February 5, 2024 SAI Applied Sai Computing LLC/Applied Digital Corporation 3811 Turtle Creek Blvd Suite 2100 Dallas, TX 75219 Attn: Chief Financial Officer Telephone: (214) 427 1738 Email: david@applieddigital.com Re: Termination of Loan and Security Agreement (this “Letter Agreement”) Ladies and Gentlemen: Reference is made to that certain Loan and Security Agreement (as amended, the “Loan Agreement”) dated as of May 23, 2023 by and among Sai Computing LLC (the “Borrower”), Applied Digital Corporation (the “Guarantor”), B. Riley Commercial Capital, LLC, as a lender (“BRCC”), B. Riley Securities, Inc., as a lender (“BRS”; each of BRS with BRCC, a “Lender” and, collectively, the “Lenders”), and BRCC as collateral agent (the “Collateral Agent”). As used herein, “Loan Parties” refers to the Borrower, the Guarantor and any other party that has guaranteed the Obligations under the Loan Agreement. Capitalized terms used but not defined herein shall have the meanings ascribed to them in the Loan Agreement. Borrower has requested that the Lenders provide this Letter Agreement to evidence the payment of Obligations under the Loan Agreement. The total amount necessary to pay in full as of this date the outstanding Obligations (other than DM Legal Fees (as defined on Schedule A attached hereto)) under the Loan Agreement through the Payoff Effective Time (as defined below) is set forth below: Description Amount Principal (Loans) $0.00 Interest (Loans) $0.00 Prepayment fees and premiums, if any $0.00 Fees due to Lenders $0.00

Effective upon: (i) receipt by the Lenders and the Collateral Agent of a fully executed counterpart of this Letter Agreement signed by the Borrower and Guarantor, and (ii) Duane Morris LLP’s receipt of its DM Legal Fees via federal funds wire transfer pursuant to the wire instructions set forth on Schedule A attached hereto (the time of satisfaction of clauses (i) and (ii), collectively, the “Payoff Effective Time”), then, except as otherwise provided in this Letter Agreement, (a) all Obligations shall immediately and automatically be deemed fully paid and satisfied, (b) the Loan Agreement and each other Loan Document shall be immediately and automatically terminated and be of no further force and effect in accordance with the terms hereof without any further action by any other Person, except in respect of any provision that by its express terms survive the termination of the Loan Agreement or the applicable Loan Document, (c) except to the extent provided in this Letter Agreement the Borrower and the other Loan Parties shall have no other or further obligations, liabilities or indebtedness under the Loan Agreement or any other Loan Document to the Collateral Agent and the Lenders, (d) all of the Collateral Agent’s and Lenders’ security interests in and Liens on any real or personal property of the Borrower or any other Loan Party (the “Collateral”) which the Borrower or other Loan Parties granted the Collateral Agent, for its benefit and the benefit of Lenders under the Loan Agreement or any other Loan Documents, shall be immediately and automatically terminated, released and discharged without any further action by Collateral Agent, Lenders or any other Person, and (e) the Borrower and the other Loan Parties (or their respective designees) shall be authorized to file the UCC-3 Termination Statements attached hereto as Exhibit A in the filing offices identified thereon to effect the release of all Liens created pursuant to the Loan Agreement or any other Loan Document (any and all such termination statements and termination agreements shall be prepared and recorded at the Borrower’s expense). Borrower hereby confirms that the commitments of the Collateral Agent and Lenders to make Loans under the Loan Documents are immediately, automatically and irrevocably terminated as of the Payoff Effective Time, and, as of the Payoff Effective Time, the Collateral Agent and Lenders shall not have any further obligation to make Loans to the Borrower. The Borrower agrees to pay the Collateral Agent on demand all reasonable costs and expenses, including, without limitation, all reasonable attorney’s fees and expenses, incurred by the Collateral Agent in connection with the matters referred to in the paragraph immediately above. If at any time after the Payoff Effective Time Lender or Collateral Agent repays, refunds, restores, or returns in whole or in part, any payment or property (including any proceeds of Collateral) previously paid or transferred to Lender or Collateral Agent in full or partial satisfaction of any Obligations or on account of any other obligation of Borrower or Guarantor under any Loan Document, because the payment, transfer, or the incurrence of the obligation so satisfied is asserted or declared to be void, voidable, or otherwise recoverable under any law relating to creditors’ rights, including provisions of the Bankruptcy Code relating to fraudulent transfers, preferences, or other voidable or recoverable obligations or transfers (each, a “Voidable Transfer”), or because Lender or Collateral Agent elects to do so on the reasonable advice of its counsel in connection with a claim that the payment, transfer, or incurrence is or may be a Voidable Transfer, then, as to any such Voidable Transfer, or the amount thereof Lender or Collateral Agent elects to repay, restore, or return (including pursuant to a settlement of any claim in respect thereof), and as to all costs, expenses, and attorneys’ fees of Lender related thereto, (i) the liability of the Borrower and Guarantor with respect to the amount or property paid, refunded, restored, or returned will automatically and immediately be revived, reinstated, and restored and will exist, and (ii) the

