SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

APPLIED BLOCKCHAIN, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | | | | | | | |

| | | | |

☒ | | No fee required. |

| | |

| ☐ | | Fee paid previously with preliminary materials. |

| | |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

to be held November 10, 2022

| | | | | | | | | | | |

DEAR STOCKHOLDER: It is my pleasure to invite you to attend Applied Blockchain, Inc.’s ("Applied Blockchain" or the "Company") 2022 Annual Meeting of Stockholders (the "Annual Meeting"). The Annual Meeting will be held virtually on Thursday, November 10, 2022, at 9:00 a.m. Central Time at www.virtualshareholdermeeting.com/APLD2022. At the meeting, you will be asked to: | | Meeting Details |

| Who Stockholders of record as of September 14, 2022 |

| Date and Time November 10, 2022, at 9:00 a.m. Central Time |

| |

| Place www.virtualshareholdermeeting.com/APLD2022 |

| | | |

| | | | | |

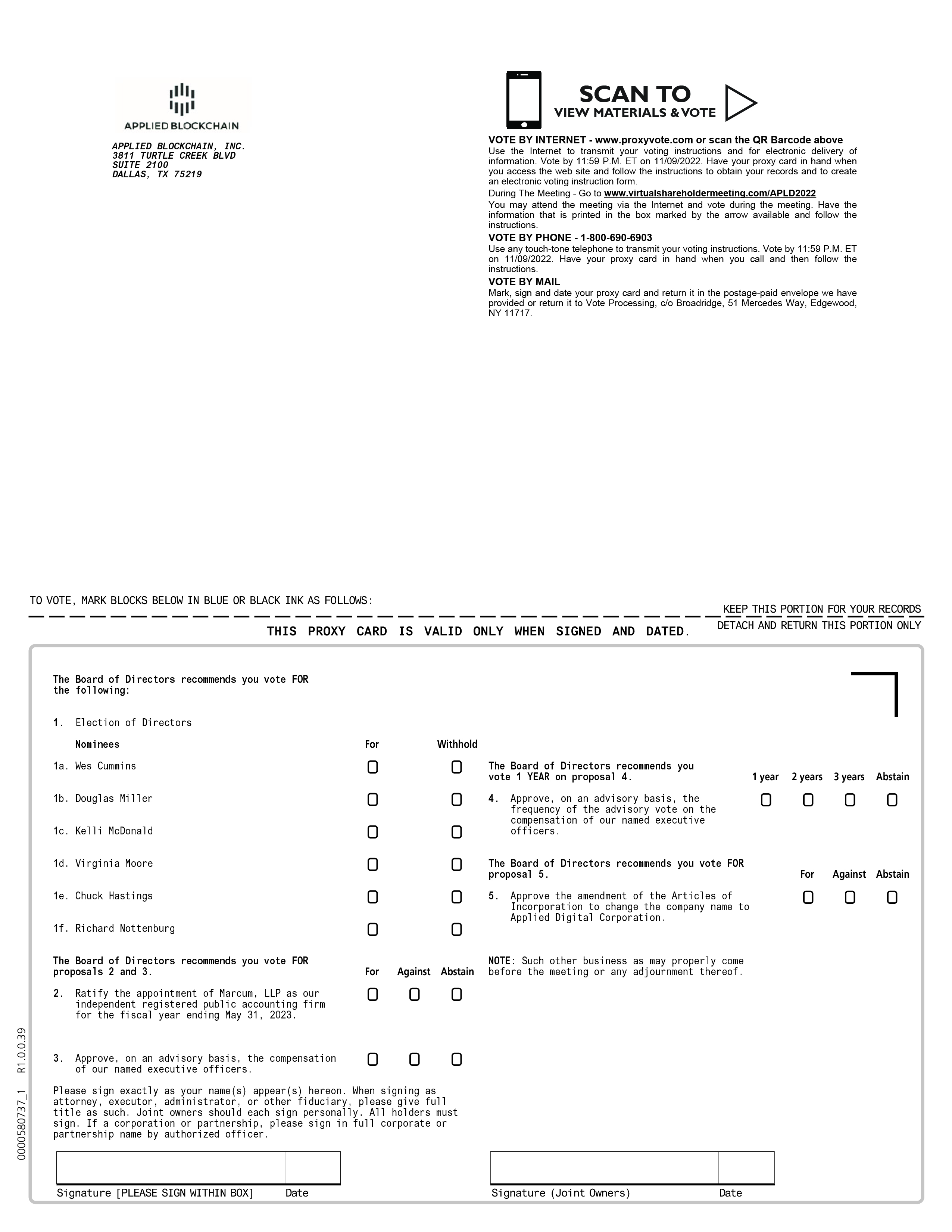

| Proposal | |

| 1 | Elect 6 directors as follows: Wes Cummins, Chuck Hastings, Kelli McDonald, Douglas Miller, Virginia Moore and Richard Nottenburg. |

| 2 | Ratify the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ended May 31, 2023. |

| 3 | Approve, on an advisory basis, the compensation of our named executive officers. |

| 4 | Approve, on an advisory basis, the frequency of the advisory vote on the compensation of our named executive officers. |

| 5 | Approve an amendment of our Articles of Incorporation to change the company name to Applied Digital Corporation. |

Only stockholders of record as of the close of business on September 14, 2022 may vote at the Annual Meeting.

It is important that your shares be represented at the Annual Meeting, regardless of the number you may hold. Whether or not you plan to attend, please vote using the Internet, by telephone or by mail, in each case by following the instructions in our proxy statement. This will not prevent you from voting your shares in person if you are present.

I look forward to seeing you on November 10, 2022.

Sincerely,

Wes Cummins

Chairman of the Board

| | |

|

We mailed a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and annual report on or about September 27, 2022. Applied Blockchain’s proxy statement and annual report are available online at ir.appliedblockchaininc.com/sec-filings. |

|

TABLE OF CONTENTS

| | | | | |

| | Page |

| PROXY SUMMARY | |

| PROPOSAL 1 – ELECTION OF DIRECTORS | |

| Nominees for Director | |

| CORPORATE GOVERNANCE | |

| Corporate Governance Guidelines | |

| Board Leadership Structure | |

| Board Independence | |

| Board and Committee Self-Evaluation and Refreshment | |

| Risk Management | |

| Environmental, Social, and Governance | |

| Code of Conduct and Insider Trading Policy | |

| Board Meetings | |

| Board Committees | |

| Director Compensation | |

| EXECUTIVE OFFICERS | |

| AUDIT COMMITTEE REPORT | |

| EXECUTIVE COMPENSATION | |

| Summary Compensation Table | |

| Narrative Disclosure to Summary Compensation Table | |

| Outstanding Equity Awards at Fiscal Year-End | |

| SECURITY OWNERSHIP | |

| PROPOSAL 2 – RATIFICATION OF MARCUM LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| PROPOSAL 3 – ADVISORY VOTE ON EXECUTIVE COMPENSATION | |

PROPOSAL 4 – ADVISORY VOTE ON THE FREQUENCY OF THE ADVISORY VOTE ON COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | |

PROPOSAL 5 – APPROVE THE AMENDMENT OF THE ARTICLES OF INCORPORATION TO CHANGE THE COMPANY NAME TO APPLIED DIGITAL CORPORATION | |

| Q&A ABOUT VOTING | |

| | | | | |

| FURTHER INFORMATION | |

| Delinquent Section 16(a) Reports | |

| Stockholder Proposals and Director Nominations | |

| List of Stockholders Entitled to Vote at the Annual Meeting | |

| Expenses Relating to this Proxy Solicitation | |

| Communication with Applied Blockchain’s Board of Directors | |

| Available Information | |

| Electronic Delivery | |

| Householding | |

PROXY SUMMARY

This proxy summary highlights information contained elsewhere in this proxy statement and does not contain all information that you should review and consider. Please read the entire proxy statement with care before voting.

| | | | | | | | | | | | | | | | | |

| 2022 Annual Meeting Details |

| Date and Time: Thursday, November 10, 2022, at 9:00 a.m. Central Time | | | | Record Date: September 14, 2022 |

| Place: www.virtualshareholdermeeting.com/APLD2022 | | | | Voting: Each share of Applied Blockchain common stock outstanding at the close of business on the record date has one vote on each matter that is properly submitted for a vote at the Annual Meeting. |

BOARD RECOMMENDATIONS

| | | | | | | | |

Proposals | Board Recommendations | Page Reference |

Proposal 1: Election of Directors | FOR each director nominee | |

Proposal 2: Ratification of Marcum LLP as our independent registered public accounting firm | FOR | |

Proposal 3: Advisory Vote on Executive Compensation | FOR | |

Proposal 4: Advisory Vote on the Frequency of the Advisory Vote on Compensation of our Named Executive Officers | 1 YEAR | |

Proposal 5: Approve the amendment of the Articles of Incorporation to change the company name to Applied Digital Corporation | FOR | |

PROPOSAL ONE

Election of Directors (page 5) Board Composition

The independent directors of our Board of Directors (the “Board”) are balanced with a mix of skills, experience, diversity and perspectives. See page 5 for more information.

