UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

APPLIED DIGITAL CORPORATION

(Name of Registrant as Specified in its Charter)

(Name(s) of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computer on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

APPLIED DIGITAL CORPORATION

3811 Turtle Creek Blvd., Suite 2100

Dallas, Texas 75219

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on November 20, 2024

To the Stockholders of Applied Digital Corporation:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Applied Digital Corporation (the “Company”) to be held on November 20, 2024, at 12:00 p.m., Eastern Time. The Annual Meeting will be held virtually via the Internet at www.virtualshareholdermeeting.com/APLD2024. You will not be able to attend the Annual Meeting at a physical location. At the Annual Meeting, stockholders will act on the following matters:

| ● | To elect six director nominees to serve as directors until the next annual meeting of stockholders (“Proposal 1”); | |

| ● | To ratify the appointment of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending May 31, 2025 (“Proposal 2”); | |

| ● | To approve, on an advisory basis, the executive compensation of the Company’s named executive officers as described in the attached proxy statement (“Proposal 3”); | |

| ● | To approve the Company’s 2024 Equity Compensation Plan and the reservation of 10,000,000 shares of common stock for issuance thereunder (“Proposal 4”); | |

| ● | To approve, for the purpose of complying with the applicable provisions of The Nasdaq Stock Market LLC (“Nasdaq”) Listing Rule 5635, the potential issuance of shares of our common stock issuable upon conversion of our Series F Convertible Preferred Stock (“Proposal 5”); | |

| ● | To approve an amendment to the Company’s Second Amended and Restated Articles of Incorporation, as amended (the “Articles”, to increase the number of shares of common stock and the number of shares of preferred stock authorized for issuance thereunder (“Proposal 6”); | |

| ● | To approve the adjournment of the Annual Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of any one or more of the foregoing proposals (“Proposal 7”); and | |

| ● | To consider any other matters that may properly come before the Annual Meeting, including any adjournment or postponement thereof. |

Only holders of our common stock, par value $0.001 per share, of record at the close of business on September 27, 2024, are entitled to receive notice of and to vote at the Annual Meeting or any postponement or adjournment thereof.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please vote electronically via the Internet or by telephone, or please complete, sign, date and return the accompanying proxy card or voting instruction card in the enclosed postage-paid envelope. If you attend the Annual Meeting and prefer to vote during the Annual Meeting, you may do so even if you have already voted your shares. You may revoke your proxy in the manner described in the proxy statement at any time before it has been voted at the Annual Meeting.

| By Order of the Board of Directors | |

| Wes Cummins | |

| Chief Executive Officer and Chairman of the Board of Directors |

Dallas, TX

PROXY STATEMENT

TABLE OF CONTENTS

| i |

APPLIED DIGITAL CORPORATION

PROXY STATEMENT

FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement (this “Proxy Statement”) contains information related to the Annual Meeting of Stockholders (the “Annual Meeting”) of Applied Digital Corporation (collectively, “we,” “us,” “our” or the “Company”) to be held on November 20, 2024, at 12:00 p.m., Eastern Time. The Annual Meeting will be held virtually via the Internet, or at such other time and place to which the Annual Meeting may be adjourned or postponed. In order to attend our Annual Meeting, you must log in to www.virtualshareholdermeeting.com/APLD2024 using the 16-digit control number on the proxy card or voting instruction form that accompanied the proxy materials.

Proxies for the Annual Meeting are being solicited by the Board of Directors of the Company (the “Board”). This Proxy Statement is first being made available to stockholders on or about .

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting To Be Held on November 20, 2024.

Our proxy materials, including our Proxy Statement for the Annual Meeting, our annual report for the fiscal year ended May 31, 2024, and proxy card are available on the Internet at www.proxyvote.com. Under the Securities and Exchange Commission (the “SEC”) rules, we are providing access to our proxy materials by sending you this full set of proxy materials .

About the Meeting

We are calling the Annual Meeting to seek the approval of our stockholders:

| ● | To elect six director nominees to serve as directors until the next annual meeting of stockholders (“Proposal 1”); | |

| ● | To ratify the appointment of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending May 31, 2025 (“Proposal 2”); | |

| ● | To approve, on an advisory basis, the executive compensation of the Company’s named executive officers as described in this Proxy Statement (“Proposal 3”); | |

| ● | To approve the Company’s 2024 Equity Compensation Plan and the reservation of 10,000,000 shares of common stock for issuance thereunder (“Proposal 4”); | |

| ● | To approve, for the purpose of complying with the applicable provisions of The Nasdaq Stock Market LLC (“Nasdaq”) Listing Rule 5635, the potential issuance of shares of our common stock issuable upon conversion of our Series F Convertible Preferred Stock (“Proposal 5”); | |

| ● | To approve an amendment to the Company’s Second Amended and Restated Articles of Incorporation, as amended (the “Articles”), to increase the number of shares of common stock and the number of shares of preferred stock authorized for issuance thereunder (“Proposal 6”); | |

| ● | To approve the adjournment of the Annual Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of any one or more of the foregoing proposals (“Proposal 7”); and | |

| ● | To consider any other matters that may properly come before the Annual Meeting, including any adjournment or postponement thereof. |

| 1 |

What are the Board’s recommendations?

Our Board believes that the (i) election of the director nominees identified herein, (ii) ratification of the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ending May 31, 2025, (iii) compensation of our named executive officers for the fiscal year ended May 31, 2024, as described in this Proxy Statement, (iv) approval of the Company’s 2024 Equity Compensation Plan and the reservation of 10,000,000 shares of common stock for issuance thereunder, (v) approval of, for the purpose of complying with the applicable provisions of Nasdaq Listing Rule 5635, the potential issuance of shares of our common stock issuable upon conversion of our Series F Preferred Stock, (vi) approval of an amendment to the Articles to increase the number of shares of common stock and the number of shares of preferred stock authorized for issuance thereunder and (vii) approval to adjourn the Annual Meeting to a later date or dates, in the event that there are insufficient votes for, or otherwise in connection with, the approval of any one or more of the foregoing proposals, are each advisable and in the best interests of the Company and its stockholders and recommends that you vote FOR each of the director nominees and FOR each of the foregoing proposals. If you are a stockholder of record and you return a properly executed proxy card or vote by proxy over the Internet but do not mark the boxes showing how you wish to vote, your shares will be voted in accordance with the recommendations of the Board, as set forth above. With respect to any other matter that properly comes before our Annual Meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, at their own discretion.

Who is entitled to vote at the Annual Meeting?

Only stockholders of record at the close of business on the record date, September 27, 2024 (the “Record Date”), are entitled to receive notice of the Annual Meeting and to vote the shares of our common stock that they held on that date at the Annual Meeting, or any postponement or adjournment of the Annual Meeting. Each share of common stock is entitled to one vote on each proposal. As of the Record Date, we had 214,511,446 shares of common stock outstanding.

Who can attend the meeting?

All stockholders of record at the close of business on the Record Date, or their duly appointed proxies, may attend the Annual Meeting.

Attendance at the Annual Meeting shall be solely via the Internet at www.virtualshareholdermeeting.com/APLD2024 using the 16-digit control number on the proxy card or voting instruction form that accompanied the proxy materials. Stockholders will not be able to attend the Annual Meeting at a physical location.

The live webcast of the Annual Meeting will begin promptly at 12:00 p.m., Eastern Time on November 20, 2024. Online access to the webcast will open approximately 15 minutes prior to the start of the Annual Meeting to allow time for our stockholders to log in and test their devices’ audio system. We encourage our stockholders to access the Annual Meeting in advance of the designated start time.

