INVESTOR PRESENTATION January 2023 Leading Provider of Next‐Gen Datacenters for High‐Performance Computing Applications

DISCLAIMER This presentation has been designed to provide general information about Applied Digital Corporation (“Applied Digital” or the “Company”). Any information contained or referenced herein is suitable only as an introduction to the Company. The information contained in this presentation is for informational purposes only. The information contained in this presentation is not investment or financial product advice and is not intended to be used as the basis for making an investment decision. Neither the Company or any of its affiliates make any representation or warranty, express or implied as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of any of the information or opinions contained in this presentation. This presentation has been prepared without taking into account the investment objectives, financial situation particular needs of any particular person. The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of the platform and solutions of Applied Digital. Forward-Looking Statements This presentation contains forward-looking statements that reflect the Company’s current expectations and projections with respect to, among other things, its financial condition, results of operations, plans, objectives, future performance and business. When used in this presentation, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Forward-looking statements include all statements that are not historical facts. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith beliefs and assumptions as of that time with respect to future events. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. Forward-looking statements may include statements about the Company’s future financial performance, including the Company’s expectations regarding net revenue, operating expenses, and its ability to achieve and maintain future profitability; the Company’s business plan and ability to effectively manage growth; anticipated trends, growth rates, and challenges in the Company’s business, the cryptoeconomy, and in the markets in which the Company operates; further development and market acceptance of cryptoasset networks and other cryptoassets; further development of the Company’s co-hosting facilities and customer base for co-hosting services; beliefs and objectives for future operations; the value of Bitcoin, Ether and other cryptoassets, which may be subject to pricing risk has historically been subject to wide swings; the Company’s expectations concerning relationships with third parties; the effects of increased competition in the Company’s markets and the Company’s ability to compete effectively; the Company’s ability to stay in compliance with laws and regulations that currently apply or become applicable to its business both in the United States and internationally; economic and industry trends, projected growth, or trend analysis; trends in revenue, cost of revenue, and gross margin; trends in operating expenses, including technology and development expenses, sales and marketing expenses, and general and administrative expenses, and expectations regarding these expenses as a percentage of revenue; increased expenses associated with being a public company; and other statements regarding the Company’s future operations, financial condition, and prospects and business strategies. There is no assurance that any forward-looking statements will materialize. You are cautioned not to place undue reliance on forward-looking statements, which reflect expectations only as of this date. Applied Digital undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. Market and Industry Data This presentation includes information concerning economic conditions, the Company’s industry, the Company’s markets and the Company’s competitive position that is based on a variety of sources, including information from independent industry analysts and publications, as well as Applied Digital’s own estimates and research. Applied Digital’s estimates are derived from publicly available information released by third party sources, as well as data from its internal research, and are based on such data and the Company’s knowledge of its industry, which the Company believes to be reasonable. Any independent industry publications used in this presentation were not prepared on the Company’s behalf. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to these estimates. The Company has not independently verified the accuracy or completeness of the data contained in these industry publications and other publicly available information. Accordingly, we make no representations as to the accuracy or completeness of that data nor do we undertake to update such data after the date of this presentation. An investment in the Company entails a high degree of risk and no assurance can be given that the Company’s objective will be achieved or that investors will receive a return on their investment. Recipients of this presentation should make their own investigations and evaluations of any information referenced herein. 2