Collateral Agent’s Liens and the terms of the Loan Agreement shall be reinstated in full force and effect and the above noted releases, terminations, cancellations or surrenders shall not diminish, release, discharge, impair or otherwise affect the obligation of Borrower or Guarantor in respect of such liability or any Collateral securing such liability. For and in consideration of Collateral Agent’s and Lenders’ agreements contained herein and in the Loan Documents, Borrower, Guarantor and each other Loan Party hereby irrevocably and unconditionally forever releases and discharges the Collateral Agent and each Lender, and each of their respective officers, directors, employees, equity holders, agents, affiliates, attorneys, representatives, successors and assigns (collectively, the “Released Parties”) from any and all claims, causes of actions, damages and liabilities of any nature whatsoever, known or unknown, which such Borrower or such Loan Party ever had, now has or might hereafter have against one or more of the Released Parties which arise out of any of the Loan Documents, or the transactions relating thereto or hereto, to the extent that any such claim, cause of action, damage or liability shall be based in whole or in part upon facts, circumstances, actions or events existing on or prior to the date hereof. If any Borrower or any other Loan Party asserts or commences any claim, counter-claim, demand or cause of action in derogation of the foregoing release or challenges the enforceability of the forgoing release (in each case, a “Violation”), then Borrower agrees to pay in addition to such other damages as any Released Party actually sustains as a result of such Violation, all attorney fees and expenses incurred by such Related Party as a result of such Violation. Further, upon and after the Payoff Effective Time, the Collateral Agent agrees to promptly execute (as applicable) and deliver to the Borrower such other required releases terminations, or possessory collateral in form and substance reasonably satisfactory to the Borrower and the Collateral Agent, and take any other actions, as the Borrower may reasonably request in writing to evidence and/or effect the Collateral Agent’s release and termination of the Obligations (except as identified above with respect to continuing liabilities and obligations) and of any Liens and security interests in the Collateral which the Borrower or other Loan Parties have granted the Collateral Agent under the Loan Agreement or any other Loan Documents. The Borrower agrees to reimburse the Collateral Agent on demand for all reasonable costs and expenses incurred by the Collateral Agent in connection with the matters referred to in this paragraph. Each Borrower and each Guarantor further acknowledges that the Collateral Agent’s execution of and/or delivery of any documents releasing any security interest or claim in any Collateral as set forth in this Agreement is made without recourse, representation, warranty or other assurance of any kind by the Collateral Agent with respect to the condition or value of any Collateral. The Lenders hereby waive any requirement for advanced notice regarding termination of the Loan Documents. This Letter Agreement shall be governed by and construed in accordance with the law of the Commonwealth of Delaware. This Letter Agreement may be executed in any number of counterparts and by different parties in separate counterparts, each of which when so executed shall be deemed to be an original

and all of which taken together shall constitute one and the same Letter Agreement. Delivery of an executed signature page of this Letter Agreement by facsimile or electronic .pdf shall be effective as delivery of a manually executed counterpart hereof. [Signature page follows]