An online portal will be available to our stockholders at www.proxyvote.com commencing approximately on or about October 11, 2024. By accessing this portal, stockholders will be able to vote in advance of the Annual Meeting. Stockholders may also vote, and submit questions, during the Annual Meeting at www.virtualshareholdermeeting.com/APLD2024. To demonstrate proof of stock ownership, you will need to enter the 16-digit control number received with your proxy card or voting instruction form to submit questions and vote at our Annual Meeting. If you hold your shares in “street name” (that is, through a broker or other nominee), you will need authorization from your broker or nominee in order to vote. We intend to answer questions submitted during the Annual Meeting that are pertinent to the Company and the items being brought for stockholder vote at the Annual Meeting, as time permits, and in accordance with the Rules of Conduct for the Annual Meeting. To promote fairness, efficiently use the Company’s resources, and ensure all stockholder questions are able to be addressed, we will respond to no more than three questions from a single stockholder. We have retained Broadridge Financial Solutions to host our virtual Annual Meeting and to distribute proxies and receive, count and tabulate votes.

| 2 |

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of a majority in voting power of the then outstanding shares of capital stock of the Company entitled to vote at the Annual Meeting will constitute a quorum for the Annual Meeting.

Abstentions will be counted for the purpose of determining whether a quorum is present. If brokers have, and exercise, discretionary authority on at least one item on the agenda for the Annual Meeting, uninstructed shares for which broker non-votes occur will constitute voting power present for the discretionary matter and will therefore count towards the quorum.

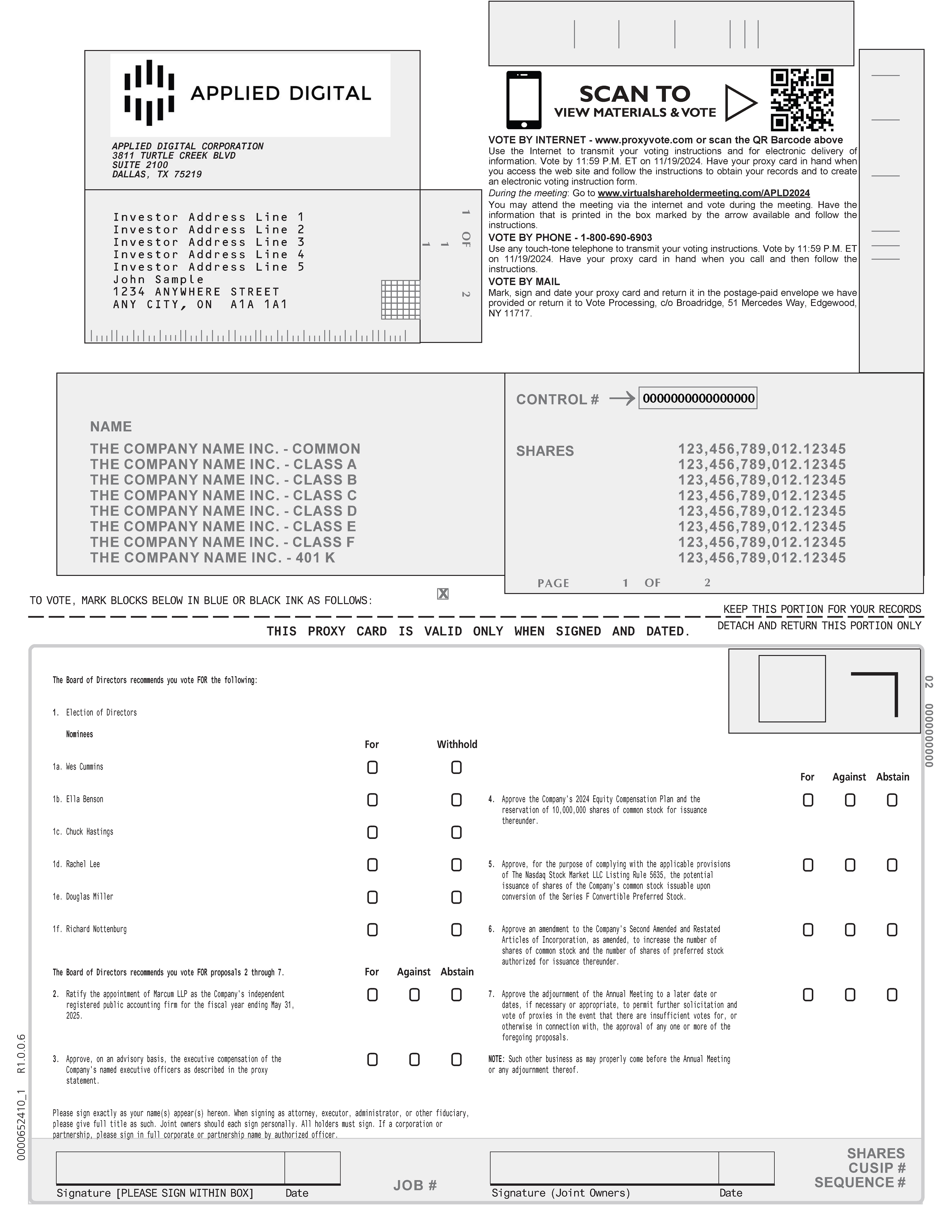

How do I vote?

You may vote on the Internet, by telephone, by mail or by attending the Annual Meeting and voting electronically, all as described below. The Internet and telephone voting procedures are designed to authenticate stockholders by use of a control number and to allow you to confirm that your instructions have been properly recorded. If you vote by telephone or on the Internet, you do not need to return your proxy card or voting instruction card.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker or other nominee, considered to be the stockholder of record. As the beneficial owner, you have the right to tell your nominee how to vote. Your nominee has sent you instructions on how to direct the nominee’s vote. You may submit a proxy to vote by following those instructions.

Vote on the Internet

If you are a stockholder of record, you may submit your proxy by going to www.proxyvote.com and following the instructions provided in the proxy card that accompanied the proxy materials. Have your proxy card or voting instruction card in hand when you access the voting website. On the Internet voting site, you can confirm that your instructions have been properly recorded. If you vote on the Internet, you can also request electronic delivery of future proxy materials. Internet voting facilities are available now and will be available 24 hours a day until 11:59 p.m., Eastern Time, on November 19, 2024.

Vote by Telephone

If you are a stockholder of record, you can also vote by telephone by dialing the telephone number shown on your proxy card. Have your proxy card or voting instruction card in hand when you call. Telephone voting facilities are available now and will be available 24 hours a day until 11:59 p.m., Eastern Time, on November 19, 2024.

Vote by Mail

You may choose to vote by mail, by marking your proxy card or voting instruction card, dating and signing it, and returning it in the postage-paid envelope provided. If the envelope is missing and you are a stockholder of record, please mail your completed proxy card to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. If the envelope is missing and your shares are held with a broker, please mail your completed voting instruction card to the address specified therein. Please allow sufficient time for mailing if you decide to vote by mail as it must be received by 11:59 p.m., Eastern Time, on November 19, 2024.

Voting at the Annual Meeting

You will have the right to vote on the day of, or during, the Annual Meeting on www.virtualshareholdermeeting.com/APLD2024. To demonstrate proof of stock ownership, you will need to enter the 16-digit control number received with your proxy card or voting instruction form to vote at our Annual Meeting.

Even if you plan to attend our Annual Meeting, we recommend that you also submit your proxy as described above so that your vote will be counted if you later decide not to attend our Annual Meeting.

The shares voted electronically, telephonically or represented by the proxy cards received, properly marked, dated, signed and not revoked, will be voted at the Annual Meeting.

| 3 |

What if I vote and then change my mind?

You may revoke your proxy at any time before it is exercised by:

| ● | filing with the Secretary of the Company a notice of revocation; |

| ● | submitting a later-dated vote by telephone or on the Internet; |

| ● | sending in another duly executed proxy bearing a later date; or |

| ● | attending the Annual Meeting remotely and casting your vote in the manner set forth above. Your latest vote will be the vote that is counted. |

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Many of our stockholders hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record

If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered, with respect to those shares, the stockholder of record. As the stockholder of record, you have the right to directly grant your voting proxy or to vote at the Annual Meeting.