DISCLAIMER “EBITDA” is defined as earnings before interest, taxes, and depreciation and amortization. “Adjusted EBITDA” is defined as EBITDA adjusted for stock-based compensation, gain on extinguishment of accounts payable, loss on extinguishment of debt, and one- time professional service costs not directly related to the company’s offering and therefore not deferred under the guidance in ASC 340 and SAB Topic 5A. These costs have been adjusted as they are not indicative of business operations. Adjusted EBITDA is intended as a supplemental measure of Applied Digital’s performance that is neither required by, nor presented in accordance with, GAAP. Applied Digital believes that the use of EBITDA and Adjusted EBITDA provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing its financial measures with those of comparable companies, which may present similar non-GAAP financial measures to investors. We also believe EBITDA and Adjusted EBITDA are useful metrics to investors because they provide additional information regarding factors and trends affecting our business, which are used in the business planning process to understand expected operating performance, to evaluate results against those expectations, and because of their importance as measures of underlying operating performance, as the primary compensation performance measure under certain programs and plans. However, you should be aware that when evaluating EBITDA and Adjusted EBITDA, Applied Digital may incur future expenses similar to those excluded when calculating these measures. In addition, Applied Digital’s presentation of these measures should not be construed as an inference that its future results will be unaffected by unusual or non-recurring items. Applied Digital’s computation of Adjusted EBITDA may not be comparable to other similarly titled measures computed by other companies, because all companies may not calculate Adjusted EBITDA in the same fashion. Because of these limitations, EBITDA and Adjusted EBITDA should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. Applied Digital compensates for these limitations by relying primarily on its GAAP results and using EBITDA and Adjusted EBITDA on a supplemental basis. You should review the reconciliation of net loss to EBITDA and Adjusted EBITDA above and not rely on any single financial measure to evaluate Applied Digital’s business. 3

4 • Leading Digital Infrastructure and Colocation Provider of U.S.-based Next-Generation Datacenters • Next-Generation Datacenters are Optimized for High Performance Computing (HPC) Applications • AI, Machine Learning, Graphics Rendering, Web 3.0 & Other HPC Workloads • 100MW online – Nearly 400MW Under Active Development Expected Online 1H Calendar 2023 • All 500MW of capacity is under multi-year arrangements • Represents Anticipated Annualized Adjusted EBITDA Potential of $100 million Once Online1 • First dedicated HPC facility expected online first half of 2023 • Experienced Management Team with Backgrounds in Capital Markets, Digital Infrastructure, Real Estate and Marketing OVERVIEW 1. Adjusted EBITDA is defined as earnings before interest, taxes, depreciation and amortization, gain on the extinguishment of accounts payable, loss on extinguishment of debt, non‐recurring professional service costs, and other one‐time/non‐recurring expenses.