Very truly yours, B. RILEY COMMERCIAL CAPITAL LLC, as Lender and Collateral Agent By: ______________________________ Name: Phillip J. Ahn Title: Chief Financial Officer B. RILEY SECURITIES, INC., as Lender By: ______________________________ Name: Mike McCoy Title: Chief Financial Officer /s/ Phillip J. Ahn /s/ Mike McCoy

Acknowledged and Agreed as of the date set forth above: SAI Computing LLC By: ______________________________ Name: David Rench Title: Manager Applied Digital Corporation By: ______________________________ Name: David Rench Title: Chief Financial Officer /s/ David Rench /s/ David Rench

Schedule A Duane Morris LLP Legal Fees / DM Legal Fees Legal fees, costs and expenses of Duane Morris LLP (the “DM Legal Fees”) equal to $2,475.00. Payments of Duane Morris Legal Fees pursuant to this Letter Agreement should be made in immediately available wire transferred funds to: Account Name: Duane Morris LLP Receipts Bank Name: Wells Fargo Bank NA Account Number: ABA Number: 121000248 International Swift Code: WFBIUS6S Bank Address: One South Broad Street, Philadelphia, PA 19107 Ref. No.: K1180-287 – SAI Applied Payoff (please reference)

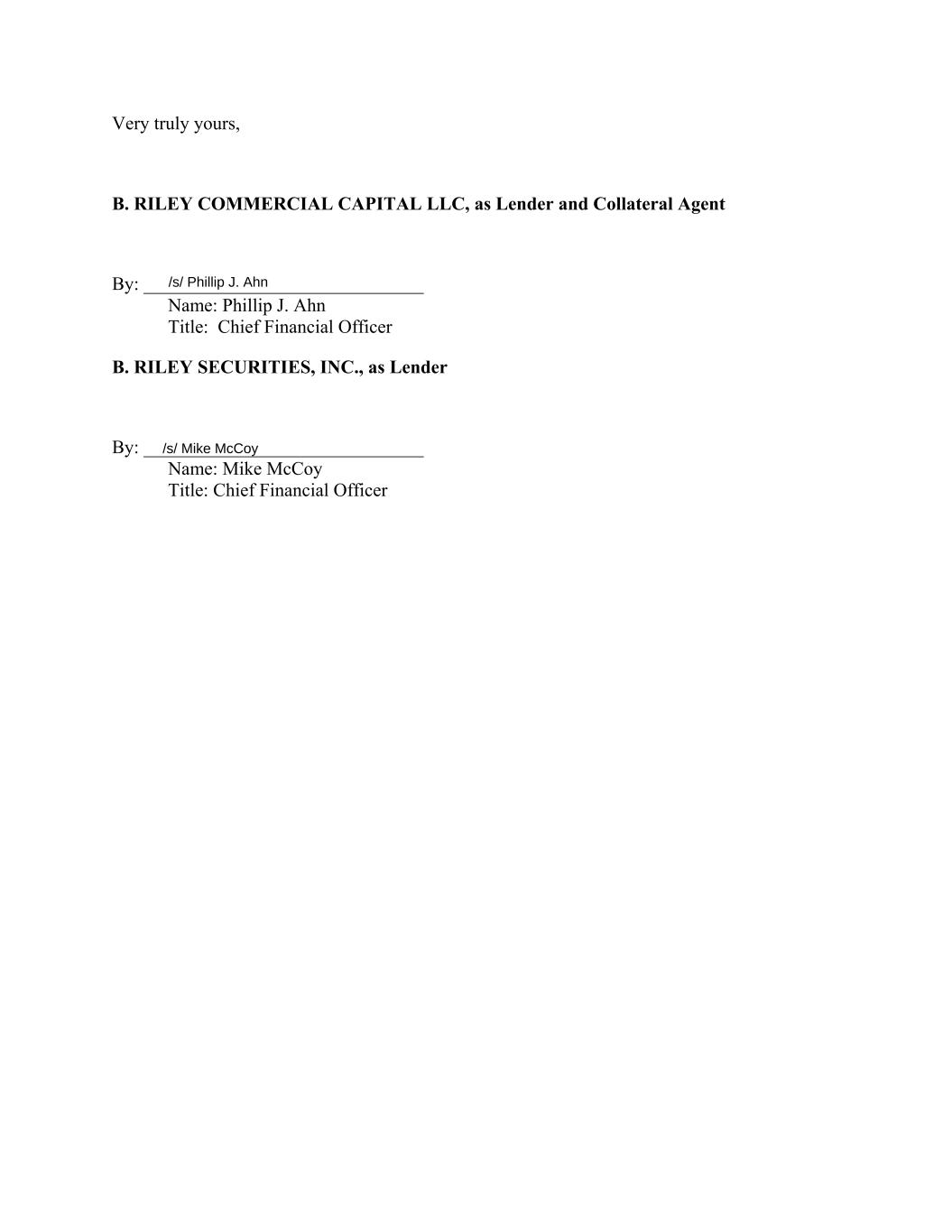

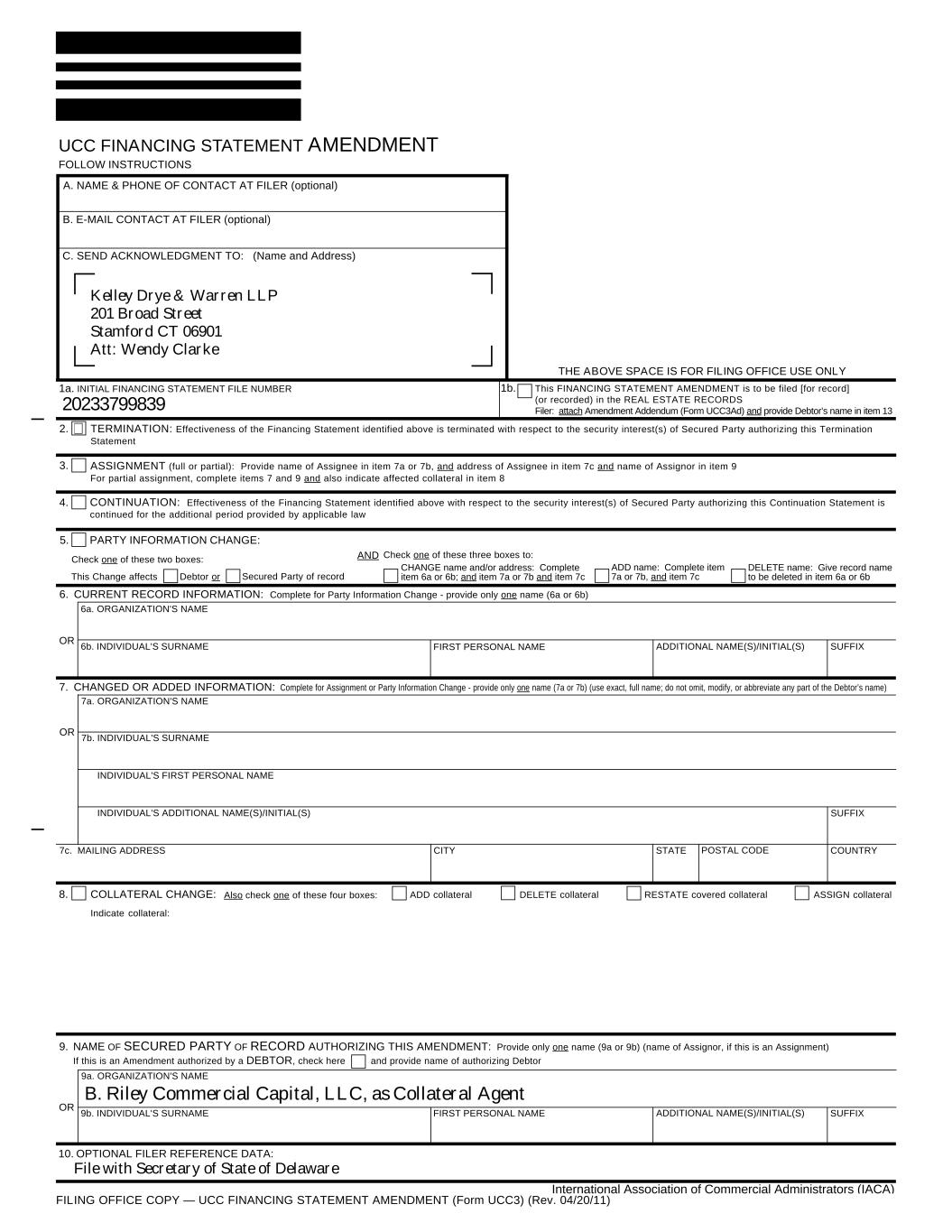

Exhibit A UCC-3 Termination Statement (See Attached)

