Applied Digital CFO Summary Investor Day | October 12, 2023

Applied Digital This presentation has been designed to provide general information about Applied Digital Corporation (“Applied Digital” or the “Company”). Any information contained or referenced herein is suitable only as an introduction to the Company. The information contained in this presentation is for informational purposes only. The information contained herein does not constitute or form a part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer, buy or subscribe for, any securities, nor shall there be any offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale would be unlawful. This document is not a prospectus. The information contained in this presentation is not investment or financial product advice and is not intended to be used as the basis for making an investment decision. Neither the Company, B. Riley Securities, Inc. (“B. Riley”), or any of their respective affiliates make any representation or warranty, express or implied as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of any of the information or opinions contained in this presentation. This presentation has been prepared without taking into account the investment objectives, financial situation particular needs of any particular person. The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of the platform and solutions of Applied Digital. Forward-Looking Statements This presentation contains forward-looking statements that reflect the Company’s current expectations and projections with respect to, among other things, its financial condition, results of operations, plans, objectives, future performance and business. When used in this presentation, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Forward-looking statements include all statements that are not historical facts. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith beliefs and assumptions as of that time with respect to future events. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. Forward-looking statements may include statements about the Company’s future financial performance, including the Company’s expectations regarding net revenue, operating expenses, and its ability to achieve and maintain future profitability; the Company’s business plan and ability to effectively manage growth; anticipated trends, growth rates, and challenges in the Company’s business, the cryptoeconomy, and in the markets in which the Company operates; further development and market acceptance of cryptoasset networks and other cryptoassets; further development of the Company’s co-hosting facilities and customer base for co-hosting services; beliefs and objectives for future operations; the value of Bitcoin, Ether and other cryptoassets, which may be subject to pricing risk has historically been subject to wide swings; the Company’s expectations concerning relationships with third parties; the effects of increased competition in the Company’s markets and the Company’s ability to compete effectively; the Company’s ability to stay in compliance with laws and regulations that currently apply or become applicable to its business both in the United States and internationally; economic and industry trends, projected growth, or trend analysis; trends in revenue, cost of revenue, and gross margin; trends in operating expenses, including technology and development expenses, sales and marketing expenses, and general and administrative expenses, and expectations regarding these expenses as a percentage of revenue; increased expenses associated with being a public company; and other statements regarding the Company’s future operations, financial condition, and prospects and business strategies. More information about these risks and other factors that may affect the Company’s operating results are set forth under the captions “Risk factors” in our periodic reports (e.g. 10-K, 10-Q) that we file with the SEC, as well as “Risk Factors” in registration statements that we file with the SEC. There is no assurance that any forward-looking statements will materialize. You are cautioned not to place undue reliance on forward-looking statements, which reflect expectations only as of this date. Neither Applied Digital nor B. Riley undertakes any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. Market and Industry Data This presentation includes information concerning economic conditions, the Company’s industry, the Company’s markets and the Company’s competitive position that is based on a variety of sources, including information from independent industry analysts and publications, as well as Applied Digital’s own estimates and research. Applied Digital’s estimates are derived from publicly available information released by third party sources, as well as data from its internal research, and are based on such data and the Company’s knowledge of its industry, which the Company believes to be reasonable. Any independent industry publications used in this presentation were not prepared on the Company’s behalf. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to these estimates. The Company has not independently verified the accuracy or completeness of the data contained in these industry publications and other publicly available information. Accordingly, we make no representations as to the accuracy or completeness of that data nor do we undertake to update such data after the date of this presentation. An investment in the Company entails a high degree of risk and no assurance can be given that the Company’s objective will be achieved or that investors will receive a return on their investment. Recipients of this presentation should make their own investigations and evaluations of any information referenced herein. This presentation is available on Applied Digital Corporation’s website at www.applieddigital.com/news-events/presentations. Disclaimer

