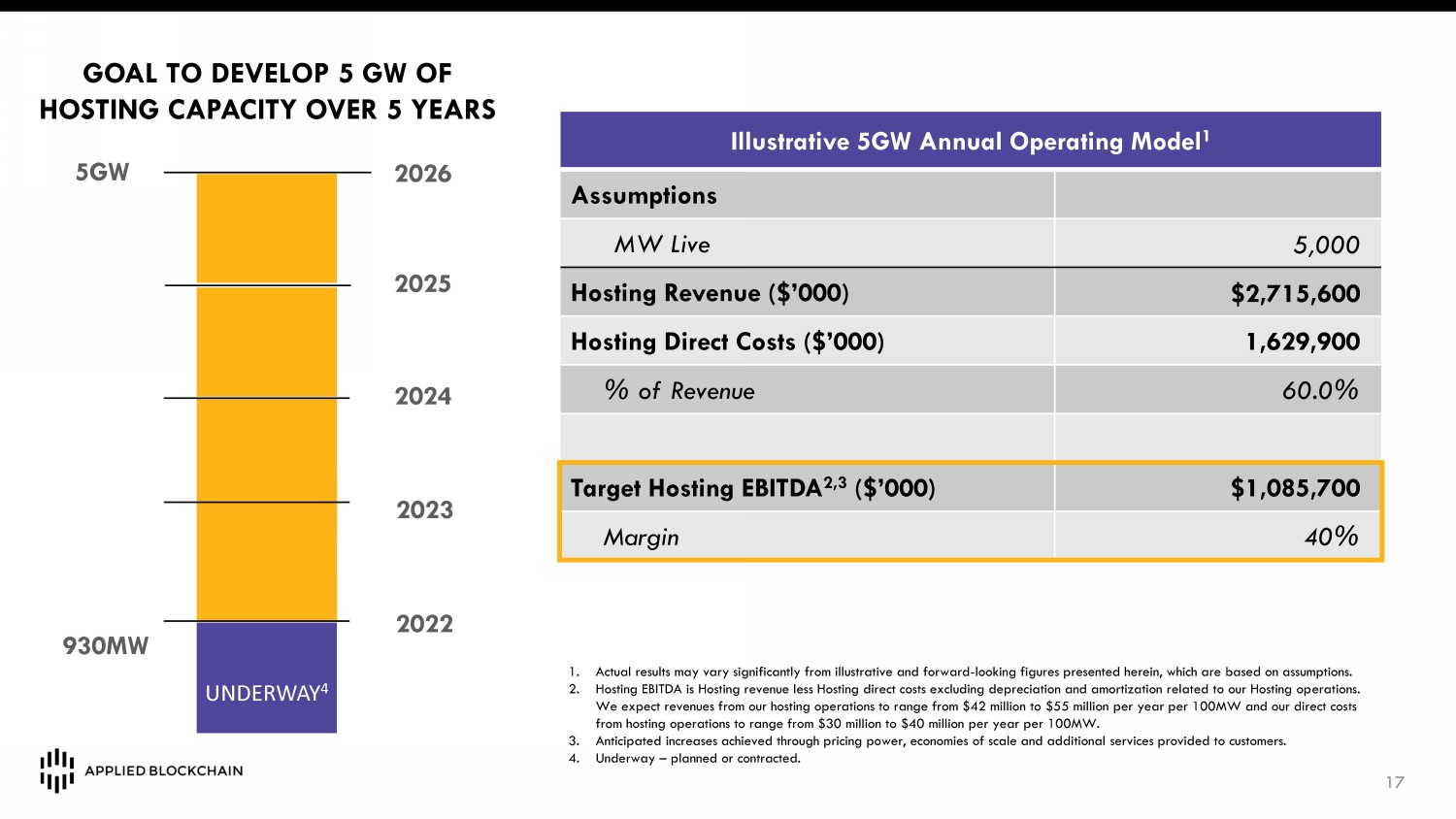

Illustrative 5GW Annual Operating Model 1 Assumptions MW Live 5,000 Hosting Revenue ($’000) $2,715,600 Hosting Direct Costs ($’000) 1,629,900 % of Revenue 60.0% Target Hosting EBITDA 2,3 ($’000) $1,085,700 Margin 40% UNDERWAY 4 5GW GOAL TO DEVELOP 5 GW OF HOSTING CAPACITY OVER 5 YEARS 1. Actual results may vary significantly from illustrative and forward - looking figures presented herein, which are based on assumpt ions. 2. Hosting EBITDA is Hosting revenue less Hosting direct costs excluding depreciation and amortization related to our Hosting op era tions. We expect revenues from our hosting operations to range from $42 million to $55 million per year per 100MW and our direct cos ts from hosting operations to range from $30 million to $40 million per year per 100MW. 3. Anticipated increases achieved through pricing power, economies of scale and additional services provided to customers. 4. Underway – planned or contracted. 930MW 2022 2023 2024 2025 2026 17