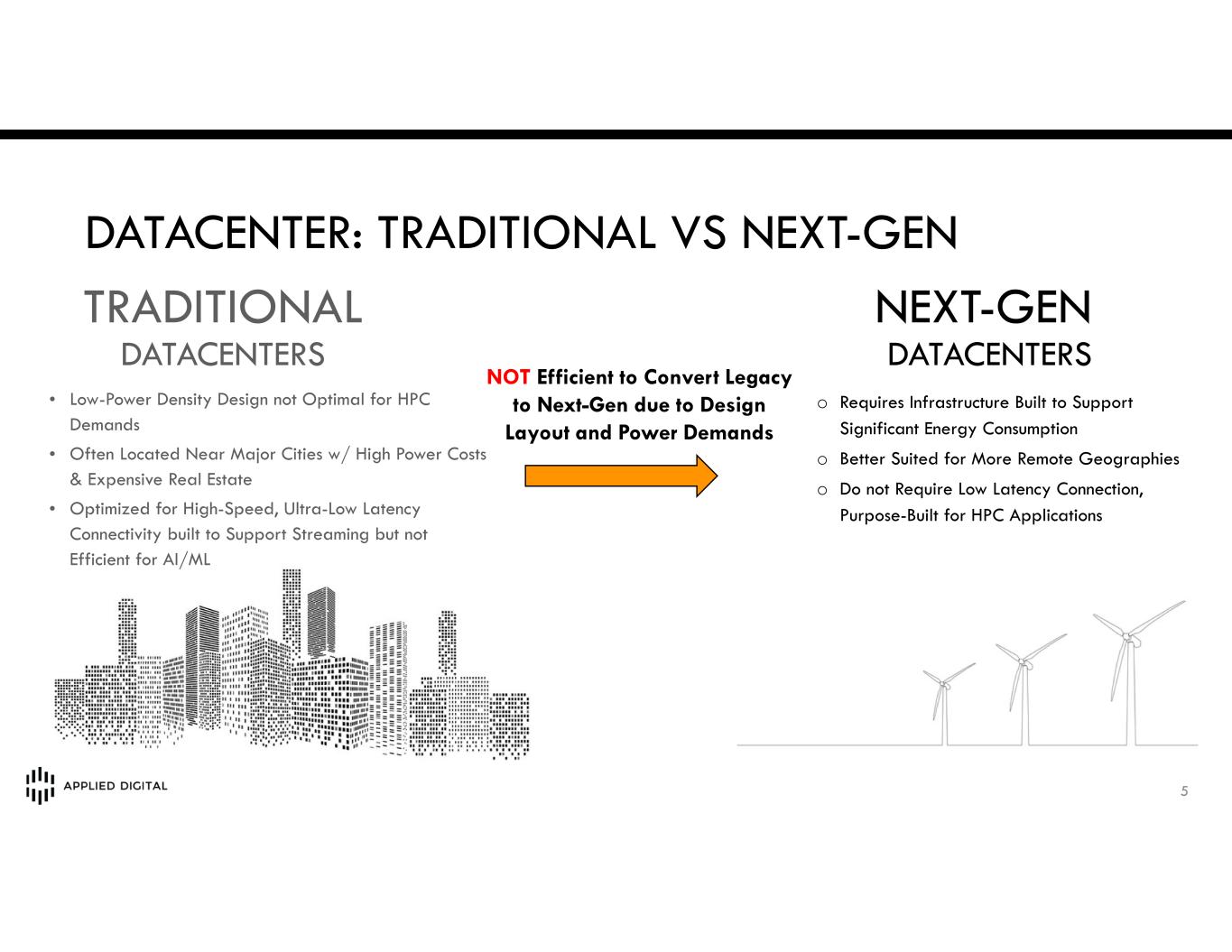

o Requires Infrastructure Built to Support Significant Energy Consumption o Better Suited for More Remote Geographies o Do not Require Low Latency Connection, Purpose-Built for HPC Applications 5 • Low-Power Density Design not Optimal for HPC Demands • Often Located Near Major Cities w/ High Power Costs & Expensive Real Estate • Optimized for High-Speed, Ultra-Low Latency Connectivity built to Support Streaming but not Efficient for AI/ML TRADITIONAL DATACENTERS NEXT-GEN DATACENTERS NOT Efficient to Convert Legacy to Next-Gen due to Design Layout and Power Demands DATACENTER: TRADITIONAL VS NEXT-GEN