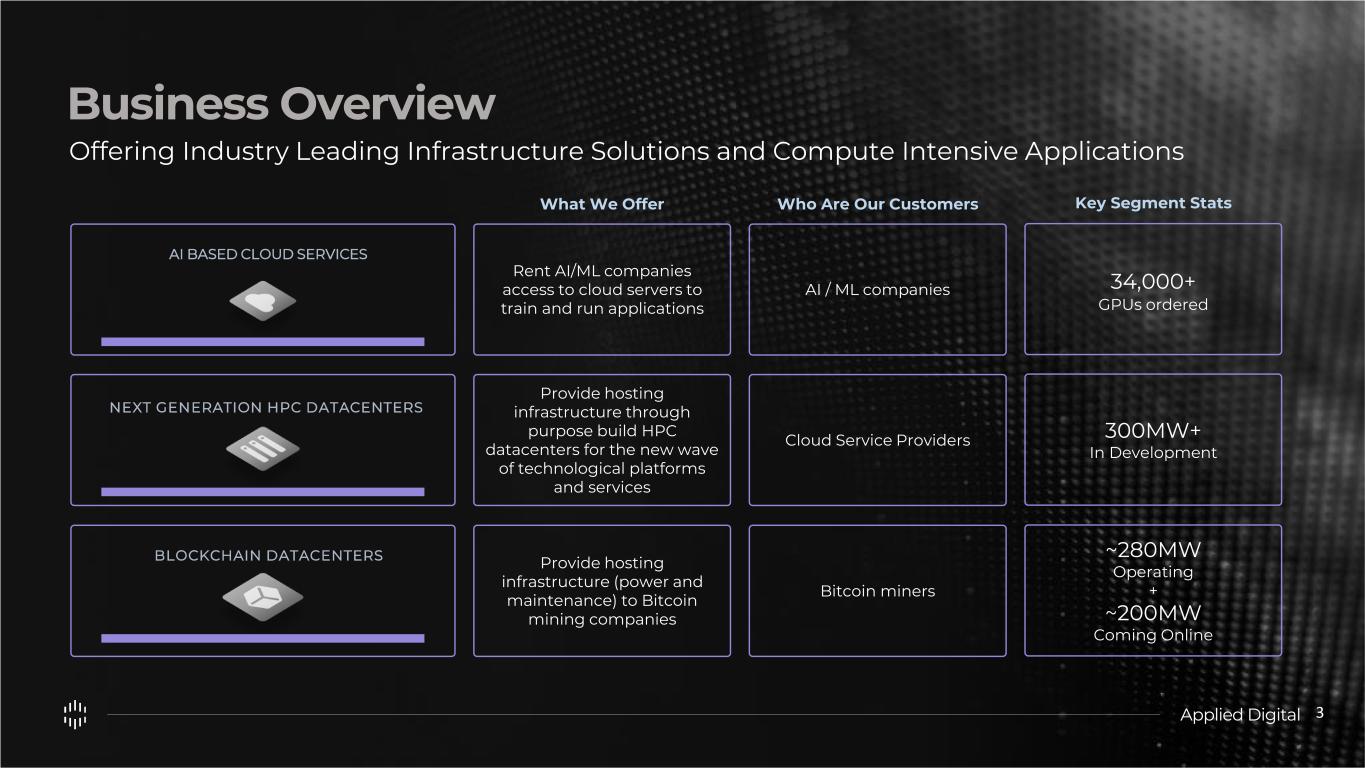

Applied Digital Business Overview Offering Industry Leading Infrastructure Solutions and Compute Intensive Applications 3 AI BASED CLOUD SERVICES NEXT GENERATION HPC DATACENTERS BLOCKCHAIN DATACENTERS Rent AI/ML companies access to cloud servers to train and run applications Provide hosting infrastructure through purpose build HPC datacenters for the new wave of technological platforms and services Provide hosting infrastructure (power and maintenance) to Bitcoin mining companies What We Offer Who Are Our Customers AI / ML companies Cloud Service Providers Bitcoin miners 34,000+ GPUs ordered 300MW+ In Development ~280MW Operating + ~200MW Coming Online Key Segment Stats

