INSIDER TRADING POLICY APPLIED DIGITAL CORPORATION Adopted on October 28, 2024 This Insider Trading Policy (this “Policy”) of Applied Digital Corporation (the “Company”) is designed to prevent insider trading or allegations of insider trading, protect the Company’s reputation for integrity and ethical conduct and to assist Covered Persons (as defined below) in complying with their obligations under the federal securities laws. You must read, sign and retain a copy of this Policy and, annually, or otherwise upon request by the Company, re- acknowledge it. Please address questions to the Company’s Chief Financial Officer, who has initially been designated as the “Compliance Officer” for this Policy, or such other person who is designated by the Board of Directors of the Company. WHO IS SUBJECT TO THIS POLICY? (1) Company Insiders. “Company Insiders” refers to all directors, officers and employees of the Company. The Company may also designate, from time to time, certain consultants and independent contractors as Company Insiders. If you are receiving this Policy, you are considered a Company Insider. The use of “you” and “your” throughout this Policy speaks directly to Company Insiders. (2) Family Members and others living in your household. “Family Members” refers to any of the following: • Any of your relatives, such as a child, stepchild, grandchild, parent, stepparent, aunt, uncle, niece, nephew, grandparent, spouse, sibling and in-law, and any other person typically considered a relative, in each case, whose Trading (as defined below) you either direct or control; and • Anyone who lives in your household, whether or not they are your relative, and whether or not you either direct or control their Trading. You are responsible for your Family Members’ Trading and therefore should inform your Family Members of the need to obtain your approval before they Trade in Company Securities (as defined below). (3) Controlled Entities. “Controlled Entities” are any entities or accounts, including corporations, partnerships, retirement plans or trusts, which are under your direction or control, or where you or a Family Member are a beneficiary. Trading by Controlled Entities should be treated as if you Traded directly yourself. (4) Covered Persons.

-2- “Covered Persons” refers to Company Insiders and their Family Members and Controlled Entities. WHAT IS ILLEGAL AND PROHIBITED INSIDER TRADING? Generally, illegal and prohibited insider trading occurs when a person who is aware of material nonpublic information about a company buys or sells, or engages in transactions with (e.g. hedging, shorting, swaps, etc.), that company’s securities or provides material nonpublic information to another person who may Trade on the basis of that information. Material Information Material information is information that a reasonable investor would consider important in making an investment decision (i.e., a decision to buy, hold, or sell securities) or information that would have been viewed by the reasonable investor as having significantly altered the ‘total mix’ of information made available to them. Any information that could be expected to affect the Company’s stock price, whether it is positive or negative, should be considered material. Material information is not limited to information of a financial nature; rather, material information can relate to virtually any aspect of the Company's business. Material information is also not limited to historical facts. You can be in possession of material information with respect to a future event, such as a merger, acquisition or introduction of a new product. There is no bright-line standard for assessing materiality; rather, materiality is based on an assessment of all of the facts and circumstances, and is often evaluated by enforcement authorities with the benefit of hindsight. While it is not possible to define all categories of material information, some examples of information that ordinarily would be regarded as material are: • Projections of future earnings or losses, or other earnings guidance; • Changes to previously announced earnings guidance, or the decision to suspend earnings guidance; • A pending or probable merger, acquisition, or tender offer; • A pending or probable acquisition or disposition of a significant asset; • A pending or probable financing transaction or securities offering; • The gain or loss of a significant customer, tenant, or supplier; • The entering into, modifying or waiving a material term under a material lease or other significant contract; • Any positive or negative changes to, or any disruptions or damage to, the Company’s facilities, equipment or property, which is reasonably expected to have a material impact on the Company’s financial results, operations or condition; • Any interruption in the electrical power or other utilities that supply the Company’s facilities, which is reasonably expected to have a material impact on the Company’s financial results, operations or condition; • A pending or probable significant joint venture;