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker, bank or nominee which is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker as to how to vote and are also invited to attend the Annual Meeting. However, because you are not the stockholder of record, you may not vote these shares unless you obtain a signed proxy from the record holder giving you the right to vote the shares. If you do not provide the stockholder of record with voting instructions or otherwise obtain a signed proxy from the record holder giving you the right to vote the shares, broker non-votes may occur for the shares that you beneficially own. The effect of broker non-votes is more specifically described in “What vote is required to approve each proposal?” below.

What vote is required to approve each proposal?

Assuming that a quorum is present, the following votes will be required:

| ● | With respect to Proposal 1, directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote, and the director nominees who receive the greatest number of votes at the Annual Meeting (up to the total number of directors to be elected) will be elected. As a result, withheld votes and broker non-votes (see below), if any, will not affect the outcome of this proposal. | |

| ● | With respect to Proposal 2, the ratification of the independent registered public accounting firm, a majority of the total votes cast at the Annual Meeting, whether in person or represented by proxy, is required to approve Proposal 2. As a result, abstentions, if any, will not affect the outcome of the vote on this proposal. Because this proposal is “routine” (see below), no broker non-votes will occur on this proposal. | |

| ● | With respect to Proposal 3, the approval, on an advisory basis, of the executive compensation of the Company’s named executive officers as described in this Proxy Statement, a majority of the total votes cast at the Annual Meeting, whether in person or represented by proxy, is required to approve Proposal 3. As a result, abstentions and broker non-votes (see below), if any, will not affect the outcome of the vote on this proposal. |

| 4 |

| ● | With respect to Proposal 4, the approval of the Company’s 2024 Equity Compensation Plan and the reservation of 10,000,000 shares of common stock for issuance thereunder, a majority of the total votes cast at the Annual Meeting, whether in person or represented by proxy, is required to approve Proposal 4. As a result, abstentions and broker non-votes (see below), if any, will not affect the outcome of the vote on this proposal. | |

| ● | With respect to Proposal 5, the approval, for the purpose of complying with the applicable provisions of Nasdaq Listing Rule 5635, of the potential issuance of shares of our common stock issuable upon conversion of our Series F Preferred Stock, a majority of the total votes cast at the Annual Meeting, whether in person or represented by proxy, is required to approve Proposal 5. As a result, abstentions and broker non-votes (see below), if any, will not affect the outcome of the vote on this proposal. | |

| ● | With respect to Proposal 6, the approval of an amendment to the Articles to increase the number of shares of common stock and the number of shares of preferred stock authorized for issuance thereunder, a majority of the voting power of the issued and outstanding shares of common stock that are entitled to vote at the Annual Meeting, whether in person or represented by proxy, is required to approve Proposal 6. As a result, abstentions and broker non-votes (see below), if any, will have the effect of a vote “AGAINST” Proposal 6 if such proposal is deemed “non-routine” as described below. Accordingly, it is particularly important that beneficial owners instruct their brokers how they wish to vote their shares. If this proposal is deemed to be “routine,” no broker non-votes will occur on this proposal. | |

| ● | With respect to Proposal 7, the approval of the adjournment of the Annual Meeting in the event that there are insufficient votes for, or otherwise in connection with, the approval of any one or more of the foregoing proposals, a majority of the total votes cast at the Annual Meeting, whether in person or represented by proxy, is required to approve Proposal 7. As a result, abstentions and broker non-votes, if any, will not affect the outcome of this proposal. If this proposal is deemed to be “routine” as described below, no broker non-votes will occur on this proposal. | |

| ● | With respect to any other matter that may properly come before the Annual Meeting, a majority of the total votes cast by holders of our common stock, whether in person or represented by proxy, is required to approve such proposals, except as required by law. As a result, abstentions, if any, will not affect the outcome of the vote on these proposals. No broker non-votes will occur on any “routine” proposals, and broker non-votes will not affect the outcome of any “non-routine” proposals. |

You will not have any dissenters’ rights of appraisal in connection with any of the matters to be voted on at the meeting.

What are “broker non-votes”?

Banks and brokers acting as nominees are permitted to use discretionary voting authority to vote proxies for proposals that are deemed “routine” by the New York Stock Exchange, which means that they can submit a proxy or cast a ballot on behalf of stockholders who do not provide a specific voting instruction. Brokers and banks are not permitted to use discretionary voting authority to vote proxies for proposals that are deemed “non-routine” by the New York Stock Exchange. The determination of which proposals are deemed “routine” versus “non-routine” may not be made by the New York Stock Exchange until after the date on which this Proxy Statement has been mailed to you. As such, it is important that you provide voting instructions to your bank, broker or other nominee, if you wish to ensure that your shares are present and voted at the Annual Meeting on all matters and if you wish to direct the voting of your shares on “routine” matters.

When there is at least one “routine” matter to be considered at a meeting, a “broker non-vote” occurs when a proposal is deemed “non-routine” and a nominee holding shares for a beneficial owner does not have discretionary voting authority with respect to the “non-routine” matter being considered and has not received voting instructions with respect to such matter from the beneficial owner.

Proposal 1, the election of directors, Proposal 3, the advisory vote on executive compensation, Proposal 4, the approval of the Company’s 2024 Equity Compensation Plan and Proposal 5, the approval, for the purpose of complying with the applicable provisions of Nasdaq Listing Rule 5635, of the potential issuance of shares of our common stock issuable upon conversion of our Series F Preferred Stock, are generally not or may not be considered to be “routine” matters by the New York Stock Exchange and banks or brokers are not or may not be permitted to vote on these matters if the bank or broker has not received instructions from the beneficial owner. Accordingly, it is particularly important that beneficial owners instruct their brokers how they wish to vote their shares for Proposals 1, 3, 4, and 5. Under the applicable rules governing such brokers, we believe Proposal 2, to ratify the appointment of Marcum LLP as our independent registered public accounting firm, Proposal 6, the approval of an amendment to our Articles to increase the number of shares of common stock and preferred stock authorized for issuance thereunder, and Proposal 7, to approve the adjournment of the Annual Meeting to the extent there are insufficient proxies at the Annual Meeting to approve any of the foregoing proposals, are likely to be considered “routine” items. Therefore, a bank or broker may be able to vote on these proposals even if it does not receive instructions from you, so long as it holds your shares in its name.

How are we soliciting this proxy?

We are soliciting this proxy on behalf of our Board and will pay all expenses associated therewith. In the event that we need to adjourn the Annual Meeting to solicit additional votes, we may at that time retain a proxy solicitor at an additional cost to us. Some of our officers, directors and other employees also may, but without compensation other than their regular compensation, solicit proxies by further mailing or personal conversations, or by telephone, facsimile or other electronic means.

We will also, upon request, reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their reasonable out-of-pocket expenses for forwarding proxy materials to the beneficial owners of the capital stock and to obtain proxies.

| 5 |

ELECTION OF DIRECTORS

Our Board, upon recommendation of our Nominating and Corporate Governance Committee, has nominated Wes Cummins, Ella Benson, Chuck Hastings, Rachel Lee, Douglas Miller and Richard Nottenburg for election as directors of the Board.

Our Third Amended and Restated Bylaws (“Bylaws”) permit the Board to set the size of the Board, having at least one (1) or more members. Our Board currently consists of seven directors, six of whom are being nominated for reelection at this Annual Meeting.

Each of our current directors serves until the next annual meeting of our stockholders or the earlier death, resignation or removal of such director. Despite the expiration of a director’s term, however, the director shall continue to serve until such director’s successor is elected and qualified or until there is a decrease in the number of directors.

Our Bylaws provide that directors will be elected by a plurality of the votes cast. Thus, when the number of director nominees equals the number of directorships on the Board, each nominee needs at least one affirmative vote to be elected to the Board.