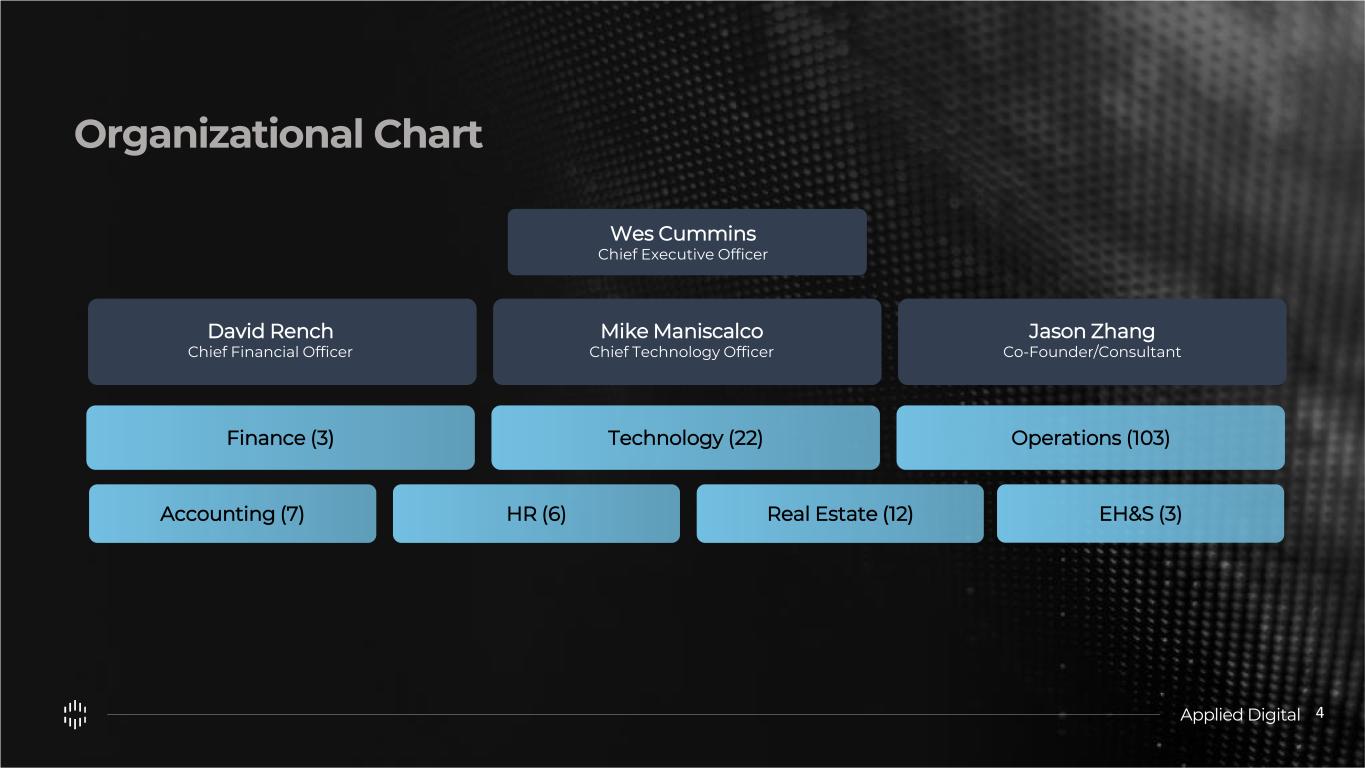

Applied Digital Organizational Chart Real Estate (12) Operations (103) Wes Cummins Chief Executive Officer Accounting (7) HR (6) EH&S (3) Finance (3) Technology (22) David Rench Chief Financial Officer Mike Maniscalco Chief Technology Officer Jason Zhang Co-Founder/Consultant 4