-3- • Any approvals, rejections or modifications to zoning or other land use approvals or laws that may have a significant effect on the Company or its properties; • A significant company restructuring; • Significant related party transactions; • Cybersecurity incidents; • A change in dividend policy or the declaration of a stock split; • Bank borrowings or other financing transactions out of the ordinary course of business involving significant proceeds or obligations; • The establishment of a repurchase program for Company Securities; • Major marketing changes; • A change in senior management; • A change in auditors or notification that the auditor’s reports may no longer be relied upon; • Development of a significant new property, process, or service which is reasonably expected to have a material impact on the Company’s financial results, operations or condition; • Pending or threatened significant litigation, or the resolution of such litigation; • Impending bankruptcy or the existence of severe liquidity problems; or • The imposition of a ban on Trading in Company Securities or the securities of another company. If you are unsure whether information is material, you should consult the Compliance Officer before making any decision to disclose such information (other than to persons who need to know it) or to Trade in or recommend securities to which that information relates. The Compliance Officer’s approval or disapproval of a trading clearance is binding on the individual requesting trading clearance and can only be modified in writing by the Board or the Audit Committee. Nonpublic Information Information that has not been disclosed to the public is generally considered to be nonpublic information. In order to establish that the information has been disclosed to the public, it may be necessary to demonstrate that the information has been widely disseminated. Information generally would be considered widely disseminated if it has been disclosed through a press release disseminated through newswire services, a broadcast on widely available internet, radio or television programs, publication in a widely-available newspaper, magazine or news website, or public disclosure documents filed with the Securities and Exchange Commission (the “SEC”) that are available on the SEC’s website. By contrast, information would likely not be considered widely disseminated if it is available only to the Company’s employees, or if it is only available to a select group of analysts, brokers, institutional investors or industry participants. For example, discussions between the Company and another company about a potential business deal that has not yet been publicly announced would be considered nonpublic information. Once information is widely disseminated, it is still necessary to afford the investing public sufficient time to digest the information. As a general rule, information should not be considered fully digested by the marketplace until forty-eight (48) hours after the information

-4- is released. If, for example, the Company were to make an announcement before market hours on a Monday morning, the information typically would not be considered digested until pre- market on Wednesday morning. Depending on the particular circumstances, the Company may determine that information has been digested sooner or later than this forty-eight (48) hour period. As a general rule, no Trades should take place prior to the completion of this forty-eight (48) hour period. As described in more detail below, you are also required to obtain pre-clearance for any Trade. If you would like to seek pre-clearance prior to the completion of the forty- eight (48) hour period, you may do so in accordance with the “Pre-Clearance Procedures” section of this Policy, but the Compliance Officer has no obligation to grant such pre- clearance. If the Compliance Officer grants pre-clearance for any particular Trade, the Compliance Officer has no obligation to grant pre-clearance for any similar or other Trade. If pre-clearance has been granted for another Covered Person, that does not mean your contemporaneous Trade has also been pre-cleared or approved; each Covered Person’s Trade must be pre-cleared. As with questions of materiality, if you are not sure whether information is considered public, you should either consult with the Compliance Officer or assume that the information is nonpublic and treat it as confidential. TRANSACTIONS SUBJECT TO THIS POLICY This Policy applies to any and all transactions in Company Securities, including common stock, preferred stock, options to purchase common stock, securities that are convertible into common stock or preferred stock of the Company or any other securities that the Company may issue, as well as derivative securities that are not issued by the Company such as exchange-traded put or call options or swaps relating to the Company’s securities (collectively, “Company Securities”). Transactions subject to this Policy include sales, purchases, gifts (see discussion on gifts below), pledges, hedges, and other acquisitions, dispositions, or transfers of securities, in each case, directly or indirectly (each of the foregoing transactions, a “Trade” or “Trading” within the meaning of this Policy). Gifts For purposes of this Policy, gifts or other transfers to Family Members, whether for estate planning or otherwise, or to charities or other third parties, are considered “Trading” within the meaning of this Policy. Gifts are subject to the requirements and restrictions outlined in this Policy and require pre-clearance in accordance with the “Pre-Clearance Procedures” section of this Policy. Pre-Clearance As described in more detail below in the “Pre-Clearance Procedures” section of this Policy, all Covered Persons are prohibited from Trading in Company Securities without first obtaining pre-clearance of the Trade in accordance with the “Pre-Clearance Procedures” section of this Policy. The transactions described in the “Exempt Transactions” section of this Policy do not require pre-clearance.