As discussed below, we believe that each of our director nominees possesses the experience, skills and qualities to fully perform his or her duties as a director and contribute to our success. Our director nominees were nominated because each is of high ethical character, is highly accomplished in his or her field with superior credentials and recognition, has a reputation, both personal and professional, that is consistent with our image and reputation, has the ability to exercise sound business judgment, and is able to dedicate sufficient time to fulfilling his or her obligations as a director. Each director nominee’s principal occupation and other pertinent information about such director’s particular experience, qualifications, attributes and skills that led the Board to conclude that such person should serve as a director, appears on the following pages. There are no family relationships between any of our directors or executive officers.

Nominees for Election Until the Next Annual Meeting

The following table sets forth the name, age, position and tenure of each of the nominees at the Annual Meeting:

| Name | Age | Position(s) Held With Applied Digital Corporation |

Period of Service | |||||

| Wes Cummins | 46 | Chief Executive Officer and Chairman of the Board |

Director from February 2007 to December 2020 and March 2021 to Present, sole officer from March 2012 to December 2020 and CEO, Secretary and Treasurer from March 2021 to Present | |||||

| Ella Benson | 39 | Director | May 2024 to Present | |||||

| Chuck Hastings | 46 | Director | April 2021 to Present | |||||

| Rachel Lee | 40 | Director | February 2024 to Present | |||||

| Douglas Miller | 67 | Director | April 2021 to Present | |||||

| Richard Nottenburg | 70 | Director | June 2021 to Present | |||||

| 6 |

Wes Cummins

Mr. Cummins has served as a member of our Board from 2007 until 2020 and from March 11, 2021 through present. During that time Mr. Cummins also served in various executive officer positions and he is currently serving as our chairman of the Board and Chief Executive Officer. Mr. Cummins is also the founder and CEO of 272 Capital LP, a registered investment advisor, which he sold to B. Riley Financial, Inc. (NASDAQ: RILY) in August 2021. Following the sale, Mr., Cummins served as President of B. Riley Asset Management until February 2024. Mr. Cummins has been a technology investor for over 20 years and held various positions in capital markets including positions at investment banks and hedge funds. Prior to founding 272 Capital and starting our operating business, Mr. Cummins was an analyst with Nokomis Capital, L.L.C., an investment advisory firm, a position he held from October 2012 until February 2020. Mr. Cummins also served as president of B. Riley & Co., from 2002 to 2011. Mr. Cummins also serves as a member of the board of Sequans Communications S.A. (NYSE: SQNS), a fabless designer, developer and supplier of cellular semiconductor solutions for massive, broadband and critical Internet of Things (IoT) markets. Mr. Cummins served on the board of Telenav (NASDAQ: TNAV) from August 2016 until February 2021. Mr. Cummins also served on the board of Vishay Precision Group, Inc. (NYSE: VPG) from July 2017 to June 2024. He holds a BSBA from Washington University in St. Louis where he majored in finance and accounting. We believe Mr. Cummins is qualified to serve on our Board because of his business and leadership experience, as well as a result of having served as a director since starting our operating business.

Ella Benson

Ms. Benson brings over a decade of experience in financial services and is a Director at Oasis Management Co., Ltd. (“Oasis”). She has substantial experience working with public companies undergoing strategic transitions. Ms. Benson served on the board of directors of Stratus Properties (NASDAQ: STRS) from 2017 to 2020. Prior to joining Oasis in 2013, Ms. Benson was an analyst at GAM, an independent asset management firm, from 2009 to 2013. Ms. Benson holds a Bachelor of Business Administration in Finance from the McCombs School of Business at the University of Texas at Austin. Since May 2024, Ms. Benson has served as a member of the Company’s Board where she is also the Chairperson of the Nominating and Corporate Governance Committee. We believe Ms. Benson is qualified to serve on our Board because of her substantial experience working with public companies undergoing strategic transitions.

Chuck Hastings

Mr. Hastings currently serves as Chief Executive Officer of B. Riley Wealth Management. Mr. Hastings joined B. Riley Financial in 2013 as a portfolio manager and became Director of Strategic Initiatives at B. Riley Wealth Management in 2018 and President in 2019. Prior to joining B. Riley, Mr. Hastings served as Portfolio Manager at Tri Cap LLC and was Head Trader at GPS Partners, a Los Angeles-based hedge fund, where he managed all aspects of trading and process including price and liquidity discovery and trade execution from 2005 to 2009. While at GPS Partners, Mr. Hastings was instrumental in growing the fund with the founding partners from a small start-up to one of the largest funds on the West Coast. Earlier in his career, Mr. Hastings served as a convertible bond trader at Morgan Stanley in New York. Mr. Hastings also serves as a Board member for IQvestment Holdings. Mr. Hastings holds a B.A. in political science from Princeton University. We believe Mr. Hastings is qualified to serve on our Board because he is a recognized leader in the financial industry with more than two decades of global financial and business expertise.

Rachel Lee

Ms. Lee brings 17 years of finance and investment experience and 10 years of board experience at growth companies, including publicly traded entities. Most recently, Ms. Lee served as a Partner and the Head of the Consumer Private Equity practice at Ares Management Corporation (NYSE: ARES) and spent almost 15 years at the firm. In her role as the Head of Consumer Private Equity, she led all aspects of deal activity from origination to monetization including due diligence, debt capital raises, tack-on acquisitions, legal negotiations, and exits via initial public offerings. Before joining Ares in 2008, Ms. Lee was in the investment banking division at J.P. Morgan, where she participated in the execution of a variety of transactions, including leveraged buyouts, mergers and acquisitions, and debt and equity financings across various industries. Ms. Lee also serves on the boards of Bank of Hope (NASDAQ: HOPE) and Legacy Franchise Concepts and previously served on the boards of Cooper’s Hawk Winery and Restaurants and Floor and Decor Holdings (NYSE: FND), among others. She holds a B.S. in Corporate Finance and a B.S. in Accounting from the University of Southern California. We believe Ms. Lee is qualified to serve on our Board because of her finance and investment experience and 10 years of board experience at growth companies, including publicly traded entities.

| 7 |

Douglas Miller

Mr. Miller has served as a member of the board of directors of three public companies over the past nine years: Telenav, Inc. (NASDAQ: TNAV) from July 2015 to February 2021, CareDx, Inc. (NASDAQ: CDNA) from July 2016 to May 2017, and Procera Networks, Inc. (NASDAQ: PKT) from May 2013 to June 2015. He has chaired the Audit Committee for each of these companies, and has also served as a Lead Independent Director and as chair or committee member on Compensation, Nominating and Corporate Governance and Special committees. Prior to his roles as board member, Mr. Miller served as senior vice president, chief financial officer and treasurer of Telenav, Inc. a wireless application developer specializing in personalized navigation services, from 2006 to 2012. From 2005 to 2006, Mr. Miller served as vice president and chief financial officer of Longboard, Inc., a privately held provider of telecommunications software. Prior to that, from 1998 to 2005, Mr. Miller held various management positions, including senior vice president of finance and chief financial officer, at Synplicity, Inc., a publicly traded electronic design automation company. Mr. Miller also served as chief financial officer of 3DLabs, Inc., a publicly held graphics semiconductor company, and as an audit partner at Ernst & Young LLP, a professional services organization. Mr. Miller is a certified public accountant (inactive). He holds a B.S.C. in Accounting from Santa Clara University. We believe Mr. Miller is qualified to serve on our Board because of his board experience at publicly traded companies and his finance and accounting experience.

Richard Nottenburg

Dr. Nottenburg is Executive Chairman of NxBeam Inc., which designs and builds leading proprietary mmWave ICs and radio products to power the next generation of satellite and terrestrial communication networks. Dr. Nottenburg is on the board of directors of Cognyte Software Ltd., (NASDAQ: CGNT),a global leader in security analytics software and Verint Systems Inc. (NASDAQ: VRNT), a customer engagement company. He serves as chairman of the compensation committee of both companies. He is also a member of the board of Sequans Communications S.A. (NYSE: SQNS), a leading developer and provider of 5G and 4G chips and modules for massive, broadband and critical IoT applications where he serves on both the audit and compensation committees. Previously, Dr. Nottenburg served as President and Chief Executive Officer and a member of the board of directors of Sonus Networks, Inc. from 2008 through 2010. From 2004 until 2008, Dr. Nottenburg was an officer with Motorola, Inc., ultimately serving as its Executive Vice President, Chief Strategy Officer and Chief Technology Officer. Dr. Nottenburg holds a BSEE from New York University – Polytechnic School of Engineering, a master degree in electrical engineering from Colorado State University, and a PhD in electrical engineering from Ecole Polytechnique Fédérale de Lausanne. We believe Dr. Nottenburg is qualified to serve on our Board because of his industry expertise and board experience at publicly traded companies.