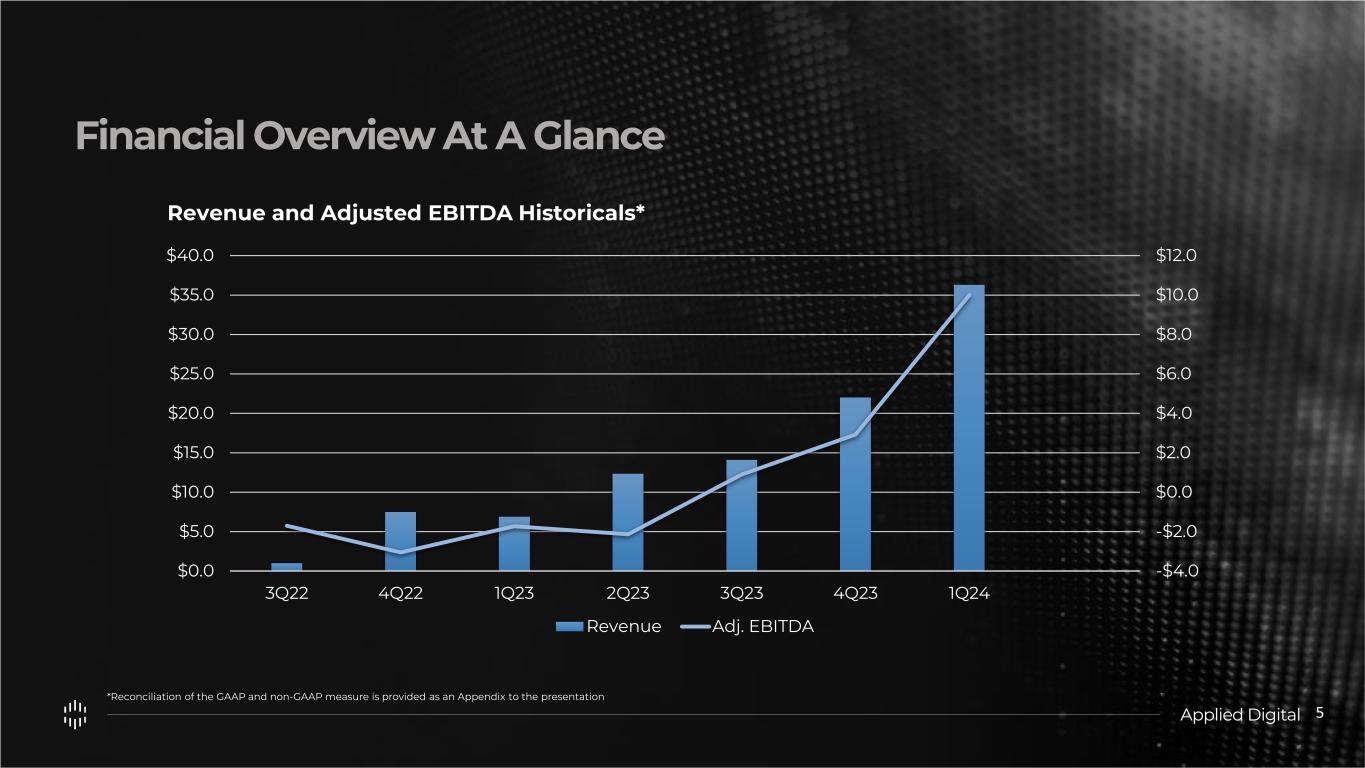

Applied Digital 5 -$4.0 -$2.0 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 Revenue Adj. EBITDA Financial Overview At A Glance Revenue and Adjusted EBITDA Historicals* *Reconciliation of the GAAP and non-GAAP measure is provided as an Appendix to the presentation