Governance Highlights

Our Board seeks to maintain the highest standards of corporate governance and ethical business conduct, including the following highlights:

•A majority of the directors on the Board are "independent directors" consistent with definitional guidance provided by the listing standards of The Nasdaq Stock Market (the "Nasdaq Listing Standards");

•Each member of our Audit, Compensation and Nominating and Corporate Governance ("NCG") Committees are "independent" under the Nasdaq Listing Standards and are otherwise qualified for membership in accordance with the relevant committee's charter;

•The Board evaluates each candidate in the context of Board composition as a whole, and seeks to align Board composition with the Company's strategic needs while considering relevant industry and business experience, leadership and director experience, and diversity;

•Our Board has a Lead Independent Director, and five of our six nominees for the Board are independent;

•No nominee for director serves on more than three other public company boards (four public company boards in total);

•Each regular meeting of the Board includes an executive session at which no employee directors or other employees are present, presided over by the Lead Independent Director;

•The Board evaluates its performance and the performance of its committees on an annual basis through an evaluation process administered by the NCG Committee;

•The Compensation Committee determines the criteria by which the Chief Executive Officer is evaluated and conducts a review, at least annually, of the performance of the Chief Executive Officer; and

•Stockholders shall have reasonable access to directors at annual meetings of stockholders and an opportunity to communicate directly with directors on appropriate matters.

Environmental, Social, and Governance

The Company's datacenters are served by transmission networks that move substantial volumes of power with a primary focus on renewable energy that is often stranded due to lack of local demand. Additionally, the Company is capable of scaling services based on power production, ramping up or down our load on the grid, providing demand to renewable energy operators with no material interruption to their product or end-users, which has little negative impact on grid stability or congestion. The Company also takes measures to reduce waste and the use of water and chemicals harmful to the environment.

The Company seeks areas in which its digital infrastructure buildout would affect positive change and serve communities, many of which are rural. Specifically, the Company aims to bolster local governments in their promotion of renewable power production and to provide residents of these areas with higher income career opportunities.

The Company seeks to have strong corporate governance, including a management team highly aligned with stockholders and a diverse Board of Directors. Named Executive Officers and directors of the Company own approximately 28.9% of the Company's outstanding common stock. Five of the six nominees for director are independent, and two of the six nominees are female, one of whom is a minority.

| | | | | | | | | | | | | | |

The Board recommends a vote “FOR” each of the director nominees named above for re-election to the Board. |

PROPOSAL TWO

Ratification of Marcum LLP as Our Independent Registered Public Accounting Firm (page 42) The Audit Committee of the Board has appointed Marcum LLP to continue to serve as our independent registered public accounting firm for the fiscal year ended May 31, 2023.

Marcum LLP has served as our independent registered public accounting firm since June 2021.

The Audit Committee evaluates the qualifications, performance and independence of Applied Blockchain’s independent registered public accounting firm to determine whether to re-engage the same independent registered public accounting firm or whether it should be rotated.

Based on this evaluation, the Audit Committee believes that the continued retention of Marcum LLP is in the best interests of Applied Blockchain and its stockholders.

| | |

The Board recommends a vote “FOR” ratification of the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ended May 31, 2023. |

PROPOSAL THREE

Advisory Vote on Executive Compensation (page 44) Overview of Executive Compensation Practices

Incentive Structure. The core of our executive compensation philosophy going forward is that our executives’ pay should be linked to the performance of Applied Blockchain. For fiscal year ended May 31, 2022, the payment and magnitude of compensation bonuses to our executive officers were based on the successful completion of our initial public offering, which occurred on April 12, 2022. For fiscal year ended May 31, 2023, we intend to base the payment and magnitude of compensation bonuses on financial and other performance metrics as set by the Compensation Committee.

Our executive compensation policies align our executives’ interests with those of our stockholders.

Below is a summary of our key executive compensation and corporate governance practices:

| | | | | | | | | | | | | | |

| What We Do | | What We Do Not Do |

| Annually assess the risk-reward balance of our compensation programs in order to mitigate undue risks in our programs | | | No pension plans or Supplemental Executive Retirement Plans |

| Provide compensation mix that involves variable pay | | | No hedging or pledging of our securities |

| An independent compensation consultant advises the Compensation Committee | | | No excise tax gross-ups upon a change in control |

| | |

The Board recommends a vote “FOR” adoption of the resolution approving the compensation of our Named Executive Officers. |

PROPOSAL FOUR

Advisory Vote on the Frequency of the Advisory Vote on Compensation of Our Named Executive Officers (page 45) Our Board believes that a frequency of every “1 year” is the appropriate choice for conducting and responding to a Say on Pay vote for Applied Blockchain because a vote every year helps our stockholders consider the effectiveness of our compensation strategies and provide feedback to our Compensation Committee.

| | |

The Board recommends a vote for adoption of the resolution approving Frequency of the Advisory Vote on Compensation of our Named Executive Officers of "1 YEAR." |

PROPOSAL FIVE

Approve the Amendment of the Articles of Incorporation to Change the Company Name to Applied Digital Corporation (page 46) Our Board believes that a change in our corporate name from "Applied Blockchain, Inc." to "Applied Digital Corporation" will more accurately reflect the Company's services and broader business offerings to serve customers that require large computing power applications. The change in corporate name would require an amendment of the Company's Second Amended and Restated Articles of Incorporation.

| | |

The Board recommends a vote “FOR” adoption of the resolution approving the amendment of the Articles of Incorporation to change the company name to Applied Digital Corporation. |

PROPOSAL ONE

Election of Directors

BALANCED BOARD WITH UNIQUE PERSPECTIVES

We are committed to ensuring that our Board is made up of directors who bring to the Board a wealth of leadership experience, diverse viewpoints, knowledge, skills and business experience in the substantive areas that impact our business and align with our strategy.

Our Nominating and Corporate Governance Committee (the “NCG Committee”) regularly reviews the characteristics, skills, background and expertise of the Board as a whole and its individual members to assess those traits against the developing needs of the Board and Applied Blockchain. Applied Blockchain is committed to seeking diversity and balance among directors of race, gender, geography, thought, viewpoints, backgrounds, skills, experience, and expertise and our NCG Committee seeks to have a Board with unique and balanced perspectives. The skills, experience and background of each of our directors, and the characteristics that our NCG Committee and our Board identified in connection with his or her nomination is set forth in the director’s biography which starts on page 7 of this proxy statement.

BOARD INDEPENDENCE AND DIVERSITY

Independence

We seek to have a Board of independent directors that bring to us a wide range of viewpoints and experiences. As discussed later in this proxy statement, we annually evaluate the independence of each of our directors utilizing the definition of “independent director” in the listing rules of the Nasdaq Stock Market.

Board Diversity

Each year, our NCG Committee will review, with the Board, the appropriate characteristics, skills, and experience required for the Board as a whole and its individual members. In evaluating the suitability of individual candidates, our NCG Committee will consider factors including, without limitation, an individual’s character, integrity, judgment, potential conflicts of interest, other commitments, and diversity. While we have no formal policy regarding board diversity for our Board as a whole nor for each individual member, the NCG Committee does consider such factors as gender, race, ethnicity and experience, area of expertise, as well as other individual attributes that contribute to the total diversity of viewpoints and experience represented on the Board.

In August 2021, the Securities and Exchange Commission (the "SEC") approved a Nasdaq Stock Market proposal to adopt new listing rules relating to board diversity and disclosure. As approved by the SEC, the new Nasdaq listing rules require all Nasdaq listed companies to disclose consistent, transparent diversity statistics regarding their boards of directors. The rules also require most Nasdaq-listed companies to have, or explain why they do not have, at least two diverse directors, including one who self-identifies as female and one who self identifies as either an under-represented minority or LGBTQ+. The Board Diversity Matrix below presents the Board’s diversity statistics in the format prescribed by the Nasdaq rules.

As of August 30, 2022, the composition of our Board was as follows:

| | | | | | | | | | | | | | |

Board Diversity Matrix (As of August 30, 2022) |

Total Number of Directors | 7 |

| | Female | Male | Non-Binary | Did Not Disclose Gender |

Gender Identity | | | | |

Directors | 2 | 5 | 0 | 0 |

Demographic Background | | | | |

African American or Black | 0 | 0 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

Asian | 0 | 1 | 0 | 0 |

| Hispanic or Latinx | 1 | 0 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

White | 1 | 4 | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

| Other (Race or Ethnicity) | 0 | 0 | 0 | 0 |

| LGBTQ+ | 0 | 0 | 0 | 0 |

| Did Not Disclose Demographic Background | 0 | 0 | 0 | 0 |

OUR DIRECTORS AND DIRECTOR NOMINEES

Our Board, upon recommendation of our NCG Committee, has nominated Wes Cummins, Douglas Miller, Kelli McDonald, Virginia Moore, Chuck Hastings, and Richard Nottenburg for election as directors of the Board.

Our Bylaws permit the Board to set the size of the Board. During the fiscal year ended May 31, 2022, the Board had seven directors. Jason Zhang, a current director on the Board, will not stand for reelection at the Annual Meeting and accordingly, as of November 10, 2022, by resolution of the Board, the number of directors on the Board will be reduced from seven to six.

Each of our current directors serves until the next annual meeting of our stockholders or earlier death, resignation or removal. Despite the expiration of a director’s term, however, the director shall continue to serve until such director’s successor is elected and qualifies or until there is a decrease in the number of directors.

Our Bylaws provide that directors will be elected by plurality of the votes cast. Thus, when the number of director nominees equals the number of directorships on the Board, each nominee needs at least one affirmative vote to be elected to the Board.

As discussed above, we believe that each of our directors possesses the experience, skills and qualities to fully perform his or her duties as a director and contribute to Applied Blockchain’s success. Our directors were nominated because each is of high ethical character, highly accomplished in his or her field with superior credentials and recognition, has a reputation, both personal and professional, that is consistent with Applied Blockchain’s image and reputation, has the ability to exercise sound business judgment, and is able to dedicate sufficient time to fulfilling his or her obligations as a director. Each director’s principal occupation and other pertinent information about particular experience, qualifications, attributes and skills that led the Board to conclude that such person should serve as a director, appears on the following pages.

NOMINEES FOR DIRECTOR

| | | | | | | | | | | |

Director Since: 2007 | Age: 45 | | | Wes Cummins Chairman of the Board and Chief Executive Officer |

| Mr. Cummins has served as a member of our Board from 2007 until 2020 and from March 11, 2021 through present. During that time Mr. Cummins also served in various executive officer positions and he is currently serving as our Chairman of the Board, Chief Executive Officer, President, Secretary and Treasurer. Mr. Cummins was also the founder and CEO of 272 Capital LP, a registered investment advisor, which was sold to B. Riley Financial, Inc. (Nasdaq: RILY) in August 2021. Following the sale Mr. Cummins joined B. Riley as President of B. Riley Asset Management. Mr. Cummins intends to spend at least 40 hours per week on our business. Mr. Cummins has been a technology investor for over 20 years and held various positions in capital markets including positions at investment banks and hedge funds. Prior to founding 272 Capital and starting our operating business, Mr. Cummins was an analyst with Nokomis Capital, L.L.C., an investment advisory firm, a position he held from October 2012 until February 2020. Mr. Cummins also serviced as president of B. Riley & Co., from 2002 to 2011. Mr. Cummins also serves as a member of the board of Sequans Communications S.A. (NYSE: SQNS), a fabless designer, developer and supplier of cellular semiconductor solutions for massive, broadband and critical Internet of Things (“IoT”) markets, and Vishay Precision Group, Inc. (NYSE: VPG), designer, manufacturer and marketer of sensors and sensor-based measurement systems, as well as specialty resistors and strain gauges based upon their propriety technology. Mr. Cummins served on the board of Telenav, Inc. (NASDAQ: TNAV) from August 2016 until February 2021. He holds a BSBA from Washington University in St. Louis where he majored in finance and accounting. |

| We believe Mr. Cummins’ experience building a business and as a Chief Executive Officer and his experience investing in technology gives him insight and perspective into creating and building a technology-based company as well as operating a public company and enables him to be an effective board member. |

| | | | | | | | | | | |

Director Since: 2021 | Age: 65 | Committees: Audit, Compensation | | | Douglas Miller Lead Independent Director |

| Mr. Miller has served as a member of the board of directors of three public companies over the past nine years: Telenav, Inc (NASDAQ: TNAV), CareDx, Inc. (NASDAQ: CDNA) and Procera Networks. He has chaired the Audit Committee for each of these companies, and has also served as Lead Independent Director and as chair or committee member on Compensation, Nominating and Governance and Special committees. Prior to his roles as board member, Mr. Miller served as senior vice president, Chief Financial Officer and Treasurer of Telenav, a wireless application developer specializing in personalized navigation services, from 2006 to 2012. From 2005 to 2006, Mr. Miller served as Vice President and Chief Financial Officer of Longboard, Inc., a privately held provider of telecommunications software. Prior to that, from 1998 to 2005, Mr. Miller held various management positions, including Senior Vice President of Finance and Chief Financial Officer, at Synplicity, Inc., a publicly traded electronic design automation company. Mr. Miller also served as Chief Financial Officer of 3DLabs, Inc., a publicly held graphics semiconductor company, and as an audit partner at Ernst & Young LLP, a professional services organization. Mr. Miller is a certified public accountant (inactive). He holds a B.S.C. in Accounting from Santa Clara University. |

| We believe Mr. Miller’s experience as a chief financial officer and board member of public companies gives him insight and perspective into how other boards function and enables him to be an effective board member. |

| | | | | | | | | | | |

Director Since: 2021 | Age: 45 Committees: Compensation, Nominating and Governance | | | Kelli McDonald Independent Director |

| Ms. McDonald has a passion for high impact charity work in her local community as well as social and environmental causes. Ms. McDonald has been active in early childhood education since 2006. She has served as the Fundraising Chairperson and Social Media Manager for KSD NOW since 2019 and works in merchandising for an independent bookseller. In addition to work in non-profit development, early childhood education and the Literacy Project from 2017 to 2020, Ms. McDonald founded NG Gives Back — a community service and engagement program focused on the St. Louis area. She earned a Bachelor of Arts degree from The University of Wisconsin Oshkosh. |

| We believe Ms. McDonald’s education and community outreach background bring a unique perspective to the Board and enables her to be an effective board member. |

| | | | | | | | | | | |

Director Since: 2021 | Age: 49 Committees: Compensation, Nominating and Governance | | | Virginia Moore Independent Director |

| Ms. Moore is the Co-founder, and CEO since 2017, of Catavento, a home textiles company based in Los Angeles. For 7 years prior to that, Ms. Moore was a partner and Vice President of Corbis Global, a 100-person architectural and engineering outsourcing firm. Earlier in her career she held positions in Marketing and Category Management with Coca-Cola, ACNielsen and Universal Studios Home Entertainment. Ms. Moore earned a Business Administration degree from Universidad Católica de Cordoba in her native Argentina and an MBA from ESADE Business School in Barcelona, Spain. |

| Ms. Moore’s business and entrepreneurial experience brings a unique perspective to our Board and enable her to be an effective board member. |

| | | | | | | | | | | |

Director Since: 2021 | Age: 44 Committees: Audit, Nominating and Governance | | | Chuck Hastings Independent Director |

| Mr. Hastings currently serves as Chief Executive Officer of B. Riley Wealth Management. Mr. Hastings joined B. Riley Financial in 2013 as a portfolio manager and became Director of Strategic Initiatives at B. Riley Wealth Management in 2018 and President in 2019. Prior to joining B. Riley, Mr. Hastings served as Portfolio Manager at Tri Cap LLC and was Head Trader at GPS Partners, a Los Angeles-based hedge fund, where he managed all aspects of trading and process including price and liquidity discovery and trade execution from 2005 to 2009. While at GPS Partners, Mr. Hastings was instrumental in growing the fund with the founding partners from a small start-up to one of the largest funds on the West Coast. Earlier in his career, Mr. Hastings served as a convertible bond trader at Morgan Stanley in New York. Mr. Hastings also serves as a Board member for IQvestment Holdings. Mr. Hastings holds a B.A. in political science from Princeton University. He is a recognized leader in the financial industry with more than two decades of global financial and business expertise. |

| We believe Mr. Hastings’ experience and expertise will be of tremendous value as we pursue opportunities to leverage our initial investment and further scale our mining operations and build our co-hosting operations and enables him to be an effective board member. |

| | | | | | | | | | | |

Director Since: 2021 | Age: 68 | Committees: Audit, Compensation | | | Richard Nottenburg Independent Director |

| Dr. Nottenburg brings a wealth of experience and expertise to our Board. He is currently on the Board of Directors of Cognyte Software Ltd., (NASDAQ: CGNT),a global leader in security analytics software and Verint Systems Inc. (NASDAQ: VRNT), a customer engagement company. He serves as chairman of the compensation committee of both companies. He is also a member of the board of Sequans Communications S.A. (NYSE: SQNS), a leading developer and provider of 5G and 4G chips and modules for massive, broadband and critical IoT applications where he serves on both the audit and compensation committees. Dr. Nottenburg is also Executive Chairman of NxBean Inc., a provider of leading proprietary mmWave ICs and radio products to power the next generation of satellite and terrestrial communication systems, and an investor in various ealy stage technology companies. Previously, Dr. Nottenburg served as President and Chief Executive Officer and a member of the Board of Directors of Sonus Networks, Inc. from 2008 through 2010. From 2004 until 2008, Dr. Nottenburg was an officer with Motorola, Inc., ultimately serving as its Executive Vice President, Chief Strategy Officer and Chief Technology Officer. |

| We believe that Dr. Nottenburg’s deep experience in global technology-focused businesses and will be a valuable resource to us as we look to leverage our supply chain and scale our operations and enable him to be an effective member of the Board. |

| | |

Recommendation of the Board: The Board recommends a vote “FOR” each of the director nominees. |

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE GUIDELINES

The Board adopted Corporate Governance Guidelines on December 10, 2021, which pertain to the Board's role within the Company and its composition, Board meetings, Board committees, performance evaluation of directors and officers, and Company-wide communication. Specific guidelines include the following:

•A majority of the directors on the Board should be "independent directors" consistent with definitional guidance provided by the listing standards of The Nasdaq Stock Market (the "Nasdaq Listing Standards");

•The Board has three committees as mandated by the Nasdaq Listing Standards—an Audit Committee, a Compensation Committee and a NCG Committee;

•Each member of the Audit, Compensation and/or NCG Committees shall be "independent" under the Nasdaq Listing Standards and shall be otherwise qualified for membership in accordance with the relevant committee's charter;

•The Board selects director nominees to stand for election and re-election by the Company's stockholders and may also fill Board vacancies and newly created directorships upon recommendations from the NCG Committee;

•The Board evaluates each candidate in the context of Board composition as a whole, and seeks to align Board composition with the Company's strategic needs while considering relevant industry and business experience, leadership and director experience, and diversity;

•The roles of the Chair and Chief Executive Officer may be held by separate individuals or may be held by the same individual, and if the serving Chair does not qualify as independent, the independent directors shall select from among themselves a Lead Independent Director;

•All directors may only serve on three other public company boards (four public company boards in total);

•A director who experiences a significant change in his or her principal business, professional position, employment or responsibility shall offer his or her resignation from the Board;

•Each director is expected to disclose any existing or proposed relationships or transactions that involve or could give rise to a conflict of interest, and shall accordingly recuse himself or herself from Board discussions if requested to do so;

•Directors have an affirmative duty to protect and hold confidential all non-public information (whether or not material to the Company) entrusted to or obtained by a director by reason of his or her position as a director of the Company;

•Four Board meetings are calendared in advance for each year, with additional regular or special meetings held as circumstances warrant as determined by the Chair in consultation with the Lead Independent Director (if any), the Chief Executive Officer and as appropriate the members of the Board;

•Directors who attend fewer than 75% of regular and special meetings combined will be contacted by the Chair (or Lead Independent Director, if any) to discuss the circumstances and whether continued Board service is appropriate;

•Each regular meeting of the Board shall include an executive session at which no employee directors or other employees are present, presided over by the Chair; if an independent director, or, in the absence of an independent Chair, the Lead Independent Director;

•The Board evaluates its performance and the performance of its committees on an annual basis through an evaluation process administered by the Nominating and Governance Committee;

•The Compensation Committee determines the criteria by which the Chief Executive Officer is evaluated and conducts a review, at least annually, of the performance of the Chief Executive Officer;

•The NCG Committee reports to the Board periodically on executive officer succession planning and leadership development processes;

•As a general matter, the Chief Executive Officer (and senior executives to whom the Chief Executive Officer further delegates) has authority to speak for the Company on most matters related to Company performance, operations and strategy; and

•Stockholders shall have reasonable access to directors at annual meetings of stockholders and an opportunity to communicate directly with directors on appropriate matters.

Certain of these guidelines are discussed in greater detail below.

BOARD LEADERSHIP STRUCTURE

Subject to the Corporate Governance Guidelines as described above, the Board has not adopted a formal policy regarding the need to separate or combine the offices of Chair of the Board and Chief Executive Officer and instead the Board remains free to make this determination from time to time in a manner that seems most appropriate for Applied Blockchain. Currently, Wesley Cummins serves as the Company's Chief Executive Officer and Chair of the Board.

In order to facilitate and strengthen the Board’s independent oversight of Applied Blockchain’s performance, strategy and succession planning and to uphold effective governance standards, the Board has established the role of a Lead Independent Director. Our current Chair, Mr. Cummins, is not “independent” under the Nasdaq Listing Standards. Our Lead Independent Director provides leadership to the Board if circumstances arise in which the role of chief executive officer and chairperson of our Board may be, or may be perceived to be, in conflict, and perform such additional duties as our Board may otherwise determine and delegate. Douglas Miller currently serves as Applied Blockchain’s Lead Independent Director.

The Lead Independent Director’s duties include:

•chairing Board meetings in the absence of the Chair;

•convening and leading executive sessions of the Board (and may exclude any non-independent Chair and/or the Chief Executive Officer from such sessions);

•serving as a liaison between the Chair and the independent directors;

•being available for consultation and direct communication with major stockholders as directed by the Board; and

•performing such other duties and responsibilities as requested by the Board.

BOARD INDEPENDENCE

We require that a majority of our Board and all members of our three standing Committees be comprised of directors who are “independent,” as such term is defined in the listing standards of the Nasdaq Listing Standards. Each year, the Board undertakes a review of director independence, which includes a review of each director’s responses to questionnaires asking about any relationships with us. This review is designed to identify and evaluate any transactions or relationships between a director or any member of his or her immediate family and us, or members of our senior management or other members of our Board, and all relevant facts and circumstances regarding any such transactions or

relationships. Consistent with these considerations, our Board has affirmatively determined that each of Ms. McDonald and Ms. Moore and each of Messrs. Miller, Hastings and Nottenburg are independent.

The independent members of the Board generally meet in executive session at each regularly scheduled meeting of the Board.

BOARD AND COMMITTEE SELF-EVALUATION AND REFRESHMENT

Our Board conducts annual self-evaluations to assess the effectiveness of the Board and its Committees. These annual self-evaluations are overseen by the NCG Committee and are designed to enhance the overall effectiveness of the Board and each Committee and identify areas of potential improvement. They include written questionnaires that solicit feedback from the Board and Committee members on a range of topics, including the Committees’ roles, structure and composition; the extent to which the mix of skills, experience and other attributes of the individual directors is appropriate for the Board and each Committee; the scope of duties delegated to the Committees, including the allocation of risk assessment between the Board and its Committees; interaction with management; information and resources; the adequacy of open lines of communication between directors and members of management; the Board and Committee meeting process and dynamics; and follow-through on recommendations developed during the evaluation process.

Our Board has also implemented annual individual director self-evaluations that require each director to assess his or her performance as a director and the performance of the Board as a whole. This process involves directors providing direct feedback to the Chair of the Board, the Lead Independent Director and the Chair of the NCG Committee who, in turn, review the self-evaluations for any actions that should be taken to enhance the effectiveness of the Board.

Following the annual self-evaluations, the NCG Committee discusses areas for potential improvement with the Board and/or relevant Committees and, if necessary, identifies steps required to implement these improvements. Director suggestions for improvements to the evaluation questionnaires and process are considered for incorporation for the following year. As part of the NCG Committee’s discussion and evaluation of areas for improvement, board refreshment, including the commitment to have a balanced Board with diversity of skills and experience, is a topic that is considered.

The NCG Committee and the Board regularly review Board composition to consider succession related factors, skill sets, diversity and balance. Applied Blockchain is committed to seeking diversity and balance on our Board with directors of race, gender, geography, thoughts, viewpoints, backgrounds, skills, experience and expertise. In conducting each of these director searches, our NCG Committee considered the leadership, technical skills and operational experience that we believed would address the Board’s then current needs.

The NCG Committee and the Board review annually succession planning for Applied Blockchain’s executive officers and develop and review succession planning for Board members, including succession planning for the Chair of the Board and/or Lead Independent Director.

RISK MANAGEMENT

Board Role in Management of Risk

The Board is primarily responsible for overseeing our risk management processes. The Board, as a whole, determines our appropriate level of risk, assesses the specific risks that we face, and reviews management’s strategies for adequately mitigating and managing the identified risks. Although the Board administers this risk management oversight function, the Board committees support the Board in discharging its oversight duties and address risks inherent in their respective areas. The audit committee reviews our major financial risk exposures and the steps management has taken to monitor and control such exposures, including our procedures and related policies with respect to risk assessment and risk management. Our audit committee also reviews matters relating to compliance, cybersecurity, and security and reports to the Board regarding such matters. The compensation committee reviews risks and exposures associated with compensation plans and programs. We believe this division of responsibilities is an effective approach for addressing the risks we face and that the Board leadership structure supports this approach.

Compensation Risks

For fiscal year ended May 31, 2022, as part of our risk management process, we conducted an annual comprehensive review and evaluation of our compensation programs and policies. The assessment covered each material component of executive and non-executive employee compensation. Based on a review and analysis of our incentive plans, policies and programs, we believe these programs are not reasonably likely to give rise to risks that would have a material adverse effect on our business. In evaluating our compensation components, we took into consideration the following risk-limiting characteristics:

•A significant percentage of our overall pay mix is equity-based, which, when combined with the vesting terms, aligns our executive officers’ interests with stockholders’ interests and minimizes the taking of inappropriate or excessive risk that would impair the creation of long-term stockholder value; and

•We have effective management processes for establishing key financial and operating targets, and monitoring financial and operating metrics.

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE

We are firmly committed to sustainable leadership by integrating sustainability into how we do business. Our responsible practices, policies and programs reflect our commitment to making a positive impact.

Environmental

The Company designs, builds and operates next-generation datacenters that host high performance computing (HPC) applications that include, but are not limited to, cryptocurrency mining. The Company prioritizes the environment, which is reflected in various stages of its operations, as described below.

The Company can locate near renewable power assets such as wind farms to help the power owners monetize their "stranded" power, which consists of energy that is produced but not utilized due to constraints on delivering the energy to areas that might demand it. Accordingly, the Company's location near wind farms may spur local economies and prevent such wind farms from having to reduce output. For instance, the Company operates several projects in North Dakota because there is a surplus of stranded power. North Dakota is one of the largest wind producing states in the United States, housing more than 1,500 turbines throughout the state. In addition to the availability of stranded power directly associated with wind farms, the Governor of North Dakota, Greg Burgum, has publicly committed to making North Dakota carbon neutral by 2030, which makes the location ideal for the Company's infrastructure. Additionally, the Company is capable of scaling services based on power production, ramping up or down our load on the grid, providing demand to the wind farm operators with no material interruption to their product or end-users, which has little negative impact on grid stability or congestion.

In order to reduce waste from the disposal of the foam protecting the Company’s mining equipment during transport, the Company utilizes a foam densifier machine on site to melt the foam packaging, reducing the foam’s volume by 98%. The Company’s sites use very little water. There are no large amounts of chemicals on site that would risk the surrounding population. The transformers on site use specialized biodegradable and non-explosive fluids. The site does not emit exhaust into the air. There is no risk of chemical spills, and an overall low risk of any pollution. The Company’s focus on renewable energy and partnerships with local governments, communities and utilities represent the Company’s commitment to reducing carbon emissions and driving the adoption of renewable power as an environmentally conscientious business leader in the HPC digital infrastructure sector.

Social

The Company seeks areas in which its digital infrastructure buildout would affect positive change and serve communities, many of which are rural. Specifically, the Company aims to bolster local governments in their promotion of renewable power production and to provide residents of these areas with higher income career opportunities.

In furtherance of these aims, the Company visits every proposed location to meet its residents, at times through town-hall forums, and identifies community needs prior to starting projects, and has donated over $75,000 to date to causes that are important to these local communities. The Company also hires local contractors and vendors for the construction of projects, which helps improve the employment rate of these local communities and in turn provides demand for other

products and services generated by the local community. Because there is a limited talent-pool for next-generation data center operators, the Company develops the local workforce by using a digital learning system regarding the use of equipment in the Company’s business, and provides on-the -job training for entry level positions.

Governance

The Company seeks to have strong corporate governance, including a management team highly aligned with stockholders and a diverse Board of Directors. Named Executive Officers and Directors of the Company own approximately 28.9% of the Company’s outstanding common stock, while five of six nominees for directors are independent, and two of the six nominees are female, one of whom is a minority.

CODE OF CONDUCT AND INSIDER TRADING POLICY

The Board has adopted our Code of Business Conduct and Ethics (our “Code of Conduct”) and Insider Trading Policy, which we periodically revise to reflect best corporate governance practices and changes in applicable rules.

Our Code of Conduct sets forth standards of conduct applicable to employees, officers, and directors of Applied Blockchain, to maintain a safe and fair workplace, act in the Company's best interests, protect Company assets and information, and comply with applicable laws, rules and regulations. Our Code of Conduct is available to view at our website, ir.appliedblockchaininc.com/corporate-governance, We intend to provide disclosure of any amendments or waivers of our Code of Conduct on our website within four business days following the date of the amendment or waiver.

Acting in the Company's Best Interests. Our Code of Conduct requires directors, officers and all other employees to conduct themselves in an honest and ethical manner, including the ethical handling of actual or apparent conflicts of interest. Our Code of Conduct generally requires (1) officers and directors to disclose any outside activities, financial interests or relationships that may present a possible conflict of interest or the appearance of a conflict to the Audit Committee and (2) employees to disclose any outside activities, financial interests or relationships that may present a possible conflict of interest or the appearance of a conflict to the General Counsel or the General Counsel's designee. The Audit Committee and/or General Counsel will determine if any such outside activities, financial interests or relationships constitute a conflict of interest and a related person transaction on a case-by-case basis and will promptly disclose such activities, interests or relationships to the appropriate Committee for their review and appropriate action, if necessary. It is our preference to avoid related person transactions generally. Under applicable Nasdaq Listing Standards, all related person transactions must be approved by our Audit Committee or another independent body of the Board. Current SEC rules applicable to smaller-reporting companies define transactions with related persons to include any transaction, arrangement or relationship (1) in which Applied Blockchain is a participant, (2) in which the amount involved exceeds the lesser of $120,000 or one percent of the average of Applied Blockchain's total assets at May 31, 2022 and 2021, and (3) in which any executive officer, director, director nominee, beneficial owner of more than 5% of Applied Blockchain’s common stock, or any immediate family member of such persons has or will have a direct or indirect material interest. All directors must recuse themselves from any discussion or decision affecting their personal, business or professional interests. All related person transactions will be disclosed in our applicable SEC filings as required under SEC rules. Additionally, our Board has developed policies and procedures regarding political contributions and lobbying, which are set forth in our Code of Conduct and are reviewed annually by our Board. In accordance with this policy, we prohibit directors, officers or employees from making individual contributions with company funds; or being reimbursed for any political contributions. In those limited circumstances where Applied Blockchain would be permitted to make a corporate political contribution under federal, state or local laws, our Board has delegated to the General Counsel the responsibility for providing prior authorization for any such contribution.

Compliance with Applicable Laws, Regulations, and Rules. Our Insider Trading Policy prohibits all directors, officers and employees from engaging in transactions in our common stock while in possession of material non-public information and restricts directors, officers and other "designated insiders" from engaging in most transactions involving our common stock during periods in which we have determined that those individuals are most likely to be aware of material, non-public information.

Anti-Hedging Policy. The Company's employees, executive officers, directors, agents, consultants and contractors are prohibited from hedging ownership of shares of common stock, shares of preferred stock, stock options, restricted stock, restricted stock units, warrants, debt securities, any other type of security the Company may issue, any instrument that grants to its holder a direct or indirect ownership interest in the Company or any debt obligation of the Company and any derivative securities of such securities ("Securities"), subject to certain exceptions. The following transactions by such individuals must be reviewed and pre-approved by the General Counsel (except if the Chief Financial Officer is substituting

for the General Counsel, the pre-clearance for the Chief Financial Officer is to be done by the Chief Executive Officer): (i) all pledges of Company Securities or the Securities of any other company designated by the General Counsel and (ii) the deposit in margin accounts of Company Securities or the Securities of any other company designated by the General Counsel.

BOARD MEETINGS

During the fiscal year ended May 31, 2022, the Board held a total of four meetings. Each of our director nominees attended all of the Board meetings and meetings of the Committees on which they served during the fiscal year ended May 31, 2022. It is the policy of the Board to encourage its members to attend Applied Blockchain’s Annual Meeting of Stockholders.

BOARD COMMITTEES

The Board has three standing Committees: the Audit Committee, the Compensation Committee and the NCG Committee. Copies of the Committee charters of each of the Audit Committee, the Compensation Committee and the NCG Committee setting forth the respective responsibilities of the Committees can be found at ir.appliedblockchaininc.com/corporate-governance, and such information is also available in print to any stockholder who requests it through our Investor Relations department. Each of the Committees reviews, and revises if necessary, its respective charter not less than annually.

| | | | | | | | | | | |

| Audit Committee | Compensation Committee | Nominating and Governance Committee |

Wes Cummins | | | |

| Chuck Hastings | | | |

| Kelli McDonald | | | |

| Douglas Miller | | | |

| Virginia Moore | | | |

| Richard Nottenburg | | | |

Jason Zhang | | | |

– Committee Chair – Committee Chair |  – Committee Member – Committee Member | | |

Audit Committee

Number of Meetings during year ended May 31, 2022: Five

Members: Douglas Miller (Chair), Chuck Hastings, Richard Nottenburg

Responsibilities: Our Audit Committee is directly responsible for, among other things:

•selecting a firm to serve as the independent registered public accounting firm to audit our consolidated financial statements;

•ensuring the independence of the independent registered public accounting firm;

•discussing the scope and results of the audit with the independent registered public accounting firm and reviewing with management and that firm, our interim and year-end operating results;

•establishing procedures for employees to anonymously submit concerns about questionable accounting or audit matters;

•considering the adequacy of our internal controls and internal audit function;

•inquiring about significant risks, reviewing our policies for risk assessment and risk management, including cybersecurity risks, and assessing the steps management has taken to control these risks;

•reviewing and overseeing our policies related to compliance risks;

•reviewing related party transactions that are material or otherwise implicate disclosure requirements; and

•approving or, as permitted, pre-approving all audit and non-audit services to be performed by the independent registered public accounting firm.

Independence and Financial Expertise. The Board has determined that each member of the Audit Committee meets the independence requirements under the Nasdaq Listing Standards and the enhanced independence standards for audit committee members required by the SEC. Each member of our Audit Committee is financially literate. In addition, the Board has determined that Mr. Miller meets the requirements of an audit committee financial expert under SEC rules. This designation does not impose any duties, obligations, or liabilities that are greater than are generally imposed on members of our Audit Committee and our Board. For information regarding the business experience of the members of the Audit Committee, see “Proposal 1 – Election of Directors.”

Compensation Committee

Number of Meetings during year ended May 31, 2022: Seven

Members: Douglas Miller, Virginia Moore, Kelli McDonald (Chair), Richard Nottenburg

Responsibilities: The Compensation Committee is responsible for:

•reviewing and approving, or recommending that the Board approve, the compensation and the terms of any compensatory agreements of our executive officers;

•reviewing and recommending to the Board the compensation of our directors;

•administering our stock and equity incentive plans;

•reviewing and approving, or making recommendations to the Board with respect to, incentive compensation and equity plans; and

•establishing our overall compensation philosophy.

The Compensation Committee Chair reports on Compensation Committee actions and recommendations at Board of Director meetings.

Role of Compensation Consultants and Advisors and Management. The Compensation Committee has the authority, pursuant to its charter, to engage the services of outside legal or other experts and advisors as it in its sole discretion deems necessary and appropriate to assist the Compensation Committee in fulfilling its duties and responsibilities, and takes recommendations from key members of management. For 2022, the Compensation Committee selected and retained Compensia, Inc. (“Compensia”), an independent compensation consulting firm. See "Executive Compensation Overview: for more information on Compensia and management's recommendations with respect to executive compensation..

Independence. The Board reviewed the background, experience and independence of the Compensation Committee members based primarily on the directors’ responses to questions relating to their relationships, background and experience. Based on this review, the Board determined that each member of the Compensation Committee meets the independence requirements of the Nasdaq Listing Standards, including the heightened independence requirements specific to compensation committee members.

Compensation Committee Interlocks and Insider Participation. None of the directors who served on the Compensation Committee during fiscal year ended May 31, 2022: (i) has ever been an officer or employee of Applied Blockchain or (ii) had any relationship with Applied Blockchain during that fiscal that would require disclosure under Item 404 of Regulation S-K. During fiscal year ended May 31, 2022, none of our executive officers served as a director or member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee the entire board) of any other entity, one of whose executive officers is or has been a director of Applied Blockchain or a member of our Compensation Committee.

Nominating and Corporate

Governance Committee

Number of Meetings during year ended May 31, 2022: One

Members: Virginia Moore (Chair), Kelli McDonald, Chuck Hastings

Responsibilities: The NCG Committee is responsible for:

•identifying and recommending candidates for membership on the Board;

•recommending directors to serve on Board committees;

•reviewing and recommending our corporate governance guidelines and policies;

•reviewing succession plans for senior management positions, including the chief executive officer;

•reviewing proposed waivers of the code of business conduct and ethics for directors, executive officers, and employees (with waivers for directors or executive officers to be approved by the Board);

•evaluating, and overseeing the process of evaluating, the performance of the Board and individual directors; and

•advising the Board on corporate governance matters.

The NCG Committee Chair reports on NCG Committee actions and recommendations at Board meetings.

Consideration of Director Nominees. The NCG Committee considers possible candidates for nominees for directors from many sources, including management and stockholders. Each year, the NCG Committee will review, with the Board, the appropriate characteristics, skills, and experience required for the Board as a whole and its individual members. In evaluating the suitability of individual candidates, our nominating and governance committee will consider factors including, without limitation, an individual’s character, integrity, judgment, potential conflicts of interest, other commitments, and diversity. While we have no formal policy regarding board diversity for our Board as a whole nor for each individual member, the NCG Committee does consider such factors as gender, race, ethnicity and experience, area of expertise, as well as other individual attributes that contribute to the total diversity of viewpoints and experience represented on the Board.

The NCG Committee identifies nominees by first evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to Applied Blockchain’s business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of the Board does not wish to continue in service or if the NCG Committee or the Board decides not to re-nominate a member for re-election, the NCG Committee identifies the desired skills and experience of a new nominee in light of the above criteria. Current members of the NCG Committee and Board are polled for suggestions as to individuals meeting the Criteria for Nomination of the NCG Committee.

From time to time, the NCG Committee has engaged, and may in the future engage, the services of executive search firms to assist the NCG Committee and the Board in identifying and evaluating potential director candidates.

Independence. The composition of our Nominating and Governance Committee meets the requirements for independence under the current Nasdaq listing standards and SEC rules and regulations.

DIRECTOR COMPENSATION

General. The Board maintains a compensation arrangement for the non-employee directors of the Board. The Board compensation arrangement is comprised of the following types and levels of compensation:

Equity Grants. On January 14, 2022, each non-employee director was granted 100,000 shares of restricted stock, 50,000 of which will vest on each of (i) the date on which the SEC declares effective a registration statement covering the resale of the shares of the restricted stock and (ii) April 1, 2023. The Company filed a registration statement covering the resale of

the shares of restricted stock on September 16, 2022, but the SEC has not yet declared effective the registration statement.

On January 20, 2022, our 2022 Non-Employee Director Stock Plan (the "Director Plan") became effective, which provides for grants of restricted stock to non-employee directors and for deferral of cash and stock compensation if such deferral provisions are activated at a future date. Under the Director Plan, in fiscal year ended May 31, 2023, directors received an annual grant of 33,333 shares of restricted stock, which shares will vest on the first anniversary of grant. See "Director Plan" below for more information on the Director Plan.

Retainer and Fees Paid in Cash. The following table shows the annual cash retainer fees for non-employee directors.

| | | | | |

| Base Retainer | $25,000 |

| Audit Committee Chair | $15,000 |

| Audit Committee Member | $8,000 |

| Compensation Committee Chair | $10,000 |

| Compensation Committee Member | $5,000 |

| Nominating and Governance Committee Chair | $5,000 |

| Nominating and Governance Committee Member | $3,000 |

Directors serving in multiple leadership roles receive incremental compensation for each role. Directors are not expected to receive additional compensation for attending regularly scheduled Board or committee meetings. For less than full years of service, the compensation paid to the non-employee directors will be prorated based on the number of days of service. Directors also receive customary reimbursement for reasonable out-of-pocket expenses related to Board service.

Director Compensation Table. The following table presents the compensation for each person who served as a director on our Board during fiscal year ended May 31, 2022.

| | | | | | | | | | | |

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | Total ($) |

| | | |

| Chuck Hastings | 36,000 | | 804,000 | | 840,000 | |

| Kelli McDonald | 38,000 | | 804,000 | | 842,000 | |

| Douglas Miller | 45,000 | | 804,000 | | 849,000 | |

| Virginia Moore | 35,000 | | 804,000 | | 839,000 | |

| Richard Nottenburg | 38,000 | | 804,000 | | 842,000 | |

| Jason Zhang | 25,000 | | 804,000 | | 829,000 | |

1.Amounts shown represent the aggregate grant date fair value, computed in accordance with Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") Topic 718, of awards of restricted stock granted during fiscal year ended May 31, 2022, which include 100,000 shares of restricted stock granted to each non-employee director on January 14, 2022, not pursuant to the Director Plan. Each director held 100,000 unvested shares of restricted stock as of May 31, 2022.

THE DIRECTOR PLAN

Awards and Deferrals

The Director Plan permits (1) the grant of shares of common stock to each of our non-employee directors and (2) if and when authorized by the Board, the deferral by the directors of some or all of their directors’ cash retainer fee and stock compensation. The Director Plan will expire on January 20, 2032.

Administration

Our Chief Financial Officer (“Director Plan Administrator”) will administer the Director Plan. The Director Plan Administrator will interpret all provisions of the Director Plan, establish administrative regulations to further the purposes of the Director Plan and take any other action necessary for the proper operation of the Director Plan. All decisions and acts of the Director Plan Administrator shall be final and binding upon all participants in the Director Plan.

Eligibility

Each of our non-employee directors (a "Director") is eligible to be a participant in the Director Plan until they no longer serve as a Director. The Board currently includes six Directors.

Share Authorization

The maximum aggregate number of shares of common stock that may be issued under the Director Plan is 1,833,333 shares. The aggregate fair market value (determined as of the grant date) of shares that may be issued as stock compensation to a Director in any year shall not exceed $750,000, provided, however, that with respect to new directors joining the Board, the maximum amount shall be $1,000,000 for the first year, or portion thereof, of service.

In connection with the occurrence of any corporate event or transaction (including, but not limited to, a change in our shares or our capitalization) such as a merger, consolidation, reorganization, recapitalization, separation, partial or complete liquidation, stock dividend, stock split, reverse stock split, split up, spin-off, or other distribution of our stock or property, combination of shares, exchange of shares, dividend in kind, or other like change in capital structure, number of outstanding shares or distribution (other than normal cash dividends) to our stockholders, or any similar corporate event or transaction, the Director Plan Administrator, in its sole discretion, in order to prevent dilution or enlargement of the Directors’ rights under the Director Plan, shall substitute or adjust, as applicable, the number and kind of shares that may be issued under the Director Plan, the number and kind of shares subject to outstanding grants, the annual grant limits, and other value determinations applicable to outstanding grants. The Director Plan Administrator may also make appropriate adjustments in the terms of any grants under the Director Plan to reflect or relate to such changes or distributions and to modify any other terms of outstanding grants.

Grant of Shares

As of the first day of each compensation year (as defined in the Director Plan), we will, unless a different formula is selected in accordance with the last sentence of this paragraph, grant each Director a number of shares of our common stock for such year determined by (i) dividing the amount of each Director’s cash retainer for the compensation year by the fair market value of the shares on the first day of the compensation year, and (ii) rounding such number of shares up to the nearest whole share. We may revise the foregoing formula for any year without stockholder approval, subject to the Plan’s overall share limits.

Vesting of Shares

Shares granted under the Director Plan will vest on the first anniversary of the grant date unless otherwise determined by the Director Plan Administrator. Unvested shares will be forfeited when a Director’s service as a director terminates, except that (i) a Director’s unvested shares shall become fully vested upon the Director’s death or disability and (ii) a Director who elects not to stand for reelection as a Director for the following compensation year shall vest in a pro-rata portion of their outstanding grants at the annual meeting at which their service as a Director terminates.