-5- Prohibition on Illegal Insider Trading No Trading on Material Nonpublic Information. If you are aware of material nonpublic information about the Company or Company Securities, you may not Trade Company Securities, except as otherwise specified in this Policy (see “Exempt Transactions” below). Moreover, if you, in the course of performing your work duties for the Company, learn of material nonpublic information about a company with which the Company does business, including a customer or supplier of the Company, or that is involved in a potential transaction or business relationship with the Company (a “Related Company”), then you may not Trade in, take advantage of, or share such information about that Related Company’s securities until the information becomes public or is no longer material. No Tipping. If you are aware of material nonpublic information about the Company, or if you are aware of material nonpublic information about a Related Company that you learned in the course of performing your work duties for the company, you may not communicate or pass (“Tip”) that information on to persons within the Company whose jobs do not require them to have that information, or to persons outside the Company, including Family Members, Controlled Entities, friends or anyone else. The federal securities laws impose liability on any person who Tips or communicates (the “Tipper”) material nonpublic information to another person or entity (the “Tippee”) who then Trades on the basis of the information. Penalties may apply regardless of whether or not the Tipper Trades or derives any benefits from the Tippee’s Trading activities. Blackout Periods. Trading is prohibited during Blackout Periods or event specific Trading restrictions, as described in more detail in the “Quarterly Trading Restrictions” and “Event Specific Black-Out Procedures” sections below. Additional Prohibited Transactions. All Covered Persons are prohibited from engaging in the following transactions in Company Securities: Short Sales. Neither you, your Family Members or your Controlled Entities may sell any Company Securities that are not owned by such person at the time of the sale (a “short sale”), including a sale with delayed delivery (a “sale or short against the box”). Standardized Options. An “option” is the right either to buy or sell a specified amount or value of a particular underlying interest at a fixed exercise price by exercising the option before its specified expiration date. An option which gives a right to buy is a “call” option, and an option which gives a right to sell is a “put” option. Standardized options (which are so labeled as a result of their standardized terms) offer the opportunity to invest using substantial leverage and therefore lend themselves to significant potential for abusive Trading on material inside information. Standardized options also expire soon after issuance and thus necessarily involve short-term speculation, even where the date of expiration of the option makes the option exempt from certain SEC restrictions. The writing of a call or the acquisition of a put also involves a “bet against the company” and therefore presents a clear conflict of interest for you. As a result, you, your Family Members or your Controlled Entities may not Trade in standardized options relating to Company Securities at any time.

-6- Hedging Transactions. Certain forms of hedging or monetization transactions, such as zero- cost collars and forward sale contracts, allow you to lock in much of the value of your stock holdings, often in exchange for all or part of the potential for upside appreciation in the stock. These transactions allow you to continue to own the covered securities, but without the full risks and rewards of ownership. When that occurs, you may no longer have the same objectives as the Company’s other shareholders. Therefore, neither you, your Family Members or your Controlled Entities may engage in any such transactions. Margin Accounts and Pledges. Securities held in a margin account may be sold by the broker without the customer’s consent if the customer fails to meet a margin call. Securities pledged or hypothecated as collateral for a loan may be sold in foreclosure if the borrower defaults on the loan. Because a margin sale or foreclosure sale may occur at a time when you are aware of material nonpublic information or otherwise are not permitted to Trade in Company Securities, neither you, your Family Members nor your Controlled Entities may hold Company Securities in a margin account or pledge Company Securities as collateral for a loan unless such transaction has been pre-approved by the Compliance Officer. Exempt Transactions Stock Option Exercises. This Policy does not apply to the exercise of any stock option acquired pursuant to the Company’s equity plans, or to the exercise of a tax withholding right pursuant to which a person has elected to have the Company withhold shares subject to an option to satisfy tax withholding requirements. This Policy does apply to any sale of stock as part of a broker-assisted cashless exercise of an option (to the extent that such an exercise is permitted under the Company’s equity plans and applicable stock exchange rules and policies), or any other market sale for the purpose of generating the cash needed to pay the exercise price of an option. Restricted Stock Awards. This Policy does not apply to the vesting of restricted stock (if, as and when issued by the Company), or of a tax withholding right pursuant to which you elect to have the Company withhold shares of stock to satisfy tax withholding requirements upon the vesting of any restricted stock. This Policy, however, would apply to any market sale of restricted stock (if any becomes issued). 401(k) Plan. This Policy does not apply to purchases of Company Securities in the Company’s 401(k) plan resulting from your periodic contribution of money to the plan pursuant to your payroll deduction election. This Policy does apply, however, to certain elections you may make under the 401(k) plan, including: (a) an election to increase or decrease the percentage of your periodic contributions that will be allocated to the Company’s stock fund; (b) an election to change the investments in Company Securities or securities of a Related Company in your 401(k) pan; (c) an election to make an intra-plan transfer of an existing account balance into or out of the Company’s stock fund; (d) an election to borrow money against your 401(k) plan account if the loan will result in a liquidation of some or all of your Company stock fund balance; and (e) an election to pre‑pay a plan loan if the pre- payment will result in allocation of loan proceeds to the Company’s stock fund. Trades in any other benefit plan are subject to this Policy.