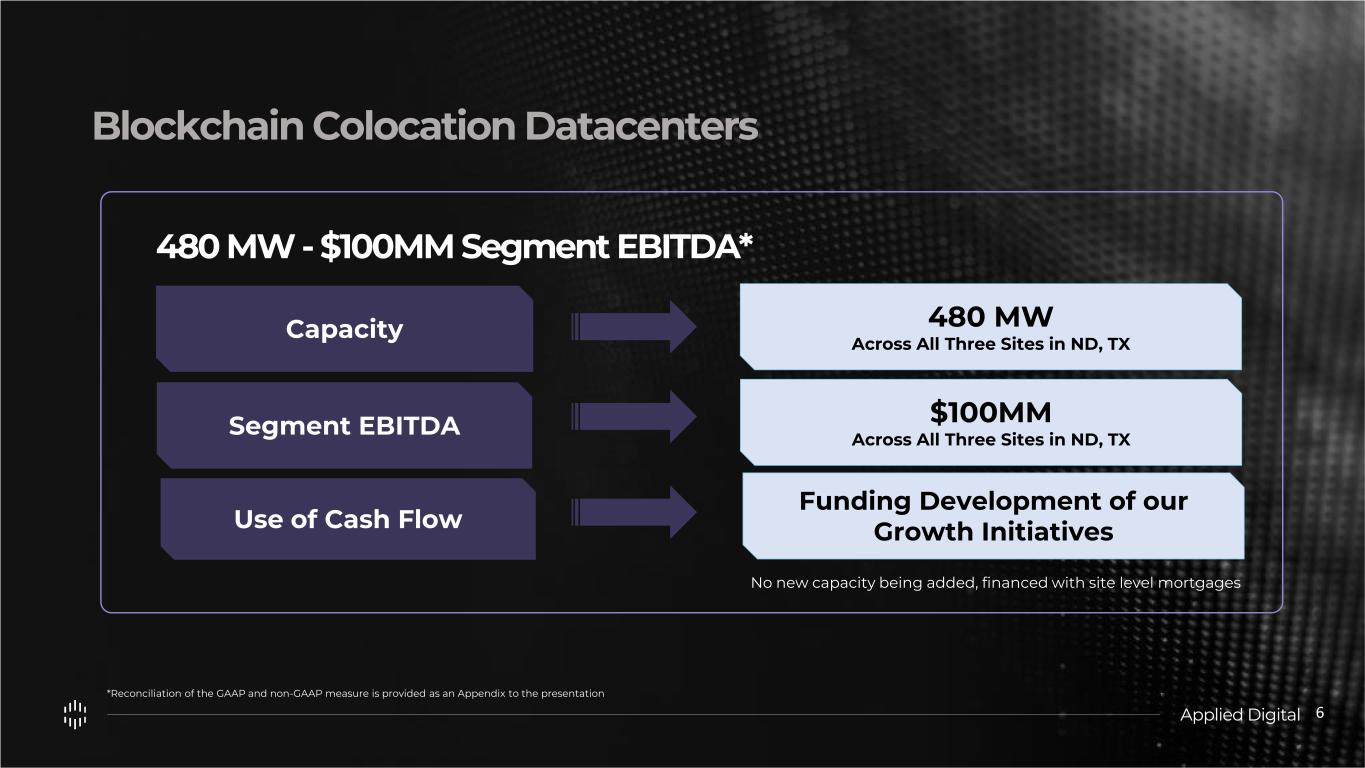

Applied Digital Blockchain Colocation Datacenters 6 No new capacity being added, financed with site level mortgages 480 MW - $100MM Segment EBITDA* Capacity Segment EBITDA Use of Cash Flow 480 MW Across All Three Sites in ND, TX $100MM Across All Three Sites in ND, TX Funding Development of our Growth Initiatives *Reconciliation of the GAAP and non-GAAP measure is provided as an Appendix to the presentation