REAL ESTATE INVESTMENT TRUST (REIT) TRANSITION o APLD’s business model as a Next - Gen datacenter operator is intended to be conducive to a REIT structure o Comparable to REIT datacenter operators like Digital Realty Trust (DLR) and Equinix (EQIX), and specialty REIT operator Innovative Industrial Properties (IIPR) 18

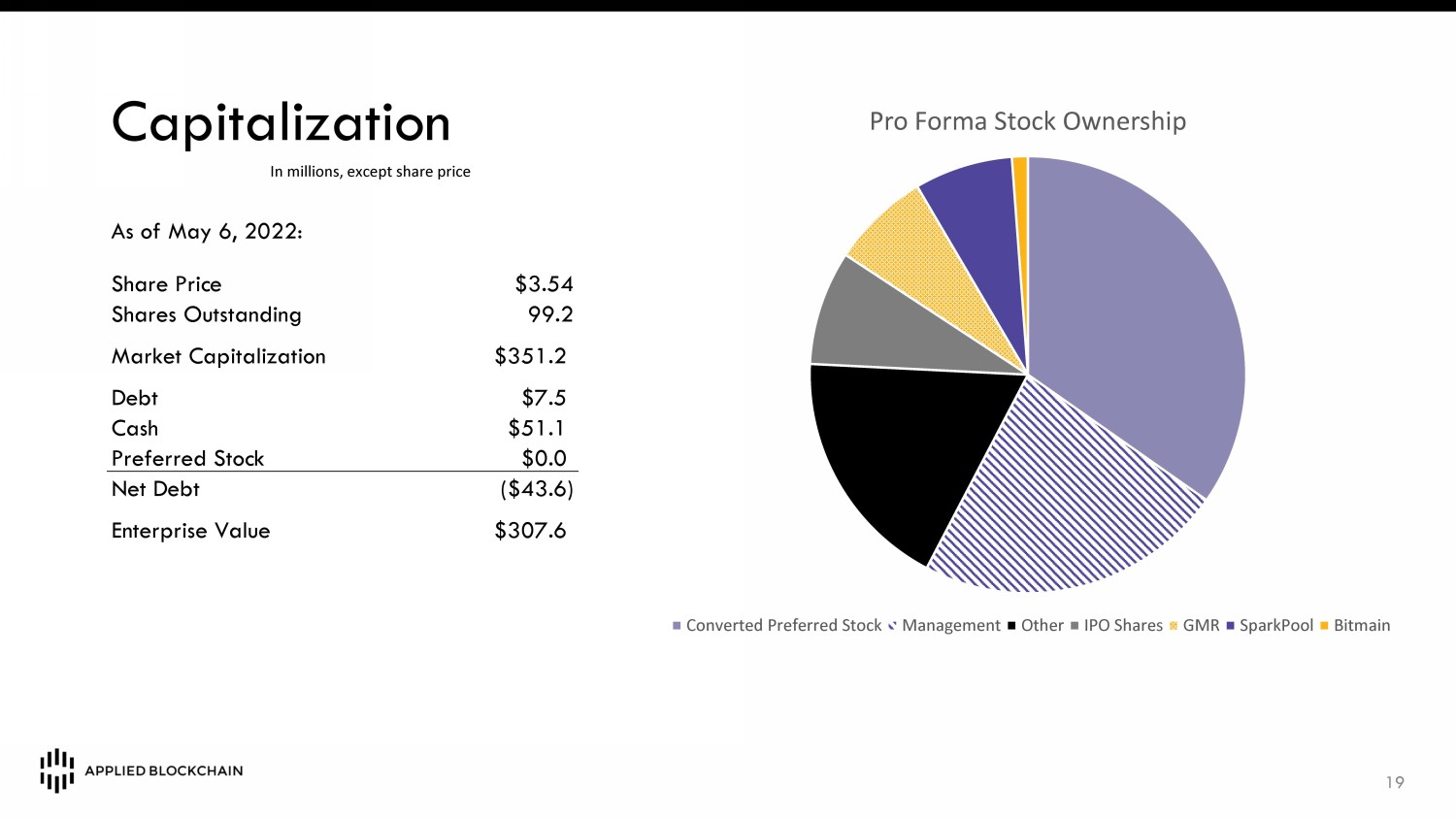

Capitalization 19 In millions, except share price Pro Forma Stock Ownership Converted Preferred Stock Management Other IPO Shares GMR SparkPool Bitmain Share Price $3.54 Shares Outstanding 99.2 Market Capitalization $351.2 Debt $7.5 Cash $51.1 Preferred Stock $0.0 Net Debt ($43.6) Enterprise Value $307.6 As of May 6, 2022:

20 INVESTOR RELATIONS CONTACTS