-7- Transactions with the Company. This Policy does not apply to the purchase of Company Securities from the Company or the sale of Company Securities to the Company. Except for above, there are no Trading exemptions to this Policy. Securities laws do not recognize any mitigating circumstances. Trades that may be necessary or justifiable for independent reasons (such as in the case of an emergency), or small Trades, or Trades to pay your taxes, are not permitted. PRE-CLEARANCE PROCEDURES All Covered Persons are prohibited from Trading in Company Securities without first obtaining pre-clearance of the transaction from the Compliance Officer (i.e., a Company Insider is required to get pre-clearance for Trades on behalf of his or her Family Members or Controlled Entities). A request for pre-clearance must be submitted in writing to the Compliance Officer at least two (2) business days in advance of the proposed Trade by submission of the Trade Pre-Clearance Request Form attached here as Addendum A. The Compliance Officer is under no obligation to approve a Trade submitted for pre-clearance, and may determine not to permit the Trade, even if similar or other Trades have been pre-cleared. When a request for pre-clearance is made, the requestor should carefully consider whether he or she may be aware of any material nonpublic information about the Company, and should describe fully those circumstances to the Compliance Officer. The requestor should also indicate whether he or she has effected any non-exempt “opposite-way” transactions within the past six (6) months, and should be prepared to report the proposed Trade on an appropriate Form 4 or Form 5. The requestor should also be prepared to comply with SEC Rule 144 and file a Form 144, if necessary, at the time of any sale. If a Covered Person seeks pre-clearance and permission to engage in the Trade is denied, then such Covered Person must refrain from initiating any Trade in Company Securities, and should not inform any other person of the restriction. All Trades in Company Securities are prohibited unless and until the Covered Person receives written confirmation from the Compliance Officer that the proposed Trade has been approved. Approvals are effective for five (5) business days after receipt of written approval (if such approval is not otherwise rescinded) and the Trade must be completed within this period (or a new approval must be obtained). Once the Blackout Period begins (or upon the notification of an event specific Trading restriction), any approval for Trades that were previously pre-cleared are automatically rescinded and all pending pre-clearance requests are automatically deemed denied. QUARTERLY TRADING RESTRICTIONS The Company has designated the following groups of individuals as part of the Company’s “Blackout Group.” The Compliance Officer will notify you in writing (or by email) if you are part of the Blackout Group. • All (i) members of the Company’s Board of Directors and (ii) officers (as defined in Rule 16a-1(f) of the Exchange Act) of the Company (i.e. the Company’s Section 16 filing persons)