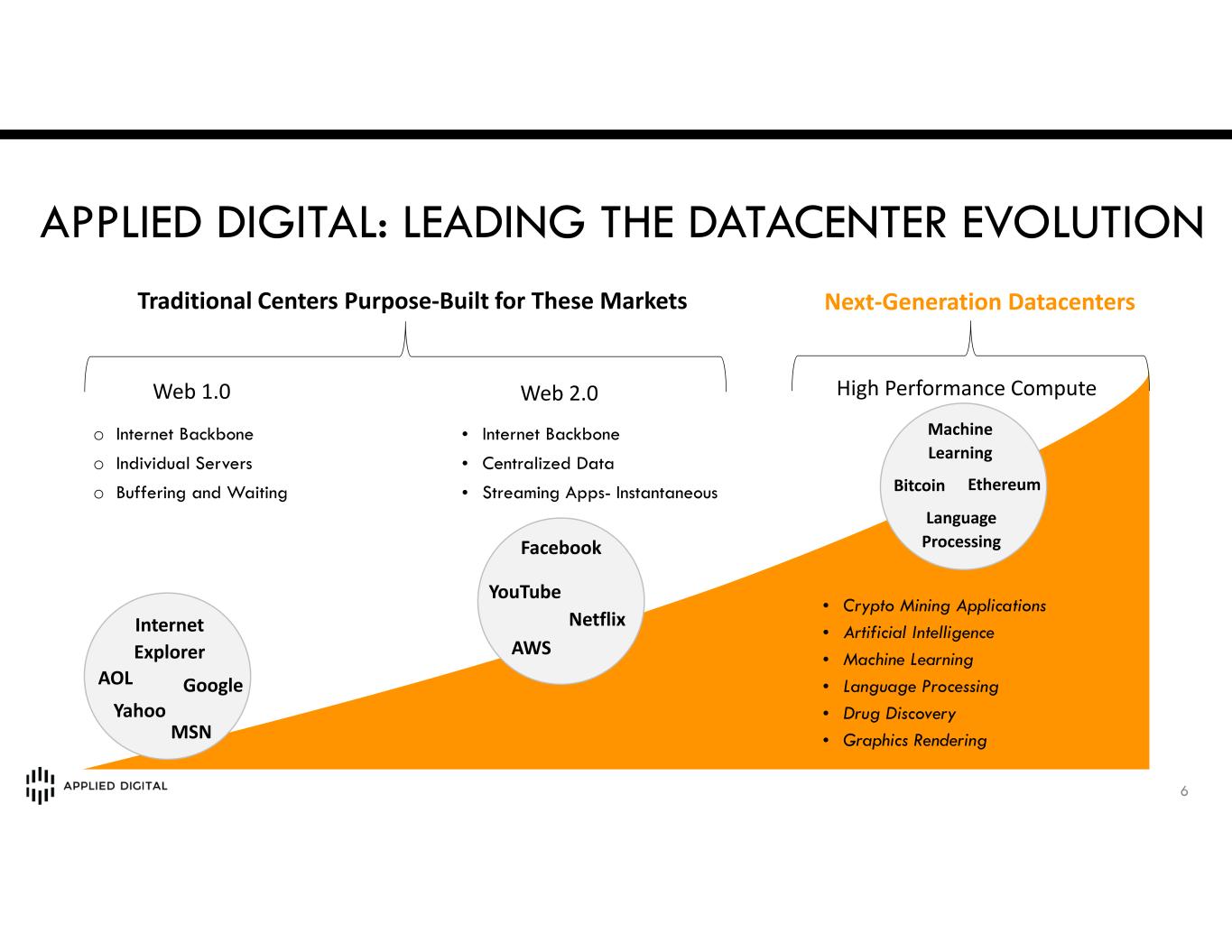

APPLIED DIGITAL: LEADING THE DATACENTER EVOLUTION 6 Traditional Centers Purpose‐Built for These Markets Next‐Generation Datacenters Web 1.0 Web 2.0 High Performance Compute o Internet Backbone o Individual Servers o Buffering and Waiting • Internet Backbone • Centralized Data • Streaming Apps- Instantaneous • Crypto Mining Applications • Artificial Intelligence • Machine Learning • Language Processing • Drug Discovery • Graphics Rendering Internet Explorer AOL Yahoo MSN Google YouTube Facebook Netflix AWS Bitcoin Ethereum Machine Learning Language Processing