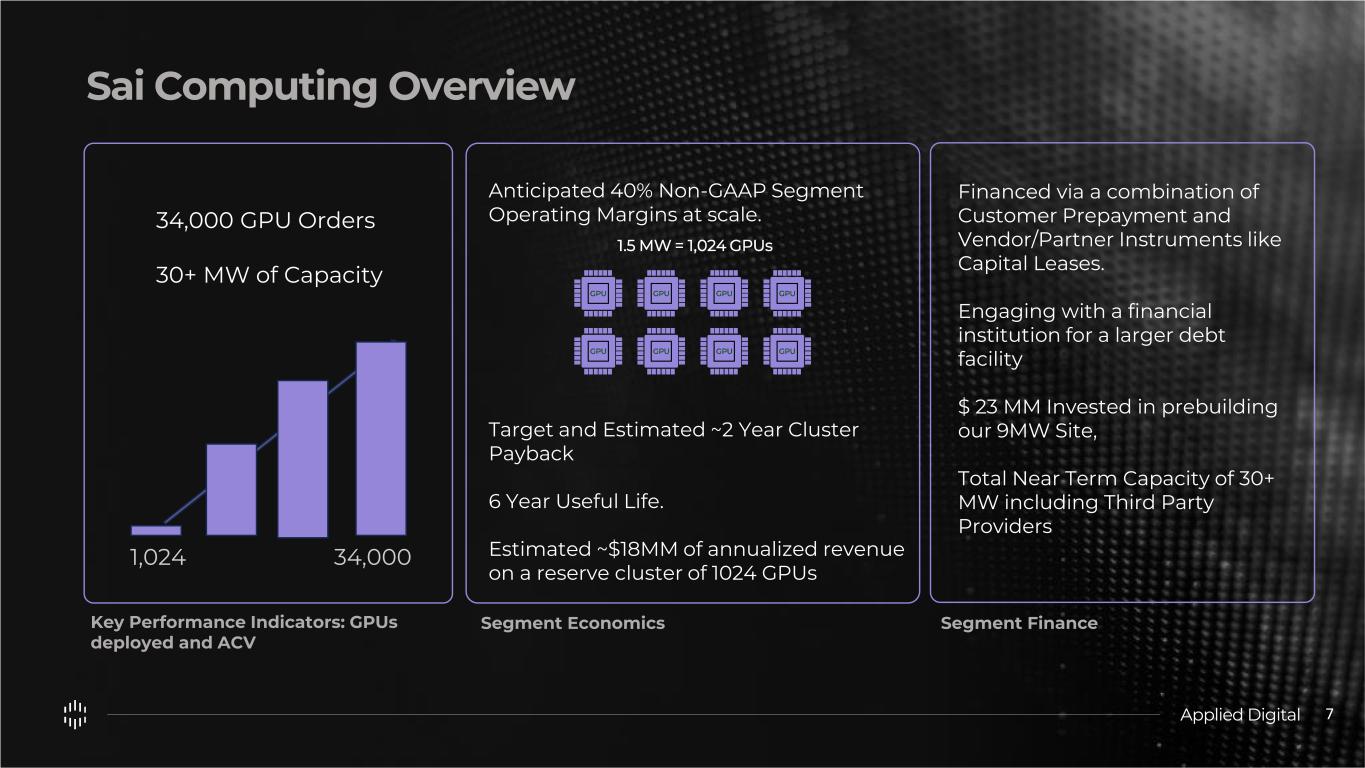

Applied Digital Sai Computing Overview 7 Key Performance Indicators: GPUs deployed and ACV Segment Economics Anticipated 40% Non-GAAP Segment Operating Margins at scale. Target and Estimated ~2 Year Cluster Payback 6 Year Useful Life. Estimated ~$18MM of annualized revenue on a reserve cluster of 1024 GPUs Segment Finance Financed via a combination of Customer Prepayment and Vendor/Partner Instruments like Capital Leases. Engaging with a financial institution for a larger debt facility $ 23 MM Invested in prebuilding our 9MW Site, Total Near Term Capacity of 30+ MW including Third Party Providers 34,000 GPU Orders 30+ MW of Capacity 1.5 MW = 1,024 GPUs GPU GPU GPU GPU GPU GPU GPU GPU 1,024 34,000

Applied Digital HPC Hosting 8 Key Performance Indicators & Next Steps: Segment Economics How Do We Finance and Cost to Build? MWs Energized and signing of an investment grade tenant for a majority of the capacity. We have ~300MW to develop between North Dakota and Utah Traditional datacenter Economics with high 40% to low 50% segment EBITDA margins . Illustratively, a 100MW site could generate ~$200 MM of Revenue Anticipated build cost of ~$6 MM per MW for our new design. Targeting 70% to 80% of construction cost financed by a traditional construction facility, with the equity portion potentially funded by a partner.