-8- • All employees within the Finance, Accounting, Investor Relations and Legal functions. • All other employees in any function who have visibility to the Company’s earnings information, including earnings information at the subsidiary level, as well as the Company level (if you are unsure about whether you have visibility to the earnings information, please speak with your manager and, as necessary and appropriate, your manager may contact the Compliance Officer to further discuss). • Such other persons as may be designated from time to time by the Compliance Officer. Members of the Blackout Group may not Trade any Company Securities (other than as specified by this Policy), during a “Blackout Period.” A Blackout Period begins on the first (1st) trading day after the end of each fiscal quarter and ends forty-eight (48) hours following the time of the public release of the Company’s earnings results for that quarter. In other words, these persons may only conduct transactions in Company Securities during the “Window Period” beginning on the third (3rd) day following the public release of the Company’s quarterly earnings and ending at the close of business on the last day of the next fiscal quarter. For example, if an earnings release were published at 4:15PM (New York time) on a Tuesday, the Blackout Period would end with the market open that Friday morning, or if an earnings release were published on a Monday at 8:15AM (New York time), then the Blackout Period would end at market open that Wednesday morning. EVENT-SPECIFIC BLACK-OUT PROCEDURES From time to time, an event may occur that is material to the Company and is known by only a few Company Insiders. So long as the event remains material and nonpublic, certain Company Insiders who are aware of the event may be designated by the Compliance Officer as restricted from Trading. In that situation, the Compliance Officer will notify these Covered Persons in writing (or by email) that they should not Trade in Company Securities, whether or not the Compliance Officer discloses the reason for the restriction. For so long as the event remains material and nonpublic, the Company Insiders designated by the Compliance Officer may not Trade Company Securities. In addition, the Company’s financial results may be sufficiently material in a particular fiscal quarter that, in the judgment of the Compliance Officer, designated Covered Persons should refrain from Trading in Company Securities even sooner than the typical Blackout Period described above. The existence of an event-specific Trading restriction period or extension of a Blackout Period will not be announced to the Company as a whole, and should not be communicated to any other person. Even if the Compliance Officer has not designated you as a person who should not Trade due to an event-specific restriction, you should not Trade while aware of material nonpublic information. Exceptions will not be granted during an event-specific Trading restriction period. RULE 10b5-1 PLANS Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, provides an affirmative defense, under certain conditions, against allegations that a Company Insider Traded in Company Securities while aware of material nonpublic information. Among other things,

-9- Rule 10b5-1 requires the use of a contract, instruction or plan that meets certain conditions specified in Rule 10b5-1 (a “10b5-1 Plan”). Company Insiders are prohibited from entering into a 10b5-1 Plan during (i) a Blackout Period, (ii) when they are subject to an event specific Trading restriction, or (iii) at any time when they are aware of material, nonpublic information about the Company. Pre-clearance is required prior to entry into a 10b5-1 Plan, termination of a 10b5-1 Plan, or a modification of a 10b5-1 Plan. A copy of a 10b5-1 Plan must be submitted to the Compliance Officer for review and pre-clearance at least three (3) business days prior to the anticipated entry into a 10b5-1 Plan. The 10b5-1 Plan document must be reviewed and pre-cleared by the Compliance Officer prior to being signed by the Company Insider. The Company has discretion to refuse approval of any 10b5-1 Plan document for any reason and need not provide any reason for such refusal to the Company Insider. Once a 10b5-1 Plan is adopted, the Company Insider must not exercise any influence over the amount of securities to be Traded, the price at which they are to be Traded, or the date of any Trade. The 10b5-1 Plan must include a cooling-off period consistent with applicable SEC rules before Trading can commence.