Required Vote

In accordance with our Bylaws, Nevada law and the Nasdaq Listing Rules, directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote, and the director nominees who receive the greatest number of votes at the Annual Meeting (up to the total number of directors to be elected) will be elected. As a result, withheld votes and broker non-votes, if any, will not affect the outcome of this proposal.

THE BOARD OF DIRECTORS RECOMMENDS THE STOCKHOLDERS VOTE “FOR” ALL OF THE NOMINEES FOR ELECTION AS DIRECTORS.

| 8 |

Corporate Governance Guidelines

Our Board adopted Corporate Governance Guidelines on December 10, 2021, which pertain to our Board’s role within the Company and its composition, Board meetings, Board committees, performance evaluation of directors and officers, and Company-wide communication. Specific guidelines include the following:

| ● | A majority of the directors on the Board should be “independent directors” consistent with definitional guidance provided by the Nasdaq Listing Rules; | |

| ● | The Board has three committees as mandated by the Nasdaq Listing Rules—an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee; | |

| ● | Each member of the Audit, Compensation and/or Nominating and Corporate Governance Committees shall be “independent” under the Nasdaq Listing Rules and shall be otherwise qualified for membership in accordance with the relevant committee’s charter; | |

| ● | The Board selects director nominees to stand for election and re-election by the Company’s stockholders and may also fill Board vacancies and newly created directorships upon recommendations from the Nominating and Corporate Governance Committee; | |

| ● | The Board evaluates each candidate in the context of Board composition as a whole, and seeks to align Board composition with the Company’s strategic needs while considering relevant industry and business experience, leadership and director experience, and diversity; | |

| ● | The roles of the Chair and Chief Executive Officer may be held by separate individuals or may be held by the same individual, and if the serving Chair does not qualify as independent, the independent directors shall select from among themselves a Lead Independent Director; | |

| ● | Each director must obtain Board approval prior to taking on any significant additional commitment, including, but not limited to, service on the board of directors of another for-profit company; | |

| ● | All directors may only serve on three other public company boards (four public company boards in total); | |

| ● | A director who experiences a significant change in his or her principal business, professional position, employment or responsibility shall offer his or her resignation from the Board; | |

| ● | Each director is expected to disclose any existing or proposed relationships or transactions that involve or could give rise to a conflict of interest, and shall accordingly recuse himself or herself from Board discussions if requested to do so; | |

| ● | Directors have an affirmative duty to protect and hold confidential all non-public information (whether or not material to the Company) entrusted to or obtained by a director by reason of his or her position as a director of the Company; | |

| ● | Four Board meetings are calendared in advance for each year, with additional regular or special meetings held as circumstances warrant as determined by the Chair in consultation with the Lead Independent Director (if any), the Chief Executive Officer and, as appropriate, the members of the Board; | |

| ● | Directors who attend fewer than 75% of regular and special meetings combined will be contacted by the Chair (or Lead Independent Director, if any) to discuss the circumstances and whether continued Board service is appropriate; | |

| ● | Each regular meeting of the Board shall include an executive session at which no employee directors or other employees are present, presided over by the Chair; if an independent director, or, in the absence of an independent Chair, the Lead Independent Director; | |

| ● | The Board evaluates its performance and the performance of its committees on an annual basis through an evaluation process administered by the Nominating and Corporate Governance Committee; | |

| ● | The Compensation Committee determines the criteria by which the Chief Executive Officer is evaluated and conducts a review, at least annually, of the performance of the Chief Executive Officer; | |

| ● | The Nominating and Corporate Governance Committee reports to the Board periodically on executive officer succession planning and leadership development processes; | |

| ● | As a general matter, the Chief Executive Officer (and senior executives to whom the Chief Executive Officer further delegates) has authority to speak for the Company on most matters related to Company performance, operations and strategy; and | |

| ● | Stockholders shall have reasonable access to directors at annual meetings of stockholders and an opportunity to communicate directly with directors on appropriate matters. |

Certain of these guidelines are discussed in greater detail below.

| 9 |

Board Leadership Structure

Subject to the Corporate Governance Guidelines as described above, the Board has not adopted a formal policy regarding the need to separate or combine the offices of Chair of the Board and Chief Executive Officer and instead the Board remains free to make this determination from time to time in a manner that seems most appropriate for the Company. Currently, Wesley Cummins serves as the Company’s Chief Executive Officer and Chair of the Board.

In order to facilitate and strengthen the Board’s independent oversight of the Company’s performance, strategy and succession planning and to uphold effective governance standards, the Board has established the role of a Lead Independent Director. Our current Chair, Mr. Cummins, is not “independent” under the Nasdaq Listing Standards. Our Lead Independent Director provides leadership to the Board if circumstances arise in which the role of chief executive officer and chairperson of our Board may be, or may be perceived to be, in conflict, and perform such additional duties as our Board may otherwise determine and delegate. Mr. Miller currently serves as the Company’s Lead Independent Director.

The Lead Independent Director’s duties include:

| ● | chairing Board meetings in the absence of the Chair; | |

| ● | convening and leading executive sessions of the Board (and may exclude any non-independent director and/or the Chief Executive Officer from such sessions); | |

| ● | serving as a liaison between the Chair and the independent directors; | |

| ● | being available for consultation and direct communication with major stockholders as directed by the Board; and | |

| ● | performing such other duties and responsibilities as requested by the Board. |

Board of Directors Composition

Each year, our Nominating and Corporate Governance Committee will review, with the Board, the appropriate characteristics, skills, and experience required for the Board as a whole and its individual members. In evaluating the suitability of individual candidates, our Nominating and Corporate Governance Committee will consider factors including, without limitation, an individual’s character, integrity, judgment, potential conflicts of interest, other commitments, and diversity. While we have no formal policy regarding board diversity for our Board as a whole nor for each individual member, the Nominating and Corporate Governance Committee does consider such factors as gender, race, ethnicity, experience, and area of expertise, as well as other individual attributes that contribute to the total diversity of viewpoints and experience represented on the Board.

In August 2021, the Securities and Exchange Commission (the “SEC”) approved a Nasdaq Stock Market proposal to adopt new listing rules relating to board diversity and disclosure. As approved by the SEC, the new Nasdaq Listing Rules require all Nasdaq listed companies to disclose consistent, transparent diversity statistics regarding their boards of directors. The rules require that smaller reporting companies have, or explain why they do not have, at least two diverse directors, including one who self-identifies as female and one who self identifies as either female, an under-represented minority or LGBTQ+. The Board Diversity Matrix below presents the Board’s diversity statistics in the format prescribed by the Nasdaq Listing Rules.

| 10 |

As of October 10, 2024, the composition of our Board was as follows.

Board Diversity Matrix (As of October 10, 2024)

Total Number of Directors: 7

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||

| Part I: Gender Identity | ||||||||

| Directors | 3 | 4 | 0 | 0 | ||||

| Part II: Demographic Background | ||||||||

| African American or Black | 0 | 0 | 0 | 0 | ||||

| Alaskan Native or Native American | 0 | 0 | 0 | 0 | ||||

| Asian | 1 | 0 | 0 | 0 | ||||

| Hispanic or Latinx | 0 | 0 | 0 | 0 | ||||

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | ||||

| White | 2 | 4 | 0 | 0 | ||||

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | ||||

| LGBTQ+ | 0 | |||||||

| Did Not Disclose Demographic Background | 0 | |||||||

Our Board met thirty-five (35) times in fiscal 2024. Each director attended at least 75% of the aggregate of (i) the total number of meetings of our Board (held during the period for which such director served on the Board) and (ii) the total number of meetings of all committees of our Board on which such director served (during the periods for which the director served on such committee or committees). We do not have a formal policy requiring members of the Board to attend our annual meetings. All members of the Board attended our 2023 annual meeting of stockholders.