1b. This FINANCING STATEMENT AMENDMENT is to be filed [for record] (or recorded) in the REAL ESTATE RECORDS Filer: attach Amendment Addendum (Form UCC3Ad) and provide Debtor’s name in item 13 THE ABOVE SPACE IS FOR FILING OFFICE USE ONLY RESTATE covered collateral ASSIGN collateral Check one of these three boxes to: FIRST PERSONAL NAME SUFFIXADDITIONAL NAME(S)/INITIAL(S)OR A. NAME & PHONE OF CONTACT AT FILER (optional) 1a. INITIAL FINANCING STATEMENT FILE NUMBER PARTY INFORMATION CHANGE: ASSIGNMENT (full or partial): Provide name of Assignee in item 7a or 7b, and address of Assignee in item 7c and name of Assignor in item 9 For partial assignment, complete items 7 and 9 and also indicate affected collateral in item 8 TERMINATION: Effectiveness of the Financing Statement identified above is terminated with respect to the security interest(s) of Secured Party authorizing this Termination Statement CONTINUATION: Effectiveness of the Financing Statement identified above with respect to the security interest(s) of Secured Party authorizing this Continuation Statement is continued for the additional period provided by applicable law 2. 3. 4. 6b. INDIVIDUAL'S SURNAME 6a. ORGANIZATION'S NAME DELETE name: Give record name to be deleted in item 6a or 6b 6. CURRENT RECORD INFORMATION: Complete for Party Information Change - provide only one name (6a or 6b) 7. CHANGED OR ADDED INFORMATION: Complete for Assignment or Party Information Change - provide only one name (7a or 7b) (use exact, full name; do not omit, modify, or abbreviate any part of the Debtor’s name) 8. UCC FINANCING STATEMENT AMENDMENT FOLLOW INSTRUCTIONS ADD name: Complete item 7a or 7b, and item 7c OR FIRST PERSONAL NAME ADDITIONAL NAME(S)/INITIAL(S) SUFFIX 9a. ORGANIZATION'S NAME 9b. INDIVIDUAL'S SURNAME 10. OPTIONAL FILER REFERENCE DATA: 9. NAME OF SECURED PARTY OF RECORD AUTHORIZING THIS AMENDMENT: Provide only one name (9a or 9b) (name of Assignor, if this is an Assignment) If this is an Amendment authorized by a DEBTOR, check here and provide name of authorizing Debtor B. E-MAIL CONTACT AT FILER (optional) C. SEND ACKNOWLEDGMENT TO: (Name and Address) CHANGE name and/or address: Complete item 6a or 6b; and item 7a or 7b and item 7cDebtor or Secured Party of record Check one of these two boxes: AND This Change affects 5. ADD collateral DELETE collateralCOLLATERAL CHANGE: Also check one of these four boxes: OR 7a. ORGANIZATION'S NAME POSTAL CODECITY7c. MAILING ADDRESS 7b. INDIVIDUAL'S SURNAME INDIVIDUAL'S FIRST PERSONAL NAME INDIVIDUAL'S ADDITIONAL NAME(S)/INITIAL(S) STATE SUFFIX COUNTRY Indicate collateral: FILING OFFICE COPY — UCC FINANCING STATEMENT AMENDMENT (Form UCC3) (Rev. 04/20/11) Kelley Drye & Warren LLP 201 Broad Street Stamford CT 06901 Att: Wendy Clarke 20233799839 ✔ B. Riley Commercial Capital, LLC, as Collateral Agent File with Secretary of State of Delaware International Association of Commercial Administrators (IACA)