POST-TRADE REPORTING You are required to report to the Compliance Officer any Trade in Company Securities by you, your Family Members or Controlled Entities no later than the business day following the date of your Trade. Each report you make should include the date of the Trade, quantity, price, and broker through which the Trade was effected. This reporting requirement may be satisfied by sending (or having your broker send) duplicate confirmations of Trades to the Compliance Officer if such information is received by the required date. The foregoing reporting requirement is designed to help monitor compliance with these procedures and to enable the Company to help those persons who are subject to reporting obligations under Section 16 of the Securities Exchange Act of 1934, as amended, to comply with such reporting obligations. Each officer and director, however, and not the Company, is personally responsible for ensuring that his or her Trades do not give rise to “short swing” liability under Section 16 and for filing timely reports of Trades with the SEC. THE CONSEQUENCES OF VIOLATING THIS POLICY Trading of Company Securities while aware of material nonpublic information, or the disclosure of material nonpublic information to others who then Trade in Company Securities, is prohibited by the federal and state laws. Insider trading violations are pursued vigorously by the SEC, U.S. Attorneys, and state enforcement authorities as well as the laws of foreign jurisdictions. Punishment for insider trading violations is severe, and could include significant fines and imprisonment. While the regulatory authorities concentrate their efforts on the individuals who Trade, or who Tip information to others who Trade, the federal securities laws also impose potential liability on companies and other “controlling persons” (such as directors, officers and other supervisory personnel) if they fail to take reasonable steps to prevent insider trading by company personnel. In addition, your failure to comply with this Policy may subject you to Company-imposed sanctions, including dismissal for cause, whether or not your failure to comply results in a violation of law. Needless to say, a violation of law, or even an SEC investigation that does not result in prosecution, can tarnish your reputation and irreparably damage a career. POST-TERMINATION TRADES This Policy continues to apply to Company Insiders even after the Company Insider ceases to be a Company Insider. If you are aware of material, nonpublic information when your employment or service relationship terminates, you may not Trade in Company Securities until that information has become public or is no longer material. REPORTING OF VIOLATIONS If any person knows or has reason to believe that this Policy has been or may be violated, the person should bring the actual or potential violation to the attention of the Compliance Officer.

MODIFICATIONS AND WAIVERS The Company reserves the right to amend or modify the procedures set forth herein at any time. Waiver of any provision of this Policy in a specific instance may be authorized in writing by the Compliance Officer. This document states a policy of the Company and is not intended to be regarded as the rendering of legal advice. This Policy is intended to promote compliance with existing law and is not intended to create or impose liability that would not exist in the absence of this Policy.

ACKNOWLEDGMENT AND CERTIFICATION The undersigned does hereby acknowledge receipt of this Policy. The undersigned has read and understands (or has had explained) this Policy and agrees to be governed by this Policy at all times and the confidentiality of nonpublic information. __________________________________ (Signature) __________________________________ (Please print name) Date: ________________________