Our common stock is listed on The Nasdaq Global Select Market. Under the Nasdaq Listing Rules, independent directors must comprise a majority of our Board. In addition, the Nasdaq Listing Rules require that all the members of the Audit Committee and Compensation Committee be independent. Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Compensation committee members must also satisfy the independence criteria established by the Nasdaq Listing Rules in accordance with Rule 10C-1 under the Exchange Act. Under the Nasdaq Listing Rules, a director will only qualify as an “independent director” if, among other qualifications, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Our Board has reviewed its composition, the composition of its committees and the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our Board has determined that Ms. Benson, Mr. Hastings, Ms. Lee, Mr. Miller and Dr. Nottenburg do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the Nasdaq Listing Rules and the SEC.

Our Board has appointed Mr. Miller as our lead independent director. Our lead independent director is expected to provide leadership to our Board if circumstances arise in which the role of chief executive officer and chairperson of our Board may be, or may be perceived to be, in conflict, and perform such additional duties as our Board may otherwise determine and delegate.

| 11 |

Our Board has established an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee, each of which have the composition and responsibilities described below. Members serve on these committees until their resignation or until otherwise determined by our Board. Each committee operates under a written charter approved by our Board that satisfies the applicable rules of the SEC and Nasdaq Listing Rules Copies of each committee’s charter are posted in the Investors section of our website. Membership in each committee is shown in the following table.

| Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | ||||

| Ella Benson | ▲ | |||||

| Wes Cummins | ||||||

| Chuck Hastings | ● | ● | ||||

| Rachel Lee | ● | ● | ||||

| Douglas Miller | ▲ | ● | ||||

| Richard Nottenburg | ● | ▲ | ● |

▲ Chair ● Member

Audit Committee

Our Audit Committee is comprised of Mr. Miller, Mr. Hastings and Dr. Nottenburg. Mr. Miller is the chairperson of our Audit Committee. Each Audit Committee member meets the requirements for independence under the current Nasdaq Listing Rules and Rule 10A-3 under the Exchange Act. Mr. Miller qualifies as an “audit committee financial expert” as defined in Item 407(d) of Regulation S-K promulgated under the Securities Act of 1933, as amended (the “Securities Act”). This designation does not impose any duties, obligations, or liabilities that are greater than those generally imposed on members of our Audit Committee and our Board. Each member of our Audit Committee is financially literate. Our Audit Committee is directly responsible for, among other things:

| ● | selecting a firm to serve as the independent registered public accounting firm to audit our consolidated financial statements; | |

| ● | ensuring the independence of the independent registered public accounting firm; | |

| ● | discussing the scope and results of the audit with the independent registered public accounting firm and reviewing, with management and that firm, our interim and year-end operating results; | |

| ● | establishing procedures for employees to anonymously submit concerns about questionable accounting or audit matters; | |

| ● | considering the adequacy of our internal controls and internal audit function; | |

| ● | inquiring about significant risks, reviewing our policies for risk assessment and risk management, including cybersecurity risks, and assessing the steps management has taken to control these risks; | |

| ● | reviewing and overseeing our policies related to compliance risks; | |

| ● | reviewing related party transactions that are material or otherwise implicate disclosure requirements; and | |

| ● | approving or, as permitted, pre-approving all audit and non-audit services to be performed by the independent registered public accounting firm. |

Our Audit Committee operates pursuant to a charter that is available in the Investors section of our website: www.applieddigital.com. Our Audit Committee met twenty-three (23) times in fiscal 2024.

Compensation Committee

Our Compensation Committee is comprised of Dr. Nottenburg, Ms. Lee, and Mr. Miller. Dr. Nottenburg is the chairperson of our Compensation Committee. The composition of our Compensation Committee meets the requirements for independence under the Nasdaq Listing Rules. Each member of this committee is a “non-employee director,” as defined in Rule 16b-3 promulgated under the Exchange Act and an “outside director” as defined in Section 162(m) of the Internal Revenue Code of 1986, as amended. Our Compensation Committee is responsible for, among other things:

| ● | reviewing and approving, or recommending that our Board approve, the compensation and the terms of any compensatory agreements of our executive officers; |

| 12 |

| ● | reviewing and recommending to our Board the compensation of our directors; | |

| ● | administering our stock and equity incentive plans; | |

| ● | reviewing and approving, or making recommendations to our Board with respect to, incentive compensation and equity plans; and | |

| ● | establishing our overall compensation philosophy. |

Our Compensation Committee operates pursuant to a charter that is available on the Investors section of our website: www.applieddigital.com. Our Compensation Committee met ten (10) times in fiscal 2024.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is comprised of Ms. Benson, Ms. Lee, Dr. Nottenburg, and Mr. Hastings. Ms. Benson is the chairperson of our Nominating and Corporate Governance Committee. The composition of our Nominating and Corporate Governance Committee meets the requirements for independence under the Nasdaq Listing Rules. Our Nominating and Corporate Governance Committee is responsible for, among other things:

| ● | identifying and recommending candidates for membership on our Board; | |

| ● | recommending directors to serve on board committees; | |

| ● | reviewing and recommending our corporate governance guidelines and policies; | |

| ● | reviewing succession plans for senior management positions, including the chief executive officer; | |

| ● | reviewing proposed waivers of the code of business conduct and ethics for directors, executive officers, and employees (with waivers for directors or executive officers to be approved by the Board); | |

| ● | evaluating, and overseeing the process of evaluating, the performance of our Board and individual directors; and | |

| ● | advising our Board on corporate governance matters. |

Our Nominating and Corporate Governance Committee operates pursuant to a charter that is available on the Investors section of our website: www.applieddigital.com. Our Nominating and Corporate Governance Committee met five (5) times in fiscal 2024.

Board and Committee Self-Evaluation and Refreshment

Our Board conducts annual self-evaluations to assess the effectiveness of the Board and its Committees. These annual self-evaluations are overseen by the Nominating and Corporate Governance Committee and are designed to enhance the overall effectiveness of the Board and each Committee and identify areas of potential improvement. They include written questionnaires that solicit feedback from the Board and Committee members on a range of topics, including the Committees’ roles, structure and composition; the extent to which the mix of skills, experience and other attributes of the individual directors is appropriate for the Board and each Committee; the scope of duties delegated to the Committees, including the allocation of risk assessment between the Board and its Committees; interaction with management; information and resources; the adequacy of open lines of communication between directors and members of management; the Board and Committee meeting process and dynamics; and follow-through on recommendations developed during the evaluation process.

Our Board has also implemented annual director self-assessments that require each director to assess the performance of each committee of the Board and of the Board as a whole. This process involves directors providing direct feedback to the Chair of the Board, the Lead Independent Director and the Chair of the Nominating and Corporate Governance Committee who, in turn, review the self-assessments for any actions that should be taken to enhance the effectiveness of the Board.

| 13 |

Following the annual self-assessments, the Nominating and Corporate Governance Committee discusses areas for potential improvement with the Board and/or relevant Committees and, if necessary, identifies steps required to implement these improvements. Director suggestions for improvements to the evaluation questionnaires and process are considered for incorporation for the following year. As part of the Nominating and Corporate Governance Committee’s discussion and evaluation of areas for improvement, board refreshment, including the commitment to have a balanced Board with diversity of skills and experience, is a topic that is considered.