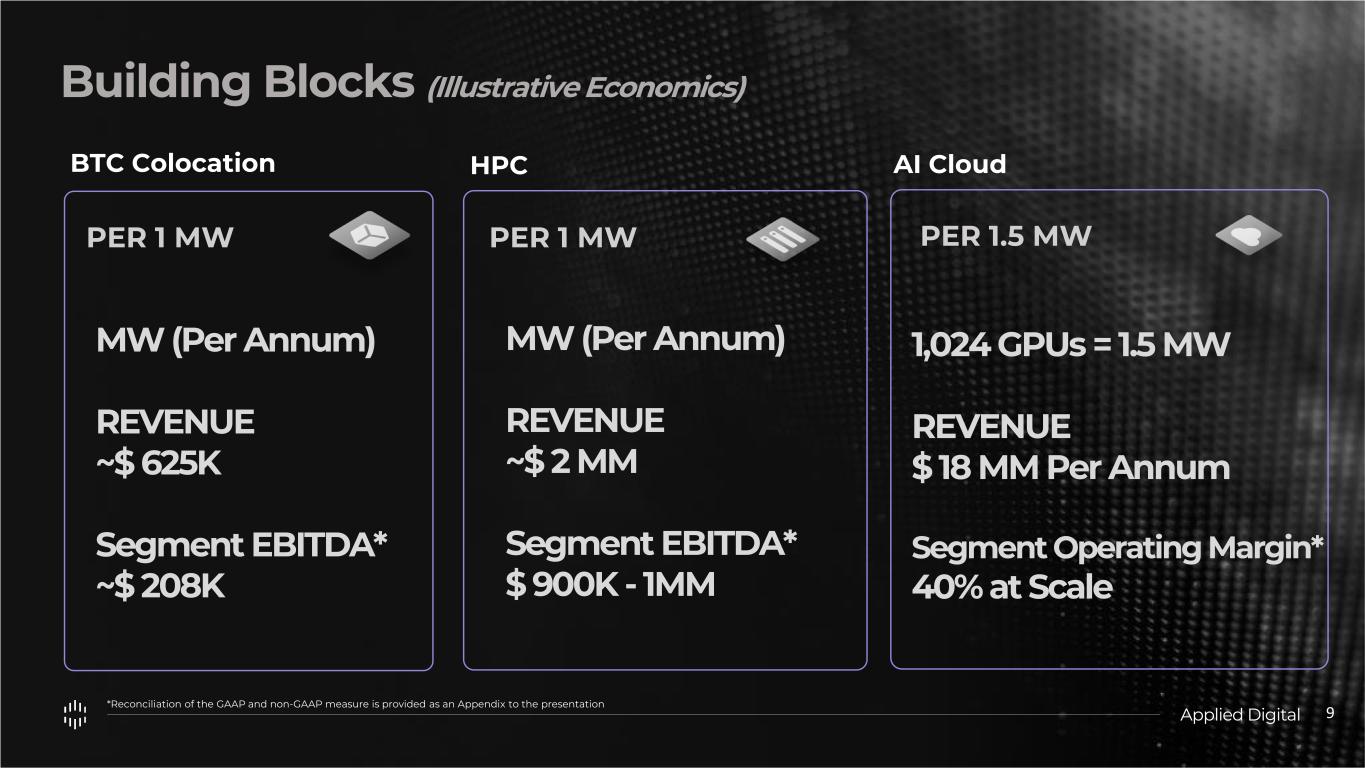

Applied Digital Building Blocks (Illustrative Economics) 9 PER 1 MW MW (Per Annum) REVENUE ~$ 625K Segment EBITDA* ~$ 208K MW (Per Annum) REVENUE ~$ 2 MM Segment EBITDA* $ 900K - 1MM PER 1 MW BTC Colocation HPC PER 1.5 MW 1,024 GPUs = 1.5 MW REVENUE $ 18 MM Per Annum Segment Operating Margin* 40% at Scale AI Cloud *Reconciliation of the GAAP and non-GAAP measure is provided as an Appendix to the presentation

Applied Digital Thank You For Joining

Applied Digital “EBITDA” is defined as earnings before interest, taxes, and depreciation and amortization. “Adjusted EBITDA” is defined as EBITDA adjusted for stock-based compensation, gain on extinguishment of accounts payable, loss on extinguishment of debt, and onetime professional service costs not directly related to the company’s offering and therefore not deferred under the guidance in ASC 340 and SAB Topic 5A. These costs have been adjusted as they are not indicative of business operations. Adjusted EBITDA is intended as a supplemental measure of Applied Digital’s performance that is neither required by, nor presented in accordance with, GAAP. Applied Digital believes that the use of EBITDA and Adjusted EBITDA provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing its financial measures with those of comparable companies, which may present similar non-GAAP financial measures to investors. We also believe EBITDA and Adjusted EBITDA are useful metrics to investors because they provide additional information regarding factors and trends affecting our business, which are used in the business planning process to understand expected operating performance, to evaluate results against those expectations, and because of their importance as measures of underlying operating performance, as the primary compensation performance measure under certain programs and plans. However, you should be aware that when evaluating EBITDA and Adjusted EBITDA, Applied Digital may incur future expenses similar to those excluded when calculating these measures. In addition, Applied Digital’s presentation of these measures should not be construed as an inference that its future results will be unaffected by unusual or non-recurring items. Applied Digital’s computation of Adjusted EBITDA may not be comparable to other similarly titled measures computed by other companies, because all companies may not calculate Adjusted EBITDA in the same fashion. Because of these limitations, EBITDA and Adjusted EBITDA should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. Applied Digital compensates for these limitations by relying primarily on its GAAP results and using EBITDA and Adjusted EBITDA on a supplemental basis. You should review the reconciliation of net loss to EBITDA and Adjusted EBITDA and not rely on any single financial measure to evaluate Applied Digital’s business. Adjusted EBITDA is defined as earnings before interest, taxes, depreciation and amortization, gain on extinguishment of accounts payable, loss of extinguishment of debt, no professional service costs, and other one-time/non occurring expenses. Segment EBITDA defined as segment profit plus segment depreciation and amortization. Reconciliations are not provided for guidance on forward-looking Non-GAAP measures as we are unable to predict the amounts to be adjusted. Appendix A