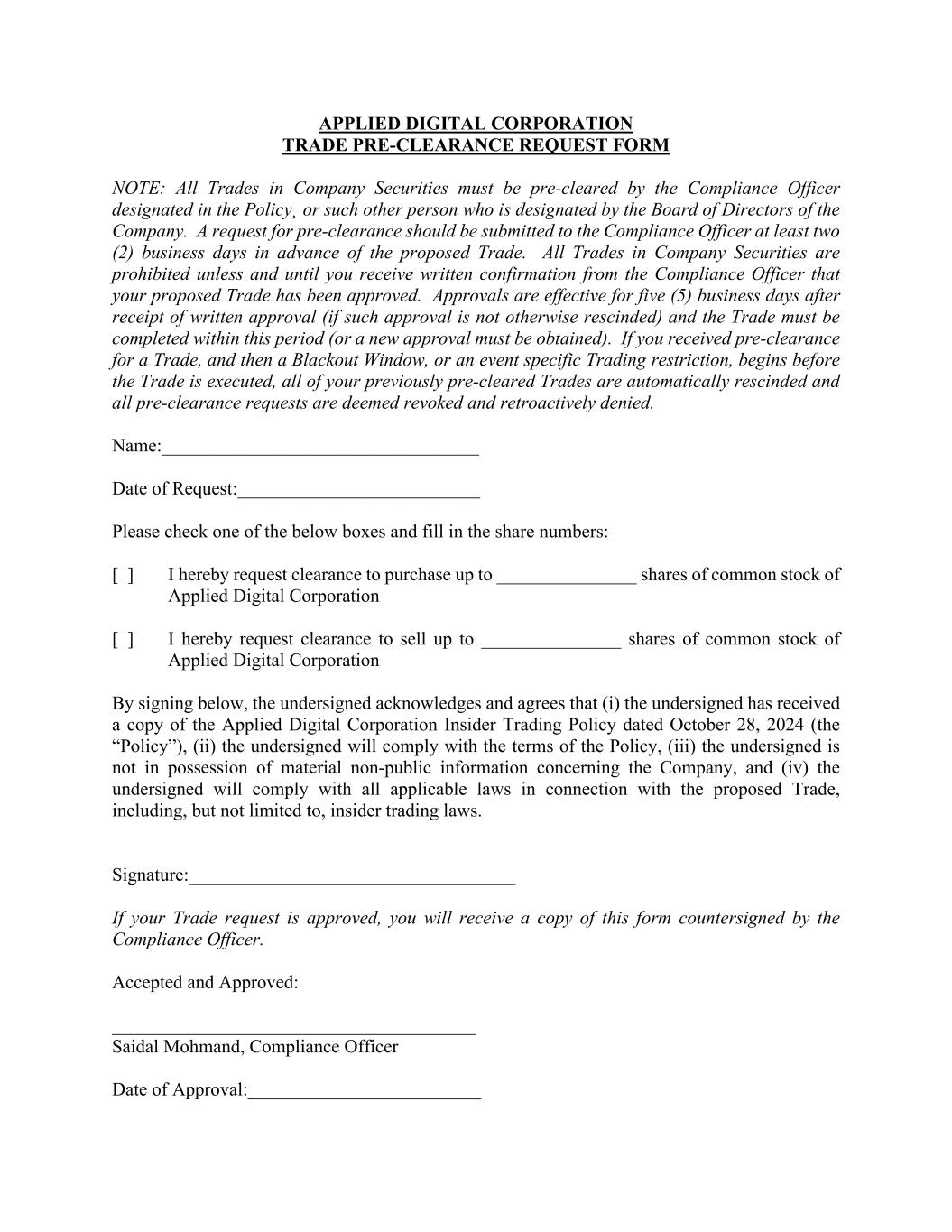

APPLIED DIGITAL CORPORATION TRADE PRE-CLEARANCE REQUEST FORM NOTE: All Trades in Company Securities must be pre-cleared by the Compliance Officer designated in the Policy¸ or such other person who is designated by the Board of Directors of the Company. A request for pre-clearance should be submitted to the Compliance Officer at least two (2) business days in advance of the proposed Trade. All Trades in Company Securities are prohibited unless and until you receive written confirmation from the Compliance Officer that your proposed Trade has been approved. Approvals are effective for five (5) business days after receipt of written approval (if such approval is not otherwise rescinded) and the Trade must be completed within this period (or a new approval must be obtained). If you received pre-clearance for a Trade, and then a Blackout Window, or an event specific Trading restriction, begins before the Trade is executed, all of your previously pre-cleared Trades are automatically rescinded and all pre-clearance requests are deemed revoked and retroactively denied. Name:__________________________________ Date of Request:__________________________ Please check one of the below boxes and fill in the share numbers: [ ] I hereby request clearance to purchase up to _______________ shares of common stock of Applied Digital Corporation [ ] I hereby request clearance to sell up to _______________ shares of common stock of Applied Digital Corporation By signing below, the undersigned acknowledges and agrees that (i) the undersigned has received a copy of the Applied Digital Corporation Insider Trading Policy dated October 28, 2024 (the “Policy”), (ii) the undersigned will comply with the terms of the Policy, (iii) the undersigned is not in possession of material non-public information concerning the Company, and (iv) the undersigned will comply with all applicable laws in connection with the proposed Trade, including, but not limited to, insider trading laws. Signature:___________________________________ If your Trade request is approved, you will receive a copy of this form countersigned by the Compliance Officer. Accepted and Approved: _______________________________________ Saidal Mohmand, Compliance Officer Date of Approval:_________________________

AMENDMENT NO. 1 TO THE INSIDER TRADING POLICY OF APPLIED DIGITAL CORPORATION Adopted and Approved by the Board of Directors on April 10, 2025 1. Compliance Officer. The Compliance Officer for the Insider Trading Policy of Applied Digital Corporation (the “Company”) is hereby designated to be Mark Chavez, General Counsel. 2. Modifications and Waivers. The Modifications and Waivers section of the Insider Trading Policy is hereby amended and restated in its entirety to read as follows: “The Company reserves the right to amend or modify the procedures set forth herein at any time. Waiver of any provision of this Policy in a specific instance may be authorized in writing by the Audit Committee, with the advice of outside counsel (with all interpretations to be made by the Audit Committee and/or the Board of Directors).” 3. Effective Date. This Amendment shall be effective as of the date it is adopted and approved by the Board of Directors of the Company.