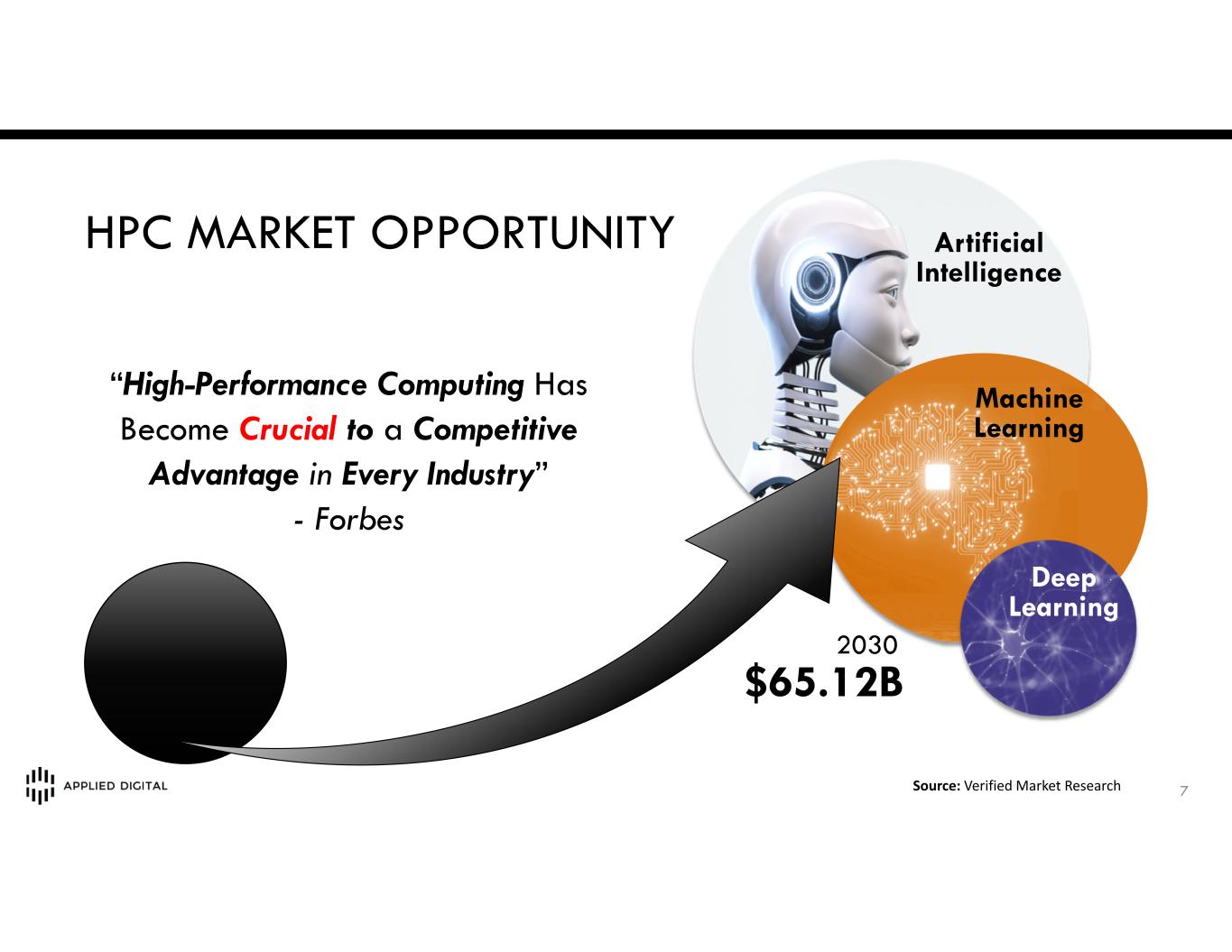

HPC MARKET OPPORTUNITY 7 “High-Performance Computing Has Become Crucial to a Competitive Advantage in Every Industry” - Forbes Source: Verified Market Research 2030 $65.12B Artificial Intelligence Deep Learning Machine Learning