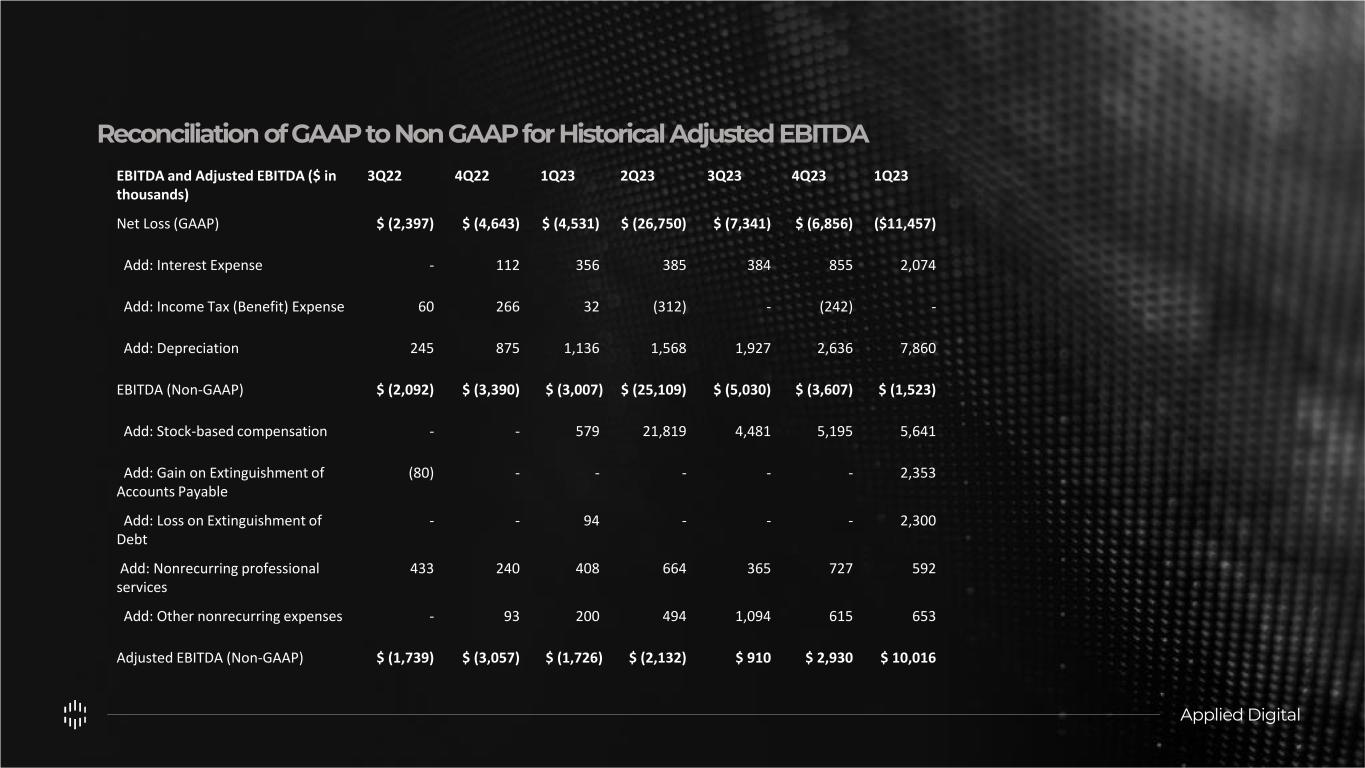

Applied Digital Reconciliation of GAAP to Non GAAP for Historical Adjusted EBITDA EBITDA and Adjusted EBITDA ($ in thousands) 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q23 Net Loss (GAAP) $ (2,397) $ (4,643) $ (4,531) $ (26,750) $ (7,341) $ (6,856) ($11,457) Add: Interest Expense - 112 356 385 384 855 2,074 Add: Income Tax (Benefit) Expense 60 266 32 (312) - (242) - Add: Depreciation 245 875 1,136 1,568 1,927 2,636 7,860 EBITDA (Non-GAAP) $ (2,092) $ (3,390) $ (3,007) $ (25,109) $ (5,030) $ (3,607) $ (1,523) Add: Stock-based compensation - - 579 21,819 4,481 5,195 5,641 Add: Gain on Extinguishment of Accounts Payable (80) - - - - - 2,353 Add: Loss on Extinguishment of Debt - - 94 - - - 2,300 Add: Nonrecurring professional services 433 240 408 664 365 727 592 Add: Other nonrecurring expenses - 93 200 494 1,094 615 653 Adjusted EBITDA (Non-GAAP) $ (1,739) $ (3,057) $ (1,726) $ (2,132) $ 910 $ 2,930 $ 10,016