The Nominating and Corporate Governance Committee and the Board regularly review Board composition to consider succession related factors, skill sets, diversity and balance. The Company is committed to seeking diversity and balance on our Board with directors of race, gender, geography, thoughts, viewpoints, backgrounds, skills, experience and expertise. In conducting each of these director searches, our Nominating and Corporate Governance Committee considered the leadership, technical skills and operational experience that we believed would address the Board’s then current needs.

The Nominating and Corporate Governance Committee and the Board review annually succession planning for The Company’s executive officers and develop and review succession planning for Board members, including succession planning for the Chair of the Board and/or Lead Independent Director.

Environmental, Social and Governance

We are firmly committed to sustainable leadership by integrating sustainability into how we do business. Our responsible practices, policies and programs reflect our commitment to making a positive impact.

Environmental

The Company prioritizes the environment, which is reflected in various stages of its operations, as described below. The Company can locate its data centers near renewable power assets such as wind farms to help the power owners monetize their “stranded” power, which consists of energy; that is produced but not utilized due to constraints on delivering the energy to areas that might demand it. Accordingly, the Company’s location near wind farms may spur local economies and prevent such wind farms from having to reduce output. For instance, the Company operates several projects in North Dakota because there is a surplus of stranded power. North Dakota is one of the largest wind producing states in the United States, housing more than 2,000 turbines throughout the state. In addition to the availability of stranded power directly associated with wind farms, the Governor of North Dakota, Greg Burgum, has publicly committed to making North Dakota carbon neutral by 2030, which makes the location ideal for the Company’s infrastructure. Additionally, the Company is capable of scaling services based on power production, ramping up or down our load on the grid, providing demand to the wind farm operators with no material interruption to their product or end-users, which has little negative impact on grid stability or congestion.

In order to reduce waste from the disposal of the foam protecting hosting equipment during transport, the Company utilizes a foam densifier machine on site to melt the foam packaging, reducing the foam’s volume by 98%. The Company’s sites use very little water. There are no large amounts of chemicals on site that would risk the surrounding population. The transformers on site use specialized biodegradable and non-explosive fluids. The site does not emit exhaust into the air. There is no risk of chemical spills, and an overall low risk of any pollution. The Company’s focus on renewable energy and partnerships with local governments, communities and utilities represent the Company’s commitment to reducing carbon emissions and driving the adoption of renewable power as an environmentally conscientious business leader in the HPC digital infrastructure sector.

Social

The Company seeks areas in which its digital infrastructure buildout would effect positive change and serve communities, many of which are rural. Specifically, the Company aims to bolster local governments in their promotion of renewable power production and to provide residents of these areas with higher income career opportunities.

| 14 |

In furtherance of these aims, the Company visits every proposed location to meet its residents, at times through town-hall forums, and identifies community needs prior to starting projects. The Company also hires local contractors and vendors for the construction of projects, which helps improve the employment rate of these local communities and in turn provides demand for other products and services generated by the local community. Because there is a limited talent-pool for next-generation data center operators, the Company develops the local workforce by using a digital learning system regarding the use of equipment in the Company’s business, and provides on-the-job training for entry level positions.

Governance

The Company seeks to have strong corporate governance, including a management team highly aligned with stockholders and a diverse Board of Directors. Named Executive Officers and directors of the Company own approximately 11.8% of the Company’s outstanding common stock. Five of the six nominees for director are independent, and two of the six nominees are female, one of whom is a minority.

Stockholder Nominations for Directorships

All shareholder recommendations for director candidates must be received by the Company in the timeframe(s) set forth under the heading “Shareholder Proposals” below. Such submissions must state the nominee’s name, together with appropriate biographical information and background materials, and information with respect to the shareholder or group of shareholders making the recommendation, including the number of shares of common shares owned by such shareholder or group of shareholders, as well as other information required by our Bylaws.

Board Leadership Structure and Role in Risk Oversight

Our Board is primarily responsible for overseeing our risk management processes. Our Board, as a whole, determines our appropriate level of risk, assesses the specific risks that we face, and reviews management’s strategies for adequately mitigating and managing the identified risks. Although our Board administers this risk management oversight function, the committees of our Board support our Board in discharging its oversight duties and address risks inherent in their respective areas. The Audit Committee reviews our major financial risk exposures and the steps management has taken to monitor and control such exposures, including our procedures and related policies with respect to risk assessment and risk management. Our Audit Committee also reviews matters relating to compliance, cybersecurity, and security and reports to our Board regarding such matters. The Compensation Committee reviews risks and exposures associated with compensation plans and programs. We believe this division of responsibilities is an effective approach for addressing the risks we face and that our Board leadership structure supports this approach.

Our Board is responsible for the oversight of cybersecurity risk management. The Board delegates oversight of the cybersecurity risk management program to the Audit Committee. The management of the program is the responsibility of our Risk Management Committee, comprised of our Chief Executive Officer, Chief Financial Officer and Chief Technology Officer. The Risk Management Committee provides quarterly updates to the Audit Committee on our cybersecurity risk management program, including updates on (1) any critical cybersecurity risks; (2) ongoing cybersecurity initiatives and strategies; (3) applicable regulatory requirements; and (4) industry standards. The Risk Management Committee also notifies the Board of any cybersecurity incidents (suspected or actual) and provides updates on the incidents as well as cybersecurity risk mitigation activities as appropriate.

Stockholders may communicate with the Board by directing their communications in a hard copy (i.e., non-electronic) written form to the attention of one or more members of the Board of Directors, or to the Board of Directors collectively, at our corporate office located at 3811 Turtle Creek Blvd, Suite 2100, Dallas, Texas 75219. A stockholder communication must include a statement that the author of such communication is a beneficial or record owner of our Common Stock. Our Corporate Secretary will review all communications meeting the requirements discussed above and will remove any communications relating to (1) the purchase or sale of products or services, (2) communications from opposing parties relating to pending or threatened legal or administrative proceedings regarding matters not related to securities law matters or fiduciary duty matters, and (3) any other communications that the Corporate Secretary deems, in his or her reasonable discretion, unrelated to our business.

Code of Business Conduct and Ethics

We have adopted a code of business conduct and ethics that applies to all of our employees, officers, and directors. The full text of our code of business conduct and ethics is posted on the Investors section of our website: www.applieddigital.com. We intend to disclose future amendments to certain provisions of our code of business conduct and ethics, or waivers of these provisions, on our website or in public filings.

Under the terms of our insider trading policy, we prohibit each officer, director and employee, and each of their family members and controlled entities, from engaging in certain forms of hedging or monetization transactions. Such transactions include those, such as zero-cost collars and forward sale contracts, that would allow them to lock in much of the value of their stock holdings, often in exchange for all or part of the potential for upside appreciation in the stock, and to continue to own the covered securities but without the full risks and rewards of ownership.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires the Company’s directors, executive officers and persons who beneficially own more than 10% of its common stock to file reports of ownership and changes in ownership with the Commission and to furnish the Company with copies of all such reports they file. Based on the Company’s review of the copies of such forms received by it, or written representations from certain reporting persons, the Company believes that none of its directors, executive officers or persons who beneficially own more than 10% of the common stock failed to comply with Section 16(a) reporting requirements during the fiscal year ended May 31, 2024 (the “Last Fiscal Year”), except for one Form 4 filed by Virginia Moore reporting eight late transactions.

| 15 |

Our executive officers and their ages as of the date of this filing are set forth below. Our executive officers are elected by, and serve at the discretion of, our Board.

| Name | Age | Position(s) Held With Applied Digital Corporation |

Period of Service | |||

| Wes Cummins | 46 | Chief Executive Officer and Chairman of the Board |

Director from February 2007 to December 2020 and March 2021 to Present, sole officer from March 2012 to December 2020 and CEO, Secretary and Treasurer from March 2021 to Present | |||

| David Rench | 46 | Chief Financial Officer | March 2021 to Present | |||

| Michael Maniscalco | 44 | Chief Technology Officer | Executive Vice President of Technology from September 2021 to June 2023; Chief Technology Officer beginning in July 2023 |

Our executive officers and their ages as of the date of this filing are set forth below. Our executive officers are elected by, and serve at the discretion of, our Board.

Wes Cummins

Biographical information with respect to Mr. Cummins is set forth above under “Proposal 1 – Election of Directors.”

David Rench

Mr. Rench became our Chief Financial Officer in March 2021 and continues to serve in that capacity. Prior to joining us, Mr. Rench co-founded in 2009, and from 2010 to 2017 served as the VP of Finance and Operations of, a software startup company, Ihiji, until the company was acquired by Control4 in 2017. After the acquisition of Ihiji, Mr. Rench joined and served as Chief Financial Officer of Hirzel Capital, an investment management company, from 2017 to 2020. Mr. Rench holds a BBA from the Neeley School of Business at Texas Christian University in Fort Worth, Texas, and an MBA from the Cox School of Business at Southern Methodist University in Dallas, Texas.

Michael Maniscalco

Mr. Maniscalco became our Executive Vice President of Technology in February 2022, and was named Chief Technology Officer in July 2023. In 2009, Mr. Maniscalco co-founded Ihiji, a remote network management services company, where he served as the Vice President of Product through February 2018, after Ihiji was acquired in 2017. From 2018 until his employment with the Company, Mr. Maniscalco founded and served as Chief Executive Officer of Better Living Technologies from 2018 to 2022. In addition, Mr. Maniscalco has founded several other companies and organizations over the last five years.

| 16 |

Overview

We are a “smaller reporting company” under applicable SEC rules and are providing disclosure regarding our executive compensation arrangements pursuant to the rules applicable to smaller reporting companies, which means that we are not required to provide a compensation discussion and analysis and certain other disclosures regarding our executive compensation. The following discussion relates to the compensation of each of the Company’s Chief Executive Officer and its two other most highly compensated individuals who were serving as executive officers at the end of the fiscal year ended May 31, 2024, for services rendered in all capacities during such year (the “Named Executive Officers”), consisting of Wes Cummins, our Chief Executive Officer, Secretary, Treasurer, Chairman of the Board, David Rench, our Chief Financial Officer, and Michael Maniscalco, our Chief Technology Officer.

Our compensation programs are designed to:

| ● | Attract, motivate, incentivize, and retain employees at the executive level who contribute to our long-term success; | |

| ● | Provide compensation packages to our executives that are competitive, reward the achievement of our business objectives and effectively align their interests with those of our stockholders; and | |

| ● | Focus on long-term equity incentives that correlate with the growth of sustainable long-term value for our stockholders. |

Our Compensation Committee is responsible for the executive compensation programs for our Named Executive Officers and reports to our Board of Directors on its discussions, decisions, and other actions. Our Chief Executive Officer makes recommendations for the respective executive officers that report to him to our Compensation Committee and typically attends Compensation Committee meetings. Our Chief Executive Officer makes such recommendations (other than with respect to himself) regarding base salary, and short-term and long-term compensation, including equity incentives, for our executive officers based on our results, an executive officer’s individual contribution toward these results, the executive officer’s role and performance of his or her duties, and his or her achievement of individual goals. Our Compensation Committee then reviews the recommendations and other data, including various compensation survey data and publicly available data of our peers, and makes decisions as to the target total direct compensation for each executive officer, including our Chief Executive Officer, as well as each individual compensation element. While our Chief Executive Officer typically attends meetings of the Compensation Committee, the Compensation Committee meets outside the presence of our Chief Executive Officer when discussing his compensation and when discussing certain other matters, as well.

Our Compensation Committee is authorized to retain the services of one or more executive compensation advisors, as it sees fit, in connection with the establishment of our executive compensation programs and related policies. In fiscal year ending May 31, 2023, the Compensation Committee retained Compensia Inc., a national compensation consulting firm with compensation expertise relating to technology and life science companies, to provide it with market information, analysis, and other advice relating to executive compensation on an ongoing basis. The Compensation Committee engaged Compensia, Inc. to, among other things, assist in developing an appropriate group of peer companies to help us determine the appropriate level of overall compensation for our executive officers, as well as to assess each separate element of compensation, with a goal of ensuring that the compensation we offer to our executive officers, individually as well as in the aggregate, is competitive and fair. We do not believe the retention of, and the work performed by, Compensia, Inc. creates any conflict of interest.

| 17 |

Compensation and Governance Practices and Policies

We endeavor to maintain strong governance standards in our policies and practices related to executive compensation. Below is a summary of our key executive compensation and corporate governance practices.

| What We Do | What We Don’t Do | |||||

| ✓ | Annually assess the risk-reward balance of our compensation programs in order to mitigate undue risks in our programs |  |

No pension plans or Supplemental Executive Retirement Plans | |||

| ✓ | Provide compensation mix that more heavily weights variable pay |  |

No hedging or pledging of our securities | |||

| ✓ | An independent compensation consultant advises the Compensation Committee |  |

No excise tax gross-ups upon a change of control |

Peer Group

The Compensation Committee reviews market data of companies that we believe are comparable to us. With Compensia’s assistance, the Compensation Committee developed a peer group for use when making its compensation decisions for the fiscal year ending May 31, 2024, which consisted of publicly traded technology companies headquartered in the U.S. that generally had a market capitalization between 0.25x and 4.0x the Company’s market capitalization. The Compensation Committee referred to compensation data from this peer group and broader survey data (for similarly-sized companies) when making base salary, cash bonus and equity award decisions for our executive officers for the fiscal year ending May 31, 2024. The following is a list of the public companies that composed our peer group for the fiscal year ending May 31, 2024:

| Alkami Technology | CleanSpark | Paya | ||

| Backblaze | Couchbase | Riot Platforms | ||

| Bakkt Holdings | Fastly | Stronghold Digital Mining | ||

| Bit Digital | Greenidge Generation Holdings | Sumo Logic | ||

| Cantaloupe | IronNet | TeraWulf | ||

| Cipher Mining | Marathon Digital Holdings | Veritone |

| 18 |

The following table presents information regarding the total compensation awarded to, earned by, or paid to Named Executive Officers as of May 31, 2024 and May 31, 2023 for services rendered in all capacities to us for the years ended May 31, 2024 and May 31, 2023.

| Name and Principal Position(s) | Year | Salary | Bonus | Stock Awards | Non-Equity Incentive Plan Compensation (1) | All Other Compensation(2) | Total(3) | |||||||||||||||||||||

| Wes Cummins | 2024 | $ | 600,000 | $ | 600,000 | $ | — | $ | — | $ | 37,002 | $ | 1,237,002 | |||||||||||||||

| Chief Executive Officer, President, Secretary and Treasurer | 2023 | $ | 312,500 | $ | 150,000 | $ | 5,455,000 | $ | — | $ | 37,078 | $ | 5,954,578 | |||||||||||||||

| David Rench | 2024 | $ | 475,000 | $ | 475,000 | $ | — | $ | — | $ | 37,002 | $ | 987,002 | |||||||||||||||

| Chief Financial Officer | 2023 | $ | 272,292 | $ | 339,375 | $ | 2,061,500 | $ | — | $ | 37,078 | $ | 2,710,245 | |||||||||||||||

| Michael Maniscalco | 2024 | $ | 375,000 | $ | 367,875 | $ | 1,028,000 | $ | — | $ | 12,334 | $ | 1,783,209 | |||||||||||||||

| Chief Technology Officer (4) | 2023 | $ | 200,000 | $ | 92,500 | $ | 842,582 | $ | — | $ | 12,359 | $ | 1,147,441 | |||||||||||||||

| (1) | Consists of value of restricted stock awards made outside of the 2022 Incentive Plan. | |

| (2) | Consists of value of health care premiums paid by the Company, and corrects previously disclosed “All Other Compensation” amount reported in the Company’s Annual Report on Form 10-K for the fiscal year ended May 31, 2024, filed with the SEC on August 30, 2024, which erroneously included the value of restricted stock awards that were previously granted under the 2022 Incentive Plan (which were unvested as of May 31, 2024). | |