Deferral Elections

While the deferral provision is not initially effective, at any point after the Director Plan is approved, the Board may determine that non-employee directors may defer all or part of their cash compensation (in 10% increments) into a deferred cash account, and they may defer all or part of their stock compensation (in 10% increments) into a deferred stock account. Prior to the Board’s taking action to permit deferrals under the Director Plan, no cash or stock deferrals shall be permitted. Deferred cash and stock accounts, once permitted and created, would be unfunded and maintained for record keeping purposes only, and Directors wishing to defer amounts under the Director Plan would be required to make their deferral elections by December 31st (or such earlier date as the Director Plan Administrator may designate) of the calendar year preceding the calendar year in which such compensation is earned or granted or, if later, within 30 days after first becoming eligible to make deferrals under the Director Plan.

Distributions of Deferrals

Distributions of deferrals under the Director Plan, once permitted, would generally be paid in a lump sum unless the Director specifies installment payments over a period up to 10 years. Deferred cash account amounts would be paid in cash, and deferred stock would be paid in whole shares of common stock. Unless otherwise elected by the Director, distributions would begin on February 15th of the year following the year in which the Director ceases to be a non-employee director. A Director could also elect to have their distributions commence on (a) the February 15th of the year following the later of the year in which they cease to be a non-employee director and the year in which they attain a specified age, or (b) the February 15th of the year following the year in which they attain a specified age, without regard to whether they are still a non- employee director.

Cash deferral accounts would be credited with earnings and losses on such basis as determined by the Board or its designee, and stock deferral accounts would be credited with additional shares equal to the value of any dividends paid during the deferral period on deferred stock. Under limited hardship circumstances, Directors could withdraw some or all of the amounts of deferred cash and stock in their deferral accounts.

Change in Control

Unless otherwise determined by the Director Plan Administrator in connection with a grant, a Change in Control (as defined in the Director Plan) shall have the following effects on outstanding awards.

1.On a Change in Control in which a Director receives a replacement award with a value and terms that are at least as favorable as the Director’s outstanding awards (a “Replacement Award”), the Director’s outstanding awards shall remain outstanding subject to the terms of the Replacement Award.

2.On a Change in Control in which our shares cease to be publicly traded, the Director’s outstanding awards shall become immediately vested unless the Director receives Replacement Awards.

3.On a Change in Control in which our shares continue to be publicly traded, a Director’s outstanding awards shall remain outstanding and be treated as Replacement Awards.

Notwithstanding the forgoing, the Director Plan Administrator may determine that any or all outstanding awards granted under the Director Plan will be canceled and terminated upon a Change in Control, and that in connection with such cancellation and termination, the Director shall receive for each share of common stock subject to such award a cash payment (or the delivery of shares of stock, other securities or a combination of cash, stock and securities equivalent to such cash payment) equal to the consideration received by our stockholders for a share of common stock in such Change in Control.

Amendment and Termination

The Director Plan Administrator may, at any time, alter, amend, modify, suspend, or terminate the Director Plan in whole or in part; provided, however, that, without the prior approval of our stockholders, no such amendment shall increase the number of shares that may be granted to any Director, except as otherwise provided in the Director Plan, or increase the total number of shares that may be granted under the Director Plan. In addition, any amendment of the Director Plan must comply with the rules of the Trading Market, and no material amendment of the Director Plan shall be made without stockholder approval if stockholder approval is required by law, regulation, or stock exchange rule.

Federal Income Tax Consequences

With respect to shares granted under the Director Plan, unless deferred if and when the Board authorizes the deferral feature, the Director will be taxed on the fair market value of such shares at ordinary income rates at the time such shares vest or, if the Director made an election under Section 83(b), on the grant date. We will receive a corresponding deduction for the same amount at the same time.

With respect to cash or shares deferred under the Director Plan, Directors will be taxed on amounts distributed to them from their deferred cash and deferred stock accounts at ordinary income rates at the time of such distributions. We will receive a deduction for the same amounts at the same time.

Upon the sale or other disposition of shares acquired by a Director under the Director Plan, the Director will recognize short-term or long-term capital gain or loss, depending on whether such shares have been held for more than one year at such time. Such capital gain or loss will equal the difference between the amount realized on the sale of such shares and the Director’s tax basis in such shares (generally, the amount previously included in income by the Director in connection with the grant or vesting of such shares). Such sale or other disposition by a Director should have no tax consequences for us.

Other Information

The number of shares to be issued in each year is not determinable, as it varies based on the amount of stock awards determined to be paid to Directors as part of their retainer fees.

EXECUTIVE OFFICERS

Set forth below is certain information relating to our current executive officers and key employees. Biographical information with respect to Mr. Cummins is set forth above under “Proposal 1 – Election of Directors.”

| | | | | | | | | | | |

CFO Since: 2021 | Age: 44 | | | David Rench Chief Financial Officer |

| David Rench became our Chief Financial Officer in March 2021 and continues to serve in that capacity. Prior to joining us, Mr. Rench in 2010 co-founded, and from 2010 to 2017 served as the VP of Finance and Operations of, a software startup company, ihiji, until the company was acquired by Control4 in 2017. After the acquisition of ihiji, Mr. Rench joined and served as Chief Financial Officer of Hirzel Capital, an investment management company, from 2017 to 2020. Mr. Rench holds a BBA from the Neeley School of Business at Texas Christian University in Fort Worth, Texas, and an MBA from the Cox School of Business at Southern Methodist University in Dallas, Texas. He is skilled in talent management and focused on long-term business growth, revenue, and profitability. He has strong experience leading the full spectrum of accounting, budgets, financial analysis, forecast planning, IT strategy, and reporting processes to achieve and exceed corporate financial goals. He has demonstrated expertise in developing and implementing streamlined tools and procedures to maximize departmental efficiency. |

| | | | | | | | | | | |

CMO Since: August 2022 | Age: 35 | | | Regina Ingel Chief Marketing Officer |

| Regina Ingel became our Chief Marketing Officer in August 2022 and continues to serve in that capacity. Ms. Ingel served as our Executive Vice President of Operations from April 2021 until August 2022. Her experience is in marketing and operations to support growth of companies across sectors. From 2016 to 2018, Ms. Ingel worked with operations in the corporate buying offices at Neiman Marcus, a large department store chain, where she worked closely with the executive team on projections, marketing and planning for its web business. Ms. Ingel also founded an event planning company in Dallas in 2019, which she grew through creative marketing and sales despite a nationwide pandemic. Ms. Ingel sold her company in early 2021 to pursue a career in the cryptocurrency marketplace and specifically as our vice president of operations. |

AUDIT COMMITTEE REPORT

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board. In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed with management the audited financial statements in the Company’s Form 10-K, including a discussion of the acceptability of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The Audit Committee reviewed and discussed with the independent registered public accounting firm, which is responsible for expressing an opinion on the conformity of those audited financial statements with the standards of the Public Company Accounting Oversight Board, the matters required to be discussed by Statements on Auditing Standards (SAS 61), as may be modified or supplemented, and their judgments as to the acceptability of the Company’s accounting principles and such other matters as are required to be discussed with the Audit Committee under the standards of the Public Company Accounting Oversight Board.

In addition, the Audit Committee has discussed with the independent registered public accounting firm their independence from management and the Company, including receiving the written disclosures and letter from the independent registered public accounting firm as required by the Independence Standards Board Standard No. 1, as may be modified, or supplemented, and has considered the compatibility of any non-audit services with the auditors’ independence.

The Audit Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for their audit. The Audit Committee met with the independent registered public accounting firm, with and without management present, to discuss the results of their examinations and the overall quality of the Company’s financial reporting.

See the portion of this proxy statement titled “Corporate Governance—Board Committees” beginning on page 16 for information on the Audit Committee’s meetings in 2022.

| | | | | |

Audit Committee Members | Chuck Hastings, Douglas Miller (Chair) and Richard Nottenburg |

September 27, 2022

Notwithstanding anything to the contrary set forth in any of our previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that might incorporate future filings, including this proxy statement, in whole or in part, the Audit Committee Report above shall not be incorporated by reference into this proxy statement.

EXECUTIVE COMPENSATION

OVERVIEW