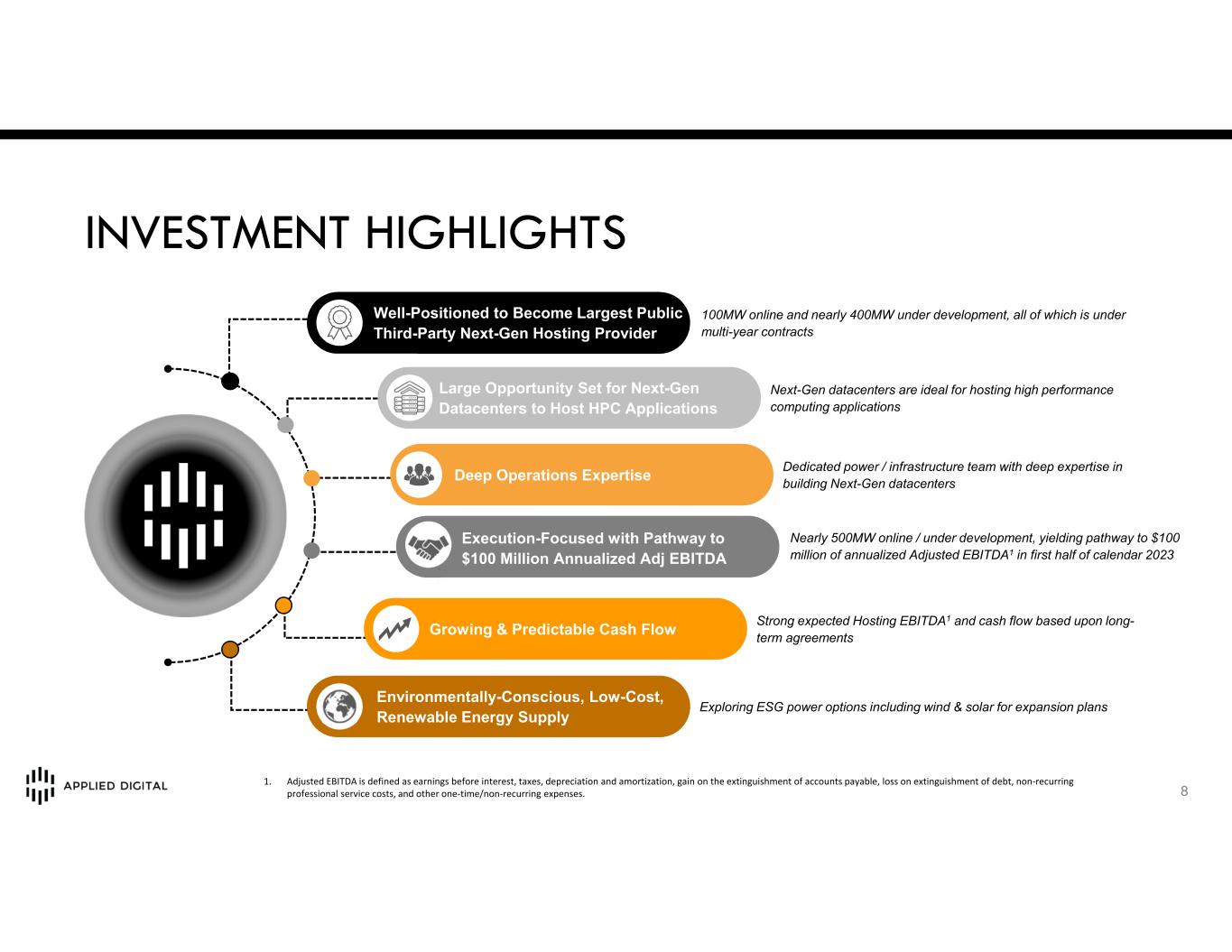

INVESTMENT HIGHLIGHTS 8 Nearly 500MW online / under development, yielding pathway to $100 million of annualized Adjusted EBITDA1 in first half of calendar 2023 Dedicated power / infrastructure team with deep expertise in building Next-Gen datacenters Next-Gen datacenters are ideal for hosting high performance computing applications Strong expected Hosting EBITDA1 and cash flow based upon long- term agreements Exploring ESG power options including wind & solar for expansion plans 100MW online and nearly 400MW under development, all of which is under multi-year contracts 1. Adjusted EBITDA is defined as earnings before interest, taxes, depreciation and amortization, gain on the extinguishment of accounts payable, loss on extinguishment of debt, non‐recurring professional service costs, and other one‐time/non‐recurring expenses. Execution-Focused with Pathway to $100 Million Annualized Adj EBITDA Environmentally-Conscious, Low-Cost, Renewable Energy Supply Growing & Predictable Cash Flow Deep Operations Expertise Well-Positioned to Become Largest Public Third-Party Next-Gen Hosting Provider Large Opportunity Set for Next-Gen Datacenters to Host HPC Applications

9 INVESTOR RELATIONS